AUDUSD This Past Week

AUDUSD started the week off pretty stable with no large price movements in the market. By Tuesday, we noticed this currency picked up the pace and started showing bullish market conditions. This was in anticipation of the meeting to be held by the Governor of the Reserve Bank of Australia. This meeting is crucial in determining the short-term changes to the interest rates for the country. The meeting between Biden and Xi had yet to occur and the anticipation for this meeting had also caused some volatility in market conditions for the U.S. dollar. AUDUSD continued on an upwards trend all till the end of the week. AUDUSD ended the week by hitting its two-week high. This came as a surprise as early on Friday, this forex pair completely dropped to around the 0.736 region. There was little hope for it to recover from this drop. However, despite all odds, AUDUSD managed to recover quite quickly. This came just in time for when the market closed at the end of the week.

RBA Philip Lowe Speech

Philip Lowe, Governor for the Reserve Bank of Australia, held a meeting early on Tuesday regarding the short-term monetary policy changes for the country. This meeting was highly anticipated by not only the people of Australia but also forex traders and analysts globally. Australia is currently suffering from a major inflation crisis. Wages are not rising as fast as the inflation rate which is causing the Australian citizens a lot of distress as they’re losing a ton of money. Lowe has therefore been under great pressure to speak out on this current economic crisis in the country and give his solution to the problem.

In his speech, Lowe revealed that the inflation rates may go up from 3.5% to 4.5% due to the current economic situation. According to Lowe, the major contributing factor for this increase is definitely the shortage in the supply of oil. This has caused the oil rates to increase in order to combat the high demand and short supply. Lowe also warned the citizens that this increase in inflation will cause wages to lose profitability by 1.5%. What this means is that Australians will be making 1.5% less than they used to due to the increase in inflation which will cause the prices of products and services in the country to increase as well.

Philip Lowe states, “The inflation rate at the moment is 3.5% and will probably go up to 4.5%, who knows, depending on what happens with oil prices. Wages are maybe going up high twos, let’s say three, and inflation is 4.5% – that’s a real wage cut of 1.5%, so that will obviously affect people’s budgets. As long as inflation comes back down again households will manage through this and on average they’ve got a lot more money to help them.” Lowe further states, “There are two issues that are really on our mind at the moment. The first is how persistent the supply side problems are, how long are they going to keep pushing up prices and at what point will some of those price increases be reversed. Because it’s quite possible that these big price increases occurred, that they’re not repeated, the prices normalize, and after a spike, inflation comes down again. The second is what goes on in the labor market. It is only possible for inflation to come back down from its spike if labor costs don’t respond too much”.

Russia-Ukraine Crisis

There have been several updates regarding the crisis between Russia and Ukraine in the past couple of days. Both countries have been trying to work out a peace agreement to end things diplomatically but unfortunately, they haven’t been able to work out terms that they both agree on as of right now. Russia had previously followed a more military approach towards this situation as they were using military weapons like bombs to get Ukraine to surrender so they can win the war. This tactic has proved to not be working for them and instead had landed them in hot waters with the international community. Several sanctions had been placed on this European superpower in order to get them to stop the war.

Under all this pressure, Russia finally opened up to the idea of using a more diplomatic approach to settle things with Ukraine. Their first move under this approach was giving Ukraine the option of signing a 15-point peace agreement to end the war in neutrality. This agreement was rejected due to favoring the Russians more than the Ukrainians. Russia then gave Ukraine the option of surrendering its port city, Mariupol, in order to end the war. This offer was also rejected by Ukraine as they are not ready to compromise on their country in any way. Further peace talks are still scheduled between the two countries so we’ll just have to wait and see for any further updates on this situation.

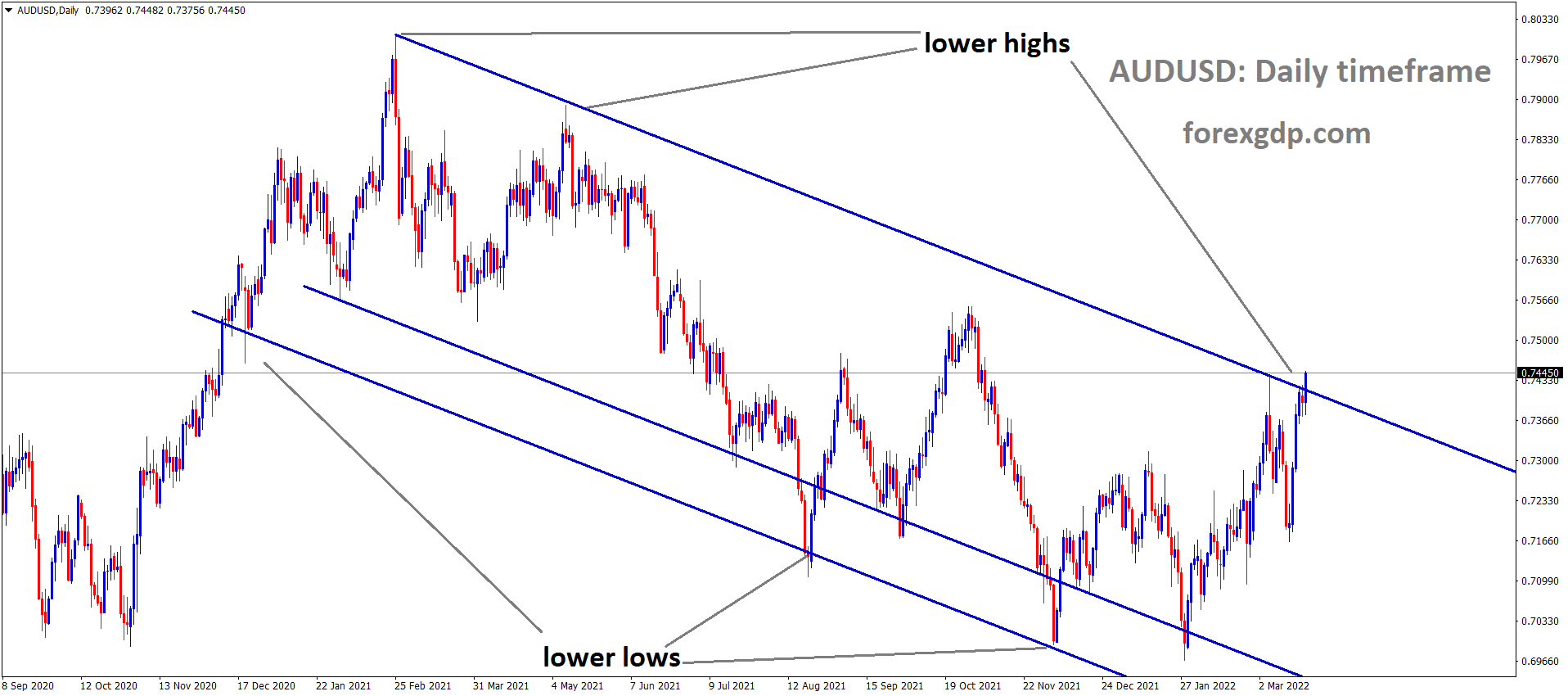

AUDUSD Today

Today, AUDUSD started off the day around a decent 0.740 mark. Midway through the day, it dropped slightly and had been seen fluctuating around the 0.738 region. This was most probably in anticipation of the RBA meeting by Governor Lowe which was to be held later in the day.

Following the release of the meeting, this currency pair could be seen skyrocketing when it finally reached its two-week high once again, for the second time this past week. AUDUSD is now teasing around the 0.744 mark with plans to possibly end the trading day slightly higher than the current rate. This two-week high was not expected at all. In fact, analysts predicted this valuable currency pair to instead show bearish market conditions.

Upcoming Important Events

There are two major speeches being released early tomorrow which can’t be slept on by any means whatsoever. The first is a speech by the Governor of the Bank of England, Andrew Bailey. He will be discussing his plans for the short-term interest rate changes for the country. The second is another speech by the Feds Chairman, Jerome Powell. He will also be speaking on some monetary changes which he may have missed in his speech today.