USD/CHF is one of the most popular pairs among pro and new traders. On the other hand, everyone seems to like Swiss Francs, which is also true when discussing uncertainty.

Even though it’s a small country, Swiss Francs hugely impact the forex market. This is because it has what we call a safe-haven status along with USD.

So, that’s why people seem to get the hang of USD/CHF.

In this guide, we’ll present an overall picture of USD/CHF, so you can grasp what the pair is all about.

History of USD/CHF

Before we dig deeper into the pair, let’s rewind the clock and talk about the history of both USD and CHF.

The US dollar is well-known and is associated with all major currencies. However, its origins may be traced back to 1792, when the United States Congress established the US dollar as the nation’s currency.

It is still recognized as the world’s unofficial reserve currency and is used as legal money in several nations.

The Swiss franc has a long history dating back to the 1700s. Switzerland had a wide range of coins in circulation during that time, including many foreign currencies.

The Swiss franc was established as the primary monetary unit to consolidate into a single currency.

The Swiss franc has been viewed as a safe-haven currency throughout history.

Historically, almost little inflation in the franc and gold reserves backed a minimum of 40% due to legal obligations.

Did you know the USD/CHF rate is the Swisse? This is because the Swiss Francs are responsible for its name.

The CHF is known as the Swisse, so USD/CHF is referred to as the Swisse.

Exchange rate history

Now that you know the history of both USD and CHF let’s find out their exchange rate history.

As you can see, the rate hit an all-time high in 2000. After 2000, the Swiss franc gained significantly in value against the US dollar and the Euro, used in the Euro Zone.

Factors such as the European financial crisis and the Federal Reserve’s supportive monetary policy in the United States helped enhance the franc’s value.

To prevent safe-haven outflows in the years after the 2008 global economic crisis, the Swiss National Bank (SNB) set the EUR/CHF rate at 1.20 in 2011.

2015 Swiss drama

The chart below illustrates a massive candle on January 15, 2015. As you can see, the price hurried back big time.

The Swiss National Bank suddenly withdrew the peg of 1.20 francs per Euro on January 15. The central bank stated that this was required since the peg was no longer viable.

In the immediate aftermath of the revelation, the currency surged 30 percent against the Euro and 25 percent against the US dollar. The decision shook the markets to their core, putting several foreign currency brokers out of a trade.

Why is CHF stronger than USD?

In the previous 30 years, the US Dollar has lost around 75% of its value vs. the Swiss Franc. So which makes you wonder why the CHF is so strong?

There isn’t just one thing at work here. The Swiss franc has traditionally been regarded as a stable currency globally.

Switzerland’s political and financial stability, high openness in financial reporting, and low bank interest rates have made it appealing for international investment.

Furthermore, investment in Swiss francs for individuals holding US dollars is particularly appealing due to the minimal short-term volatility in the exchange rate between the US dollar and the Swiss franc.

How to trade USD/CHF?

To trade USD/CHF, you need to open an account with the broker, deposit funds, and trade USD/CHF as your pair.

If the current quote of USD/CHF is 0.90, it indicates that one USD is worth 0.90 francs. To trade a forex pair, you need to know about base and quote currencies. So, here, the base currency is USD, and the quote currency is CHF.

Let’s give an example of how you can trade the pair.

Suppose you want to long (buy) USD/CHF at 0.9010. Then, the market starts moving in your direction, and the USD/CH rate becomes 0.9050. So, you make a cool 40 pips profit.

Let’s say the market doesn’t go in your favor and starts weakening, and the rate becomes 0.9000. In this case, you lost ten pips.

Factors affecting USD/CHF

There are a lot of factors that can affect the Cable. Knowing them will help you understand the pair better and make your trading positions accordingly.

Monetary policy

The US economy is determined by many variables, with interest rate decisions by the US Federal Reserve being one of the most important.

The US Federal Open Market Committee (FOMC) meets multiple times a year to vote on interest rates. The following news conferences provide investors with a basic indication of where the US economy is heading.

The Swiss National Bank (SNB) establishes a target interest rate (LIBOR). Therefore, it has a significant impact on the stability of the CHF.

The interest rate divergence between the Federal Reserve (Fed) and the Swiss National Bank (SNB) will influence this currency pair.

For example, if the Fed intervenes in open market operations to boost the US dollar, the value of the USD/CHF may rise as the US dollar strengthens against the Swiss franc.

Economic reports

The US Non-Farm Payroll report, issued on the first Friday of each month by the US Bureau of Labor Statistics, is one economic publication that significantly impacts the value of the US Dollar.

Other statistics to keep an eye on including the Consumer Price Index (CPI), retail sales data (Purchasing Manager Index), the Department of Commerce’s monthly consumer spending reports, and its quarterly prognosis for any change in US GDP rates.

Swiss inflation data (CPI) and the KOF index provide an overview of the Swiss economy. The KOF indicator is a leading composite indicator of the Swiss business cycle, and its data is deemed near accurate and dependable.

Political situation

Due to the enormous migration of safe-haven money into Swiss banks in the event of a war or conflict, or any unfavorable news about the world economy, the USD/CHF pair may gain.

Switzerland is a tiny country with a robust economic structure and a reasonable growth rate. It does not have a trade deficit, which makes it self-sufficient and helps to stabilize its currency.

USD/CHF correlation

The USD/CHF currency pair is inverse with the EUR/USD and GBP/USD currency pairs. This is owing to the Euro’s, Swiss francs, and British pound’s positive connection.

Interestingly, CHF is positively correlated to gold. This is due to Switzerland’s substantial gold reserves, as well as gold’s and CHF’s safe-haven status.

It is essential to understand that positive correlations today may not correspond to the longer-term connection between two currency pairs.

What’s the best time to trade USD/CHF?

The chart below illustrates the forex trading sessions. The best time to trade USD/CHF is 1300 to 1700 GMT.

There may be occasions when good-sized motions are produced for weeks or months at a time. Check volatility numbers regularly to identify what times of day are the busiest.

Because the USD/CHF is regularly traded around the clock, there may be additional moments you may profit from.

Strategies for USD/CHF

USD/CHF is a popular pair, so you have to come prepared to trade. Here are some of the strategies you can apply for Swissie:

Trendlines

Trendlines are merely diagonal lines that represent a price range or trend. These lines track the price movement to give traders a decent estimate of how high or low the price may go in a particular timeframe.

When the price rises, so do the trendline. When the price declines, so do the trendline.

If you connect the lows with a line when prices increase results in an ascending trendline, it’s an uptrend. When the price lowers, so do the highs. Connecting these falling highs yields a descending trendline, indicating a downtrend.

Momentum trading

Momentum trading is concerned with the strength of a trend rather than the trend itself. This strategy is predicated on the idea that if a trend continues to have a strong trend, it will continue trading in the same direction, whether it is an uptrend or a downtrend.

If you follow this strategy, you will open your position when the trend gains strength and close it when the trend begins to decelerate. Volume, volatility, and periods must all be considered when determining momentum.

The momentum indicator, RSI, MAs, and stochastic oscillator are useful indicators for this method.

Finally, the market mood has a significant impact on momentum. News and economic events, such as interest rate announcements, can significantly impact USD/CHF.

When a trend gains strength, many traders often enter the market, implying even greater momentum.

Breakout

Breakout trading includes entering a position as early as feasible in a trend. A breakout happens when the market price ‘breaks out of a consolidation or trading range; often, this occurs when a support or resistance level is met and exceeded.

Trading breakouts is an important strategy, particularly in forex, because the move marks the beginning of a volatile phase.

Waiting for a critical level to break allows forex traders to enter the trade just as the USD/CHF makes a breakout and rides it until volatility returns.

Breakouts often occur near historical support or resistance level; however, this can vary depending on the market’s strength or weakness.

Therefore, your stop-loss order should be put at the moment where the USD/CHF broke out.

What trading style mostly suits USD/CHF?

Now that you know which strategies are suitable for USD/CHF let’s find out which trading style suits the Swissie.

Day trading

The process of trading USD/CHF or any pair in a single trading day is referred to as day trading. This trading strategy suggests that you open and close all deals in a single day.

To reduce risk, no position should be left open overnight. Unlike scalpers, who only want to stay in markets for a few minutes, day traders typically monitor and manage open deals throughout the day.

As a result, day traders produce trading ideas mostly using 30-minute and 1-hour periods.

Many day traders base their trading methods on breaking news. In addition, scheduled events, such as economic figures, interest rates, GDPs, elections, and so on, have a significant influence on the market.

Scalping

Scalping is a popular trading approach that focuses on minor market fluctuations. This strategy entails opening a huge number of transactions in the hopes of making tiny returns on each one.

As a result, scalpers strive to maximize earnings by making a high number of minor gains. Unfortunately, this method is opposite to remaining in a trade for hours, days, or even weeks.

The USD/CHF liquidity and volatility remain high. As a result, investors seek markets where the price movement is continually changing to profit from modest fluctuations.

This type of trader is interested in gains of roughly five pips every trade. However, they expect a huge percentage of deals to be successful since gains are consistent, reliable, and easy to attain.

Position trading

Position trading is a long-term investment strategy. Unlike scalping and day trading, this trading method is primarily concerned with basic variables.

Minor market swings are not considered in this technique since they impact the overall market picture.

To detect cyclical patterns, position traders are likely to study central bank monetary policies, political developments, and other fundamental variables.

Over a year, successful position traders may only open a few deals. However, profit goals in these trades are likely to be in the hundreds of pips range.

Final thoughts

So that was all about the Swisse!

USD/CHF is one of the most popular pairs. It goes right with the giants like EUR/USD and GBP/USD. If you are looking to trade the pair, check out the abovementioned strategies.

Most common questions asked by the forex traders about USDCHF :

80 percent of the time, both EURUSD and USDCHF move opposite to each other which is called Inverse correlation. If Fiber moves up, Swissie moves down automatically.

The Swiss National Bank suddenly withdrew the peg of 1.20 francs per Euro on January 15. The central bank stated that this was required since the peg was no longer viable.

In the immediate aftermath of the revelation, the currency surged 30 percent against EURCHF and 25 percent against USDCHF within 15 minutes. The decision shook the markets to their core, putting several foreign currency brokers out of a trade. Most of the forex brokers got bankrupt during this time.

UK Trading session is best to forecast and trade the USDCHF currency pair.

Look out for the trend of USDCHF now, draw the support resistance line, trendlines, use the Fibonacci tool to find the exact entry.

The Successful trader provides signals with proper entry price, stop loss and take profit with good trade opportunity chart analysis and the clear trade ideas behind it. Forex GDP helps you to get free forex signal.

USD/CHF Trading Signals

Check Full Forex Market Signals with Technical Analysis Chart

Please note : It is better to do nothing instead of taking wrong trades, we focus on providing you the forex signals only at good trade setup.

Each trade signal given to you with fundamental and technical analysis chart which helps you to understand why our analyst team has given the Buy signals and Sell Signals. Now, you can trade with confident using our service. Sounds good? Let’s look out all our signal charts below.

If you want to test our forex signals, Try free plan (or) if you need more forex signals, Join here for Premium or Supreme plan

Check all our signal results and some of the subscriber’s Myfxbook results here. Try our free service now, let the results speak the rest.

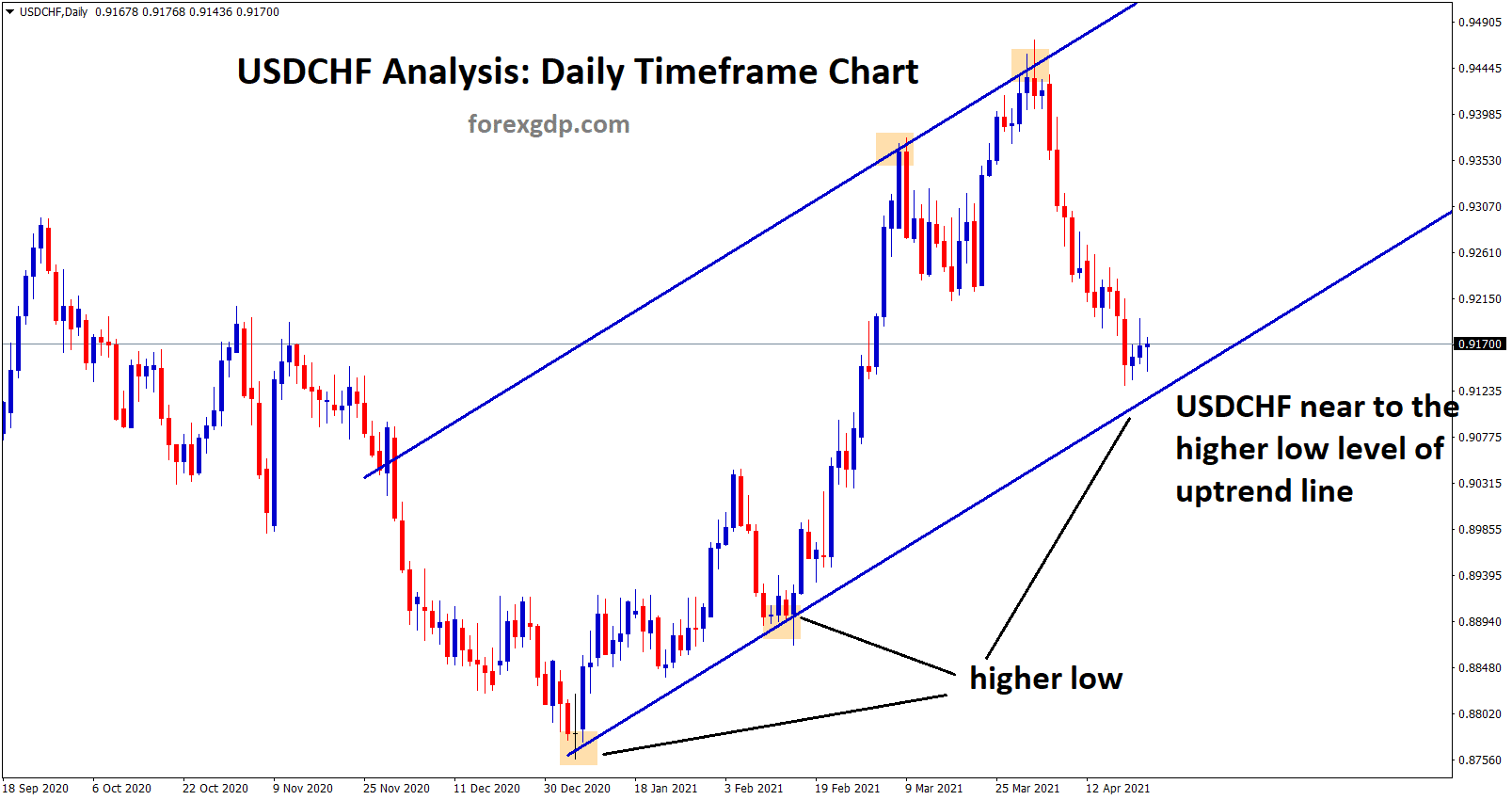

USDCHF is near to the higher low level of the uptrend line in the daily timeframe chart

Biden plan of $1.9 trillion package plays a heavy boost for the US economy. Vaccination is progressed well as 45%

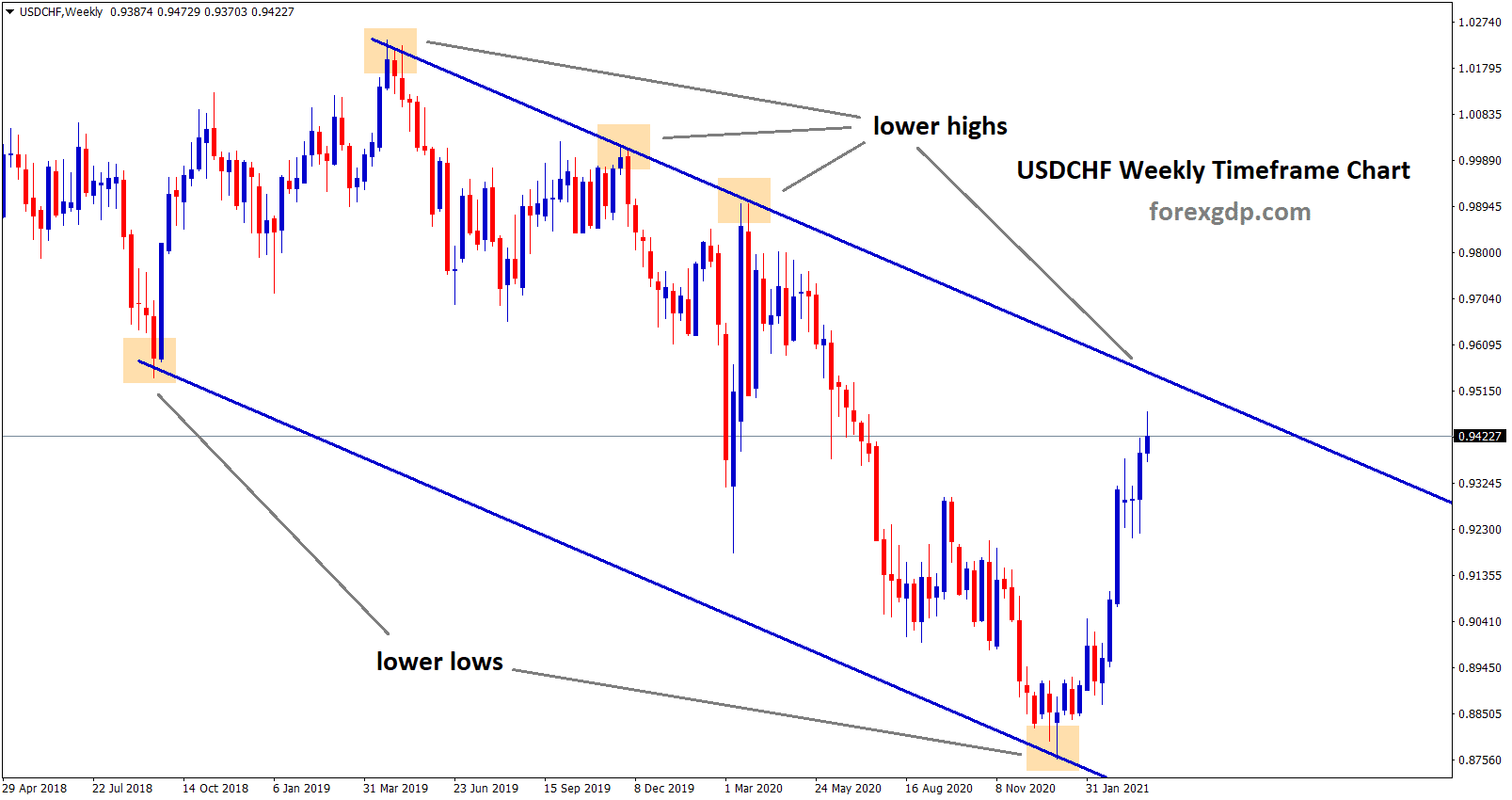

USDCHF is going to reach the top level of the downtrend line

USDCHF is going to reach the top level (lower high) of the downtrend line (descending channel) in the weekly timeframe

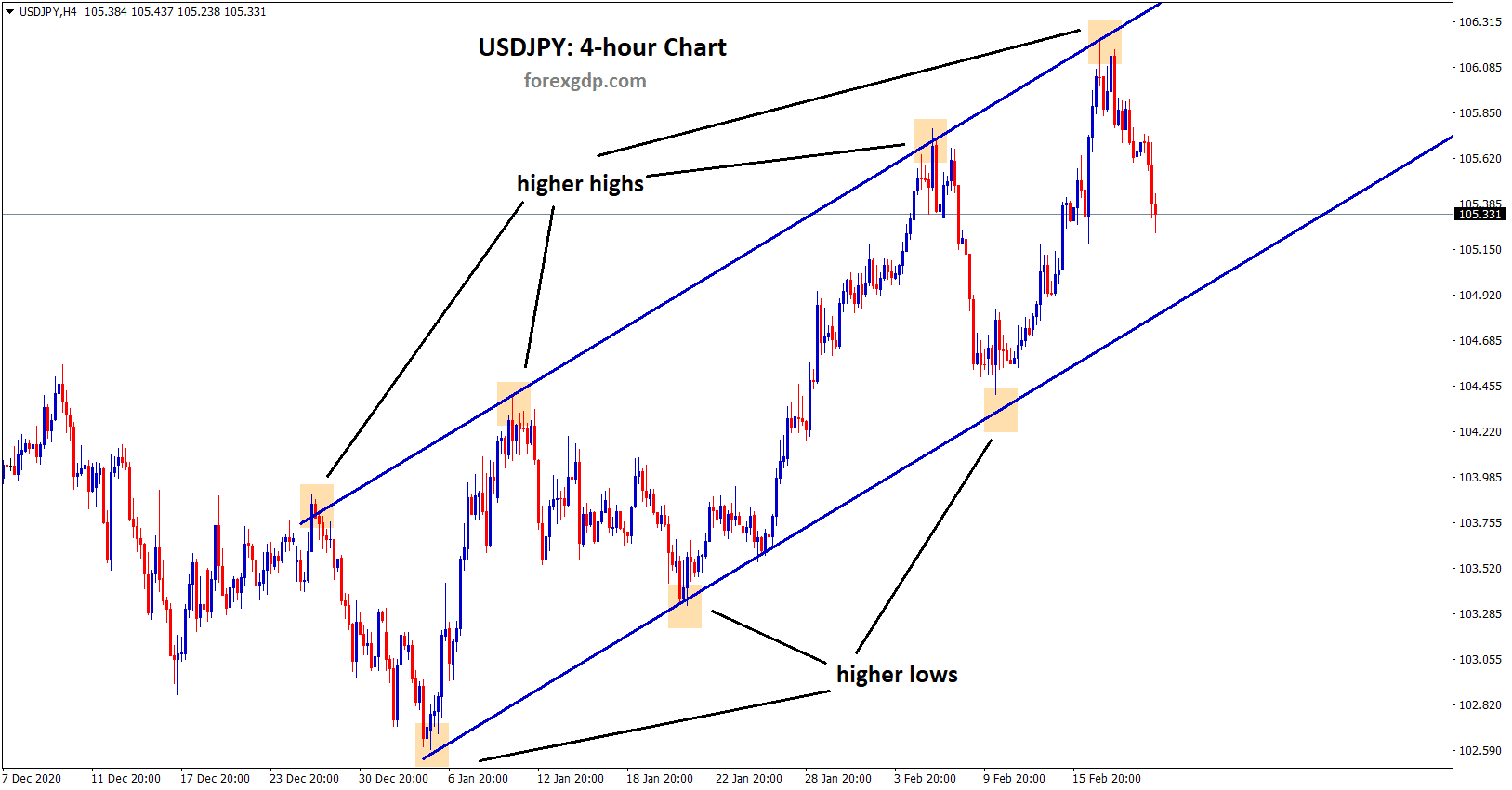

USDJPY and USDCHF are moving in an Up Trend (Ascending Channel)

USDJPY and USDCHF are all moving in an uptrend by forming higher highs and higher lows in the 4-hour Timeframe

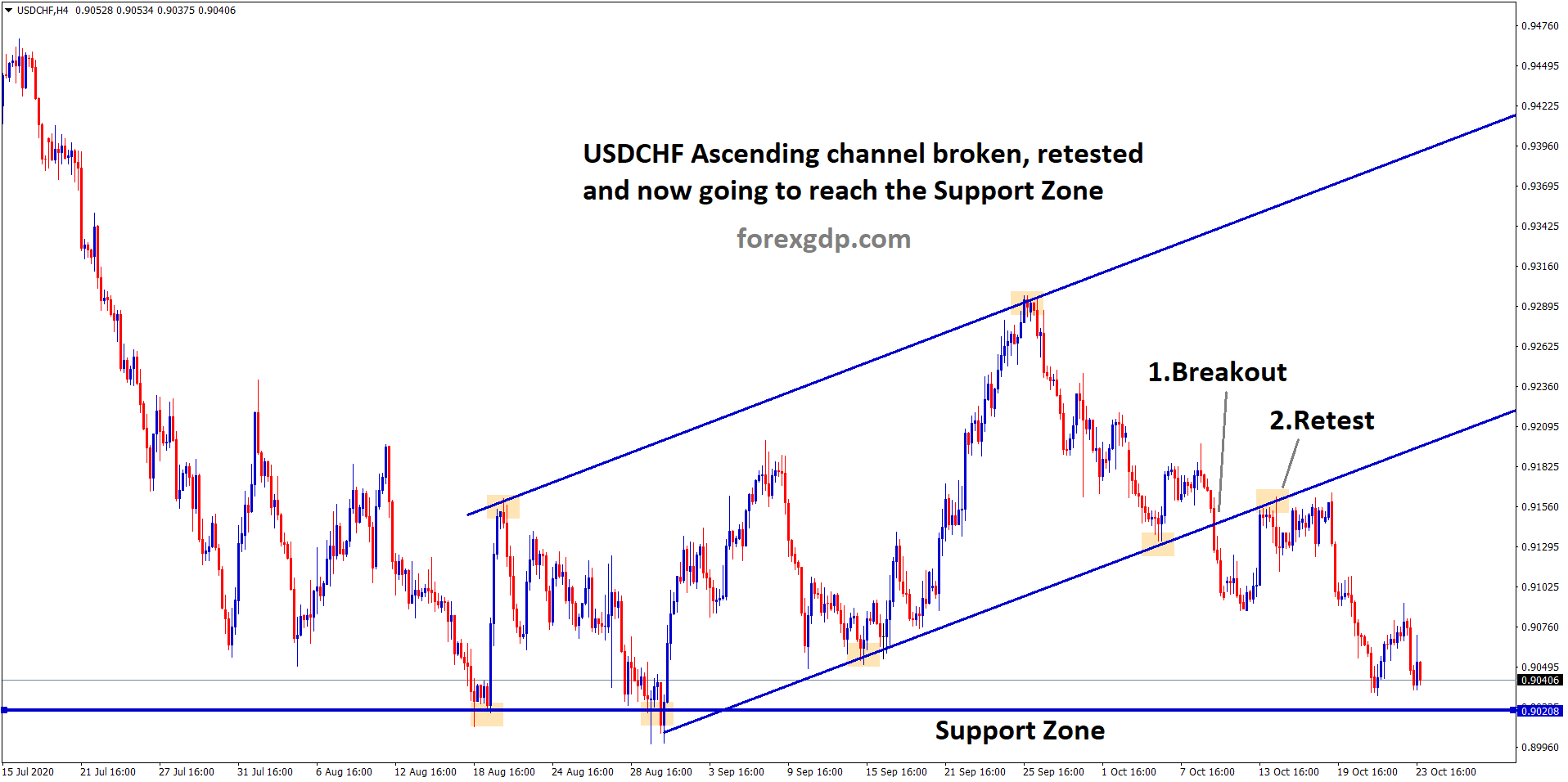

USDCHF going to reach the Support Zone after channel breakout

USDCHF Support Zone Analysis USDCHF has broken the bottom of the Ascending channel and retested the broken level. After retesting,