A Deep Insight into the USD/CAD

The USDCAD is the currency pair consisting of the US and Canadian currencies. The USD/CAD quotation informs the reader how many Canadian dollars (the quote currency) are required to buy one US dollar (the base currency).

When trading the USD/CAD currency pair, you may hear it referred to as “trading the loonie,” after Canada’s $1 coin, which has the country’s national bird on its flip side. The USD/CAD currency pair is one of the most liquid and regularly traded in the foreign exchange market.

Canada’s 1$ coin – One Canadian Dollar Coin

Overview of the USDCAD currency pair

The value of the Canadian dollar is quoted as 1 US dollar per X Canadian collar. In other words, if the pair is trading at 1.20, one Canadian dollar is worth 1.2 Canadian dollars, or USD 0.833. US dollars have traditionally been more vital than Canadian dollars, even though the USD/CAD currency combination has reached parity throughout history. The USD/CAD pair is often traded due to the close economic ties between the two nations.

Parity between the USD and the CAD

The USD/CAD pair has attained a positive correlation. For instance, the Canadian dollar climbed against the US dollar during the Great Recession from 2007 to 2009 and the ensuing quantitative easing of the Federal Reserve, ultimately dropping below parity to 0.95. Conversely, there have been moments of parity when the United States was experiencing financial difficulties, high oil prices, or both.

Significance of the USDCAD exchange rate

Because Canada and the United States are neighbours, the exchange rate significantly influences commerce, tourism, and lifestyle.

When the US currency is high, some production and labour outsourcing moves to Canada to reduce costs. Furthermore, there is a greater import of goods from Canada into the United States. Americans are more willing to travel on vacation or purchase property in Canada since it is cheaper.

When the Canadian dollar is strong, the reverse is true. Firms will import more from the United States into Canada, while Canadians will be more inclined to vacation and buy real estate in the United States.

What was the noon rate?

The noon rate was a currency phrase used by the Bank of Canada (BOC) to announce a specific instance of the foreign exchange rate between the United States dollar and the Canadian dollar (CAD), also known as the USD/CAD rate.

The central bank issued the noon rate at 12:45 p.m. each day, and it was based on the weighted average of CAD trade from 11:59 a.m. to 12:01 p.m. that day.

The noon rate was extensively used as a benchmark exchange rate by businesses and others required to perform foreign exchange computations in USD/CAD until it was abolished in 2017 and substituted by a unified indicative rate.

History of USD/CAD

Let’s talk about the history of USD/CAD. By history, we mean historical exchange rates. Here are some of the key highlights of the USD/CAD exchange rate:

During the US Civil War in 1864, the Canadian dollar was worth $2.78 (US), but it was tied to the gold standard, which the US had already abandoned.

Following the Great Recession and the quantitative easing by the Federal Reserve of the United States, the Canadian dollar rose against the US dollar to trade below parity, finally hitting 0.95.

From 1953 to 1960, the Canadian dollar traded in the $1.02 to $1.06 (US) range. On August 20, 1957, it reached $1.0614 (US). Until 2007, this was thought to be the modern-day high for the Canadian dollar vs. the US dollar.

The Canadian dollar hit $1.0443 on April 24, 1974. (US). This was the highest point of the dollar’s most recent float era, and it would not trade at these levels again for another 30 years.

In 1981, the Bank of Canada’s benchmark interest rate reached 21.2 %, and the Canadian currency reached an all-time low of 69.13 cents (US) on February 4, 1986.

The Canadian dollar increased throughout the late 1980s and early 1990s, reaching 89.34 cents on November 4, 1991. (US). This was the decade’s pinnacle. However, budget deficits, lower commodity prices, and the aftermath of the international crises in Russia and Latin America in 1998 all contributed to the Canadian dollar’s decline.

The Canadian dollar reached an all-time low versus the US dollar on January 21, 2002, falling to 61.79 cents (US).

The Canadian dollar attained parity with the US dollar for the first time in almost 31 years on September 20, 2007, after a 62 % surge in less than six years, fueled in part by record-high oil and other commodity prices.

On July 21, 2011, during the height of the commodity boom, the Canadian dollar touched $1.06 (US). It then fell quickly in modern history as commodity prices dramatically declined.

USD/CAD exchange rate from 1951 to 2016

On the other hand, oil prices fell to decade lows in 2016, selling around $30 per barrel. As a result, the Canadian dollar reached a new low, trading at 1.46.

The exchange rate has remained between 1.25 and 1.40 since 2016, with a low of 1.2062 and a high of 1.4686.

Factors affecting the USDCAD value

A combination of economic theory and empirical study has identified factors that predict exchange rates when taken apart. However, forecasting changes in the exchange rate is complex because of the interaction between these factors. Moreover, it’s not always clear why things have changed recently.

The factors that influence the value of USD/CAD are:

Political stability

The value of a currency is also affected by political stability. As a general rule, when a country’s political situation improves, its currency rises; conversely, when a country’s political situation deteriorates, the value of its currency falls.

The 2016 US election was a prime illustration of this. The dollar was expected to lose value quickly if Trump won, yet the exact reverse occurred. On the other hand, Canada was concerned by Trump’s anti-trade position.

Because Canada is the United States’ second-largest trade partner, any tariffs imposed by Trump would have severely harmed the Canadian economy. However, during Trump’s presidency, the total impact on the loonie remained uncertain.

Interest rates

Central banks exercise power over inflation and exchange rates by regulating interest rates, and changes in interest rates affect inflation and currency prices.

Larger interest rates provide lenders in an economy with a higher return than other countries. As a result, higher interest rates entice foreign money, causing the currency rate to rise.

However, increased interest rates are offset if inflation in the nation is significantly greater than in others or if other factors contribute to driving the currency down. This makes a big impact to all forex traders in the forex market.

For instance, if the value of the Canadian dollar is expected to decline, foreign investors are looking for a higher interest rate on Canadian dollar investments.

Valuation of raw materials

In contrast to the United States and many other countries, Canada’s exports heavily rely on commodity exports. As a result, as the price of Canada’s primary exports rises, so do the country’s terms of trade. As a result, the Canadian dollar rises in value as the country’s purchasing power increases. Conversely, lower commodity prices might lead to a depreciation of the Canadian dollar, and the inverse is also true.

Inflation rates

A country with a continually decreasing inflation rate typically has an increasing currency value as its buying power grows relative to other currencies. Conversely, those nations with greater inflation often see their currency depreciate about the currencies of their trading partners. So, the USD/CAD value depends on the country’s inflation rates.

International trade of goods and services

When exports outweigh imports, a nation’s exchange rate rises (the demand for the currency exceeds the supply). When a country has a trade imbalance, imports outpace exports, putting downward pressure on the currency’s exchange rate (the supply for the currency exceeds the demand).

Foreign investment, trade, and tariffs

Direct foreign investment by the US/Canada has the opposite effect. Debt repayments to foreign creditors lower the value of the currency.

In the case of the United States and Canada, one possible explanation is that they are each other’s, second-largest trading partners. Trade measures such as the current account are extremely sensitive to changes in trade, tariffs, or non-trade barriers that would greatly impact either country. Perhaps changes in exchange rates are connected to how they trade with one another.

Productivity

A country’s productivity, or the amount of output it can produce with a given level of inputs, may affect the exchange rate by affecting relative pricing and international competitiveness. For example, productivity in Canada would grow faster than in the United States, making Canadian goods more competitive and increasing demand for the country’s currency.

Natural gas report from the US

The Energy Information Administration (EIA) publishes a Natural Gas Storage report every week, which tracks the change in the number of cubic feet of natural gas kept in underground storage during the previous week.

Even though this is a US indicator, it significantly impacts the CAD and Canada’s energy sector. For example, if the rise in natural gas inventory is more than predicted, it indicates weaker demand, which leads to lower oil prices.

Impact of oil on USDCAD: Why is it significant?

The exchange rate between the US and Canadian currencies strongly influences oil prices. The value of the Canadian dollar (often known as the loonie) rises as the price of oil increases over the long run. There’s a connection because of how much of Canada’s revenue comes from selling crude oil, which accounts for the vast bulk of the country’s US dollars.

Canada’s foreign exchange earnings and crude oil

Canada’s total foreign currency income is heavily dependent on the sale of crude oil, which accounts for a significant amount of the country’s overall foreign currency revenues. Canadian crude oil production and exports ranked sixth in the world in 2019. As a result, crude oil is Canada’s primary source of foreign currency, and its share has been steadily increasing.

There’s no surprise that the US dollar is the preferred currency for most international energy transactions since most importers price crude oil in US dollars. In addition, Canada is the United States’ most crucial foreign oil supplier. More than 40% of all crude oil imports and 20% of oil intake at refineries in the United States are accounted for by Canada’s exports to the United States.

Supply and demand

The Canadian/U.S. dollar exchange rate is determined by the supply and demand of both Canadian and US currencies. Changes in crude oil price and volume significantly impact the flow of US dollars into the Canadian economy since crude oil exports make for a large portion of Canada’s US currency revenues.

Oil exports from Canada generate a lot of money when the price is high. As a result, the Canadian dollar’s value will climb since the supply of US dollars flowing into Canada will be larger than the supply of Canadian dollars. Conversely, when oil prices are low, the supply of US dollars is low compared to the supply of the Canadian dollar, resulting in a decrease in the value of the Canadian dollar.

Bottom line

USD/CAD depends on many factors for its exchange rate. The outlook for other major currencies, interest rate differentials, trade tariffs, and oil prices determine the loonie’s value. Concerns regarding the long-term effect of decreased oil prices on the Canadian economy are expressed by market participants.

Any news from the US also makes the market participants cautious of the USD/CAD exchange rate, as Canada relies heavily on the US for its trades.

How to trade USDCAD? Should I buy or Sell USDCAD?

Trading the USDCAD price is easier when you check the USDCAD Oil Correlation. When oil price increase, CAD currency get stronger so the USDCAD goes down. USDCAD and US Oil price WTI/USD has an Inverse correlation. Loonie is not a Dollar coin, instead, it’s a correlation coefficient of crude oil and the Canadian dollar.

Fundamental Economic USDCAD analysis is done easier by watching the USDCAD news such as Canadian interest rates, Crude oil inventories, Crude Oil WTI Futures News, USOIL and USDCAD trading times.

Whatever trading strategies you use on different forex pairs, the price action is the best trading strategy to follow for the forex market.

Most common questions asked by the forex traders about USDCAD :

Oil production is mostly done in Canada, So if USOIL price increase, the Canadian Dollar gets strong which leads to USDCAD price fall.

Yes, there is some inverse relationship between gold and USDCAD. If USDCAD goes down, Gold goes up. As if the demand for oil increases, then the gold price also get increase. During Covid-19 pandemic times, the Crude oil crash made the USDCAD price fall and the gold price XAU/USD breaks the all-time high and went to 2070$ per barrel.

If the demand for oil increases, CAD currency gets strong, USDCAD will fall, During this time, Gold price will rise as the US Dollar gets weak against gold and Canadian Dollar Currency.

The currency correlation between USDCAD and USDCHF is only “US Dollar” if USD gets strong, both USDCAD and USDCHF will raise, if “US Dollar” gets weak, both will fall, however, the Canadian dollar behave little different than other pairs as it is mostly moving depend on the Crude oil market price.

No, the US Dollar is only the common correlation between them. Depending on the strength and weakness of the US Dollar, both GBPUSD and USDCAD will correlate or else the loonie will decide to move depending on the Canadian economy and WTI Crude oil price, Britain pound will decide to move depending on UK Economy.

Yes, USDCAD is a slow-moving pair during the UK session and Asian session. But USDCAD will be more fast-moving and active during the US sessions. Reason: Both Canada and the US markets is open at that time.

In trading view, doing your own analysis is good instead of following other traders USDCAD forecast who uses different strategies like Elliott wave analysis, price action. Watching USDCAD historical data charts from tradingview.com is helpful for looking the market in a long term view.

USDCAD Trading Signals

Check Full Forex Market Signals with Technical Analysis Chart

Please note : It is better to do nothing instead of taking wrong trades, we focus on providing you the forex signals only at good trade setup.

Each trade signal given to you with fundamental and technical analysis chart which helps you to understand why our analyst team has given the Buy signals and Sell Signals. Now, you can trade with confident using our service. Sounds good? Let’s look out all our signal charts below.

If you want to test our forex signals, Try free plan (or) if you need more forex signals, Join here for Premium or Supreme plan

Check all our signal results and some of the subscriber’s Myfxbook results here. Try our free service now, let the results speak the rest.

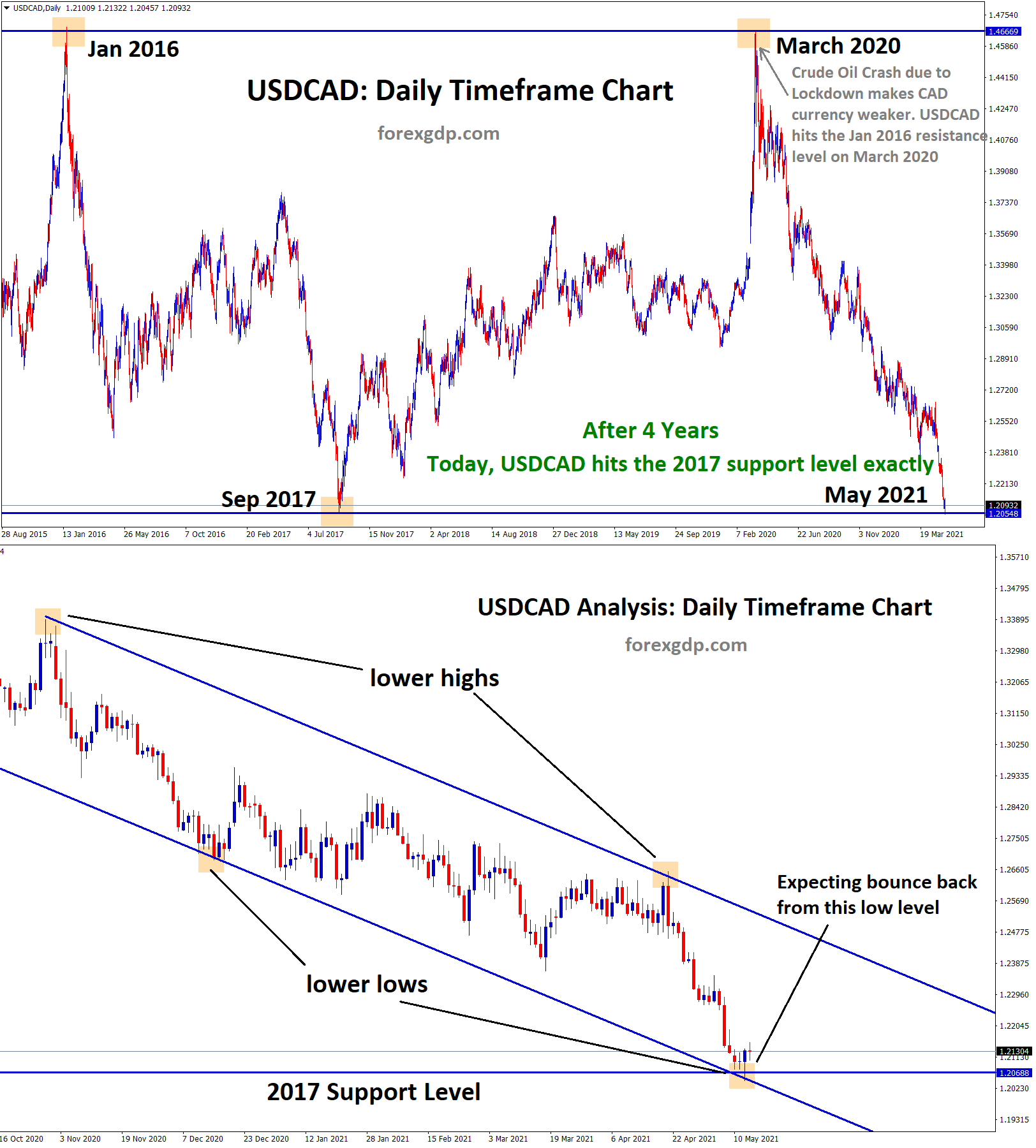

USDCAD bounces back from the low level and closed at the entry price

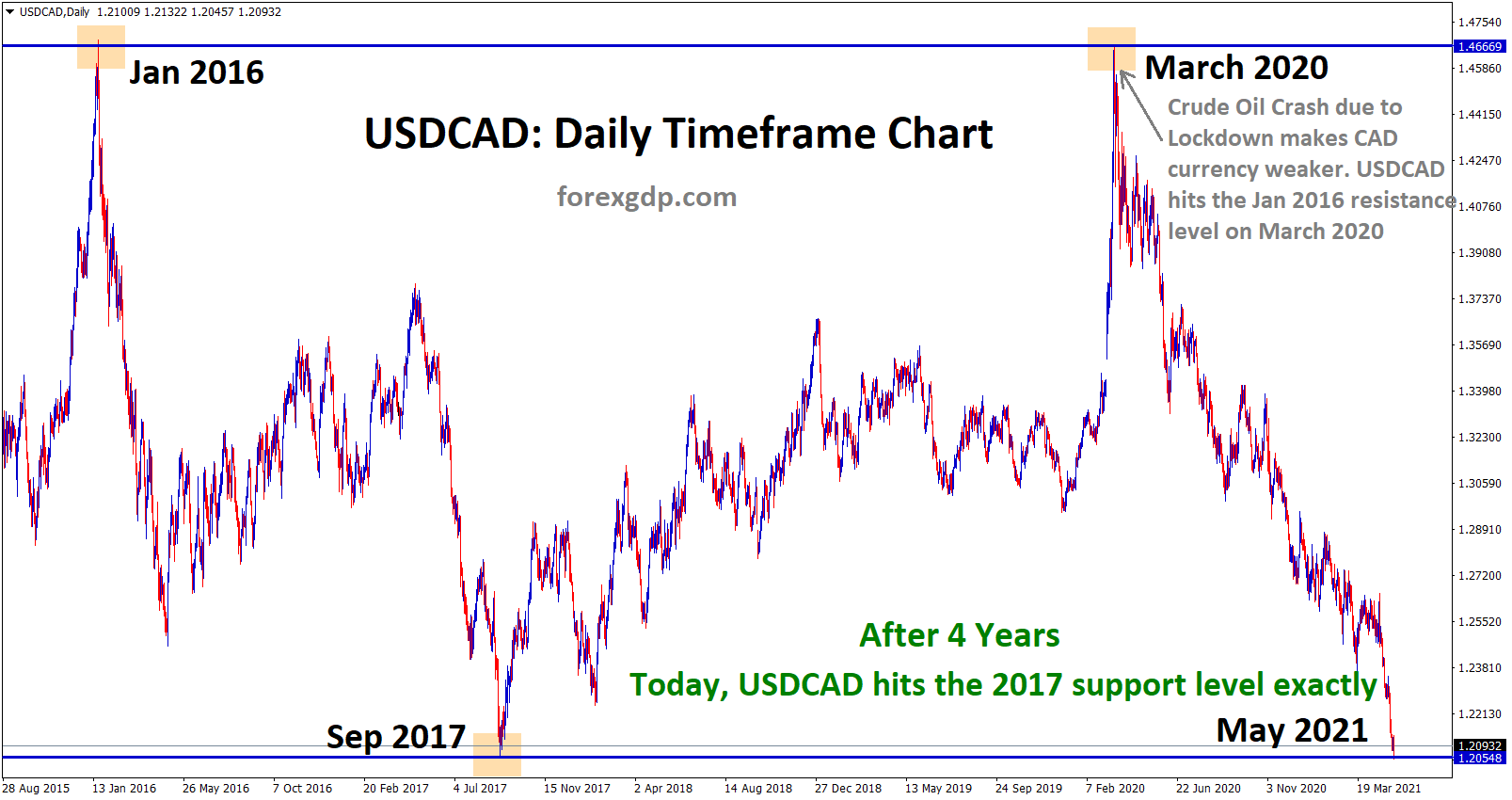

After 4 years, USDCAD hits the 2017 Support level. USDCAD is bouncing back from the 2017 support level and lower

After 4 years, Today USDCAD hits the 2017 Support level

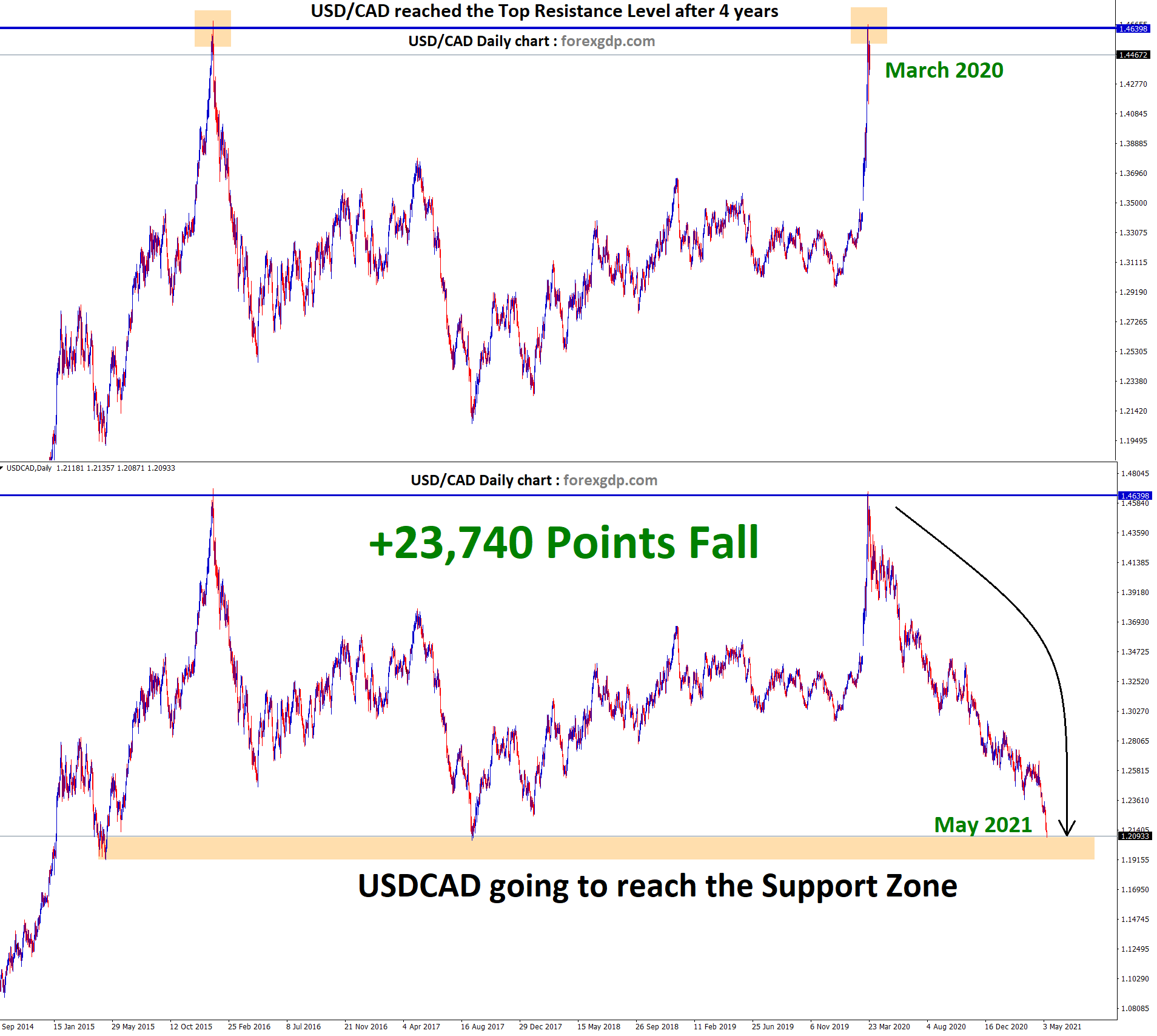

USDCAD Historical Analysis USDCAD fall straight from the March 2020 resistance level to the Support without many retracements. After 4

+23,740 Points fall on USDCAD from the Top Resistance during Crude Oil Crash

USDCAD Double Top Analysis USDCAD has formed a double top pattern in March 2020. Crude Oil crash made the USDCAD

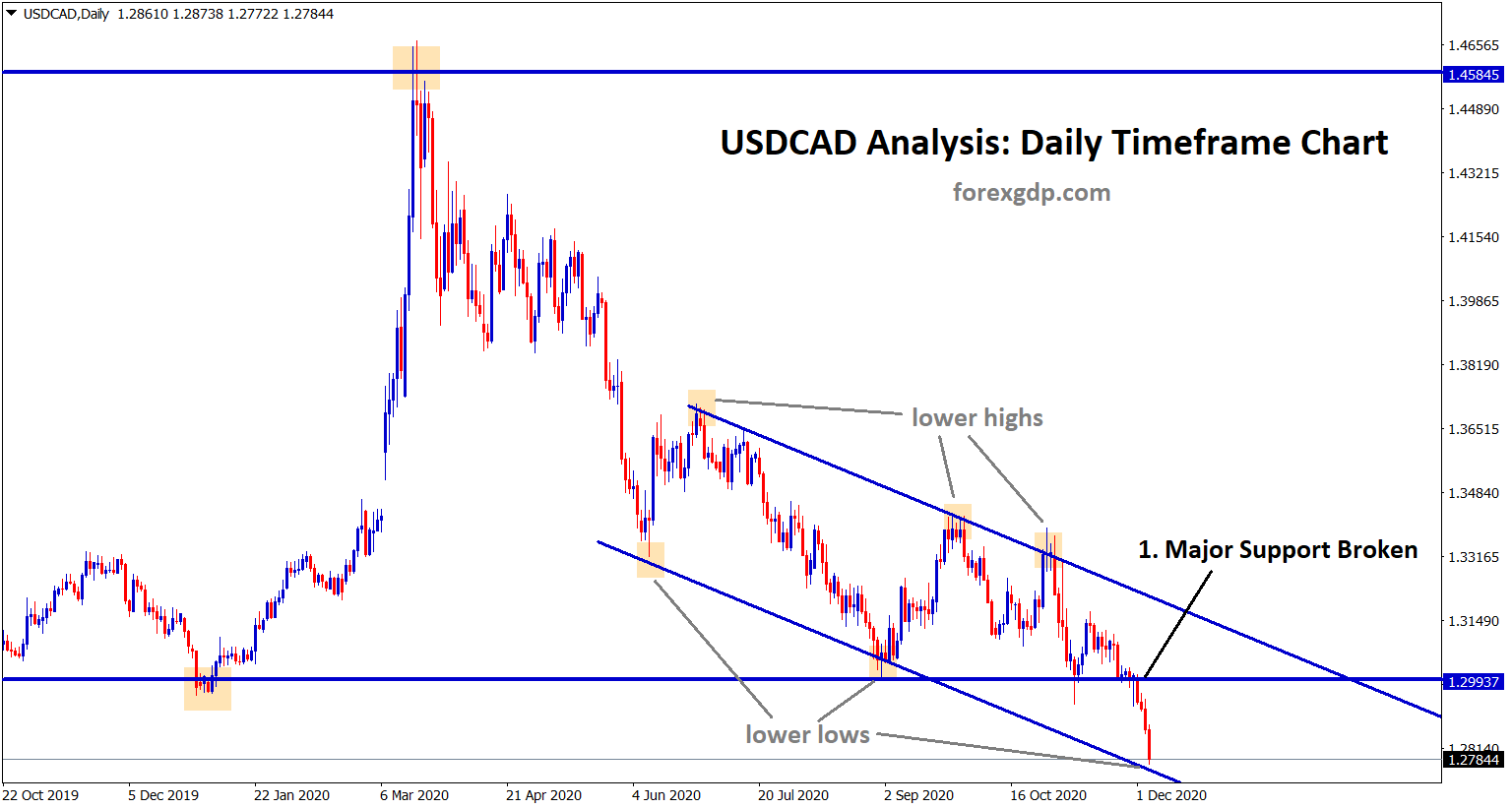

USDCAD, CADJPY, GBPCAD, EURCAD, AUDCAD, CADCHF at the key price levels. Good to enter?

USDCAD USDCAD has broken the major support level and now it reached the lower low zone of the minor downtrend