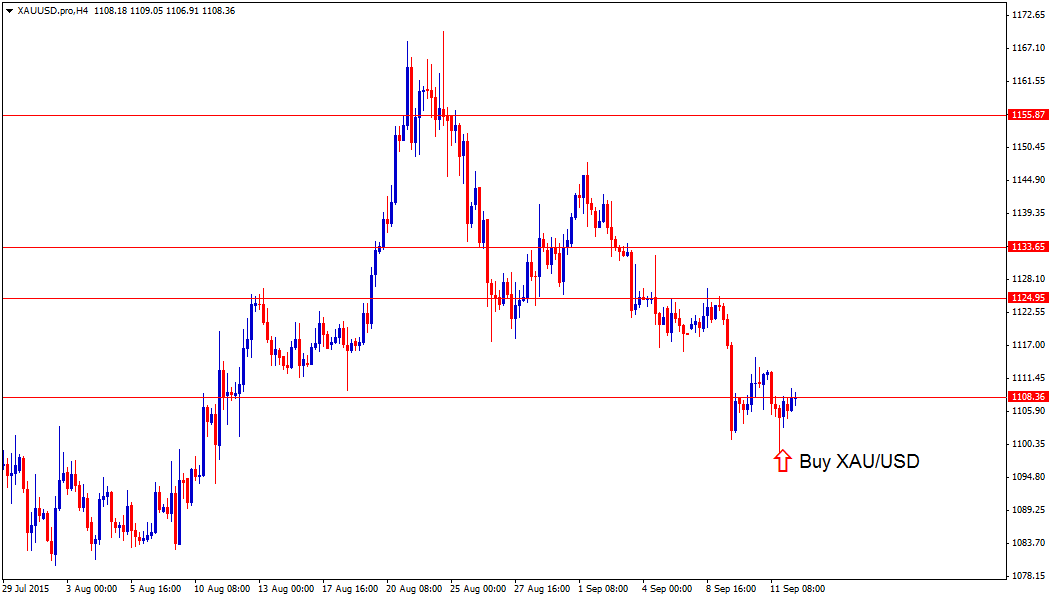

Gold: the US and Europe planned for Russian oil Banning soon

XAUUSD Gold price is moving in an Ascending channel and the market has reached the higher high area of the channel.

US President Joe Biden speaks with European Commission President Vonder Leyen about banning Russian Oil imports.

And Gold prices are expected to reach August 2020 highs as the US plans to Ban Russian oil imports to Global countries.

So Crude Oil prices reached $130bbl today, and JP Morgan’s Target is $185bbl by the end of the year.

Russia and Ukraine War still not completed and More combat going on and Result was reflected in Gold prices movements.

Russian President Putin will continue the War until the Goal is reached.

Friday NFP data shows Robust Growth and Makes US Dollar cheered Up.

And Next week’s Meeting on FOMC, FED Powell will do a rate hike of 25bps as Said Earlier.

US Dollar: NFP data came in Robust numbers than expected

USDCHF Has broken the Descending triangle pattern.

US Dollar index surpassed the 99.00 level, which is 2002 highs, Russia and Ukraine conflicts made Safe Haven Dollars increase more.

And Friday NFP data shows Robust numbers as 678K printed versus 400k Expected, and the Unemployment rate came at 3.8% versus 3.9% expected.

Domestic data and External data boosted the US Dollar index from higher highs in the market.

US President Joe Biden plans to Ban Russian oil imports; this plan is to Ceasefire War on Ukraine.

EURO: Euro currency may be dipped to 1.0600 area as Economists Forecasted

EURUSD is moving in the Symmetrical triangle pattern and the market has reached the bottom area of the pattern.

EURUSD may become back to 1.0600 as Economists expected; if the ongoing crisis between Russia and Ukraine did not end, then EURUSD would suffer losses up to the 1.0600 mark this month.

This week’s ECB monetary policy rate is more expected, whether the reduction in purchases or a Rate hike in the second half of the First Half of 2022.

And the UK has more diversified Energy supplies and more advantages than European nations.

But 46% of the population of Europe uses Russian Oil and Gas.

And Europe is the most affected nation by Russia and Ukraine War next to Ukraine small country.

In the coming weeks, EURO currency will fall more than other G10 peers lack of Commodities resources like Oil and Natural Gas.

Germany data came in Robust numbers

Contracts for Goods made in Germany rose by 1.8% versus 1.0% expected. On an annualised Basis, Germany’s industrial orders rose by 1.0% versus 30% predicted.

And German data will not push up the Euro in the near term.

Friday NFP data shows disappointment for Counert pairs and EURUSD down for 1-1.5% last Friday.

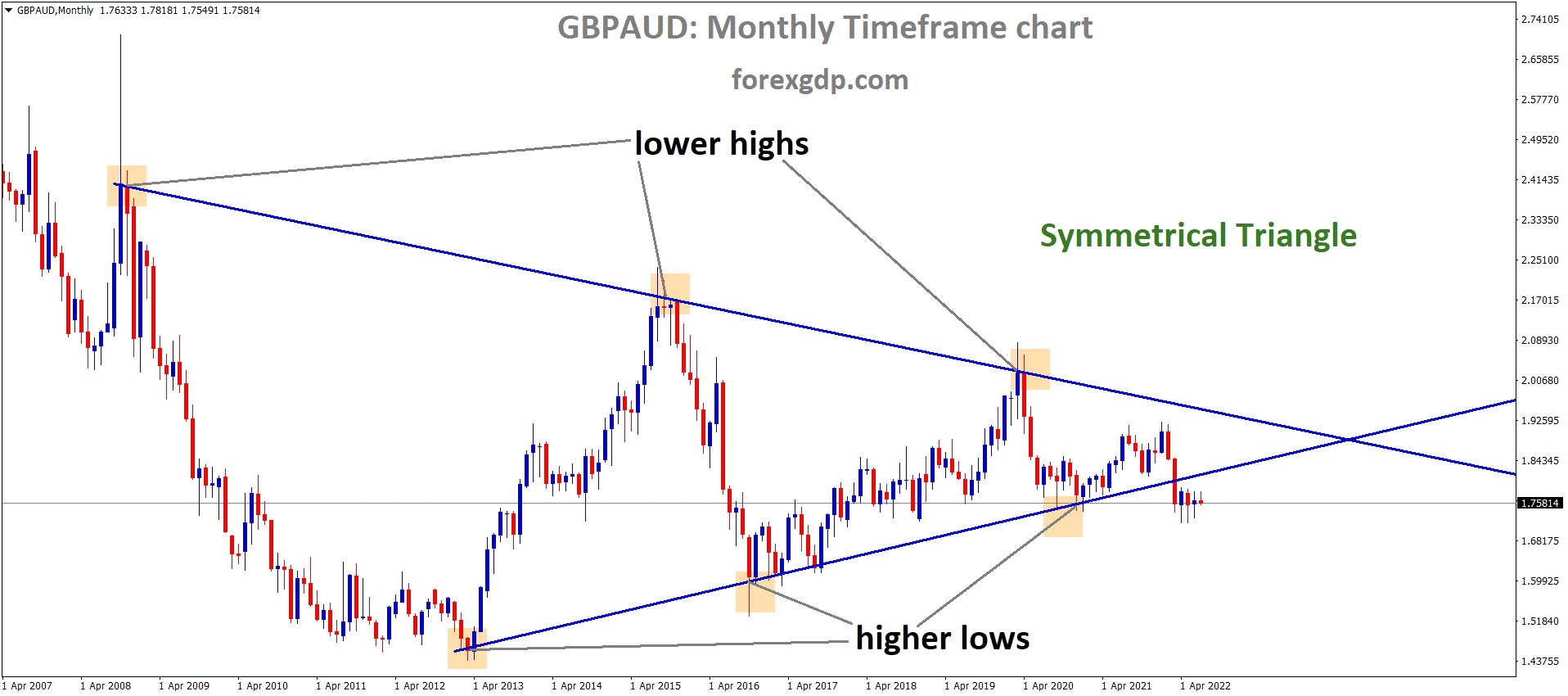

UK Pound: UK Economy not much affected if Russia Bans Oil Exports

GBPUSD is moving in the Descending channel pattern and the market has reached the Support area of the Pattern.

GBPUSD printed 2022 fresh lows at 1.3190 area amid global tensions of Russia and Ukraine War.

And 12 days of War did not come to an end, and UK Pound was little suffering due to Natural gas and Oil contributions little from Russia.

And the UK has diversified the Energy imports from Various countries.

So Banning Russian Oil imports does not much affect UK Economy, But Global oil prices increasing makes Energy inflation soaring in the UK.

Japanese Yen: Bank of Japan increasing the forecast of inflation reading in 2022

USDJPY is moving in an ascending channel and the market has reached the higher high area of the channel.

Bank of Japan plans to increase the view of inflation reading and Wage hikes for workers due to Energy costs rising further at Global levels.

And Board meeting conducted on March 18 and Whether additional stimulus will be used or any changes are expected.

Japanese Yen rising further as Fears of War more in Investors mind and Park their funds in Japanese Yen.

Crude oil: Russia accounts for 27% of global needs, and Stopping oil and gas will impact the whole world

Crude Oil is moving in the Rising Wedge Pattern and the market has fallen from the higher high area of the pattern.

US President Planning to Ban Russian Oil imports to stop War on Ukraine.

But Russia accounts for 27% of Global needs and 46.7% Solid Fuel requirements, and 41% of Natural Gas.

And Russia banned from Oil Market is not easy as we thought, but we made ready for any time for Alternative resources.

And the US Requested Saudi Arabia to increase the production, But Saudi has rejected the request and followed the current 400bbl per day progressing.

Iran’s nuclear deal was not Yet over, and it will clear means Global nations will feel better than Nothing Supply from Russia.

Australian Dollar: China Government forecast of 2022 GDP is lower than 2021

AUDUSD is moving in the Descending channel and the market has reached the lower high area of the channel.

China announced the GDP Growth target of Around 5.5% for 2022, down from the 2021 target of 6% or more.

China already faced Supply chain issues and Real estate problems last year.

But People Bank of China made lower lending rates and injected more cash flow into the market to stabilize the Economy without delay.

Australian Dollar pushed higher after Commodity like Iron ore prices surges.

And Friday’s NFP report shows 678k versus 400k expected, and the Unemployment rate fell to 3.8% from 3.9%.

This positive data is unfazed by AUDUSD Pair on Friday, Now Strong momentum based on each movement of Russia and Ukraine War tensions.

New Zealand Dollar: RBNZ tightening Monetary policy settings to control the inflation

NZDUSD is moving in an Ascending channel and the market has rebounded from the higher low area of the channel.

New Zealand Dollar eyes for 0.7000 area this week as Analysts expected, RBNZ has done 75 basis points rate hikes in last five months.

Commodity prices surging makes New Zealand Dollar soaring to higher and RBNZ tightening in every meeting to control inflation reading is more support for New Zealand Dollar.

Friday NFP data printed Positive numbers, but nothing could affect the prices of NZDUSD.

Swiss Franc: SNB Foreign reserves came lower than the previous reading

GBPCHF is moving in the Descending channel pattern and the market has reached the lower low area of the channel.

Swiss Franc made lower against USD after Friday’s robust NFP and Unemployment rate data.

And now SNB is readying to intervene in FX markets to curb the Swiss Franc prices.

But Inflation in the Swiss is not much high, and We are seeking a 2% target, then only SNB Hikes interest rates in Further.

USDCHF climbed to 0.9200 area after Friday news, and SNB Shows Foreign currency reserves for 938B from the previous 947Billion Francs.

Don’t trade all the time, trade forex only at the confirmed trade setups.

Get more confirmed trade setups at Premium or Supreme plan here: https://www.forexgdp.net/buy/