Crude oil, also known as black gold, has revolutionized human history.

It has been part of our lives for many centuries, and some say it’ll stay that way.

But what makes crude oil important, and how does oil trading work?

We’ll answer all these questions in our in-depth review.

So, make sure to stick till the end!

History of crude oil

Wood was the primary mode of energy and fuel for centuries during agrarian times.

The invention of the steam engine allowed the world to progress into the industrial era.

Coal replaced wood as it was cheaper, less bulky, and more energy-producing than its counterpart.

As the 20th century hit, coal was further overtaken by oil, which became the preferred energy source.

The first oil was discovered in 600 B.C. by the Chinese.

It was not until 1859, via Colonel Drake’s oil discovery in Pennsylvania, that oil truly became known to the world. Spindletop discovery in Texas back in 1901 was another event that set the stage for the worldwide prevalence of oil.

As more and more people began owning automobiles, the oil demand increased.

Pennsylvania Rock Oil Company was the first oil corporation, which ended up changing the world of the oil industry forever.

The first oil well was drilled by the same company, Pennsylvania Rock Oil, in Titusville in Pennsylvania. Edwin Drake was in charge of this project and was able to open the first oil well by August 1859.

In 1938, an oil well was drilled in Saudi Arabia, a pathway to the largest oil source in the world.

Crude oil exchange rate history

WTI crude oil rose after World War II, peaking in the upper $20s and entering a narrow band until the embargo in the 1970s triggered a parabolic rally to $120.

The second-highest price was $137.1 in April 1980. Before this, there was an overall increase in prices.

The prices were more or less decreasing per barrel after this, until November 1998. The prices then shot up, reaching $179.90 per barrel in June 2008, the highest price to date. Price per barrel has been fluctuating since then.

The price of crude oil at the time of writing is $92.81 per barrel.

The importance of crude oil

Crude oil is one of the most dynamic fuel sources on the planet, accounting for more than a third of global energy use in the past.

The process of finding, extracting, exporting, and refining crude oil is lengthy, and the infrastructure required to support it must be in place. Thousands of kilometers of oil pipelines, storage facilities in key oil trade hubs, and various refineries are all involved. As a result, the worldwide oil industry is a multi-trillion dollar sector in total.

Oil is particularly vital to sectors that rely substantially on fuel, such as aircraft, plastic manufacturers, and agriculture.

Crude oil is a key import and export for many countries due to its importance as an energy source. In addition, oil and oil derivatives such as futures, forwards, and options have a large financial trading industry due to their importance.

Brent or WTI, which one to choose?

West Texas Intermediate Crude and Brent Crude are the two main markets for crude oil.

WTI is sourced from the Permian Basin in the United States and other local sources, whereas Brent is sourced from more than a dozen fields in the North Atlantic. As a result, these kinds’ sulfur content and API gravity vary, with lesser values being referred to as light sweet crude oil.

Although WTI was more heavily traded in the world futures markets in 2017, Brent has proven a stronger indication of global pricing in recent years.

How to trade oil?

You need to open an account with the broker, deposit funds, and select crude oil from the commodities list to trade crude oil.

If the current quote of crude oil is 92.50, it indicates that one barrel is worth 92.50 USD.

For the standard crude oil lot, the tick value is $10, as the forex pairs. It’s because each contract represents 1,000 barrels of oil, and the tick for each barrel is measured in increments of $0.01. So if you have a position on one contract, a one-tick movement will result in a profit or loss of $10. If the price moves ten ticks, you gain or lose $100.

Let’s give an example of how you can trade the good ol’ oil.

Suppose you want to go short (sell) the crude oil at 90.00 with one standard lot. Then, the market starts trading in your direction, and the rate becomes 91.25. So, you make a cool $12.5.

Now inverse the situation. Let’s say the market doesn’t go in your favor and starts dipping, and the rate becomes 89.50. In this case, you lost $5.

Factors affecting oil prices

The world’s most used and one of the most widely traded commodities is crude oil.

For this reason, its prices are heavily influenced by a lot of factors, as we will see.

Supply and demand

The OPEC (Organization of Petroleum Exporting Countries) influences oil prices worldwide by restricting the supply of crude oil. The OPEC’s policies are, in turn, affected by geopolitical developments.

Disruptors of supply in the recent few years have ignited political events that have caused major fluctuations in oil prices.

The Iran-Iraq war, Arab oil embargo, the Iranian revolution, and the Persian Gulf wars are examples of political events. Even technological innovations have impacted crude oil production volumes and costs tremendously.

The invention of hydraulic fracturing has helped increase the supply of crude oil directly from the rocks – which, of course, influences prices.

Where supply is a contributor, demand is not far away. The demand for crude oil has been on the rise. This is due to exponentially increasing economic growth, population growth, and industrial production.

Natural disasters

Effects of disasters affect prices of crude oil more than we might think. Covid-19 is a prime example of this. During the pandemic’s start, in January 2020, the oil demand started dwindling.

A blow to the supply followed this. Russia and OPEC decided to increase production, which resulted in prices plummeting. This was counteracted by reducing output, but the prices continued downhill until June 2020.

After this, they only increased, reaching an all-time high of $85.64/b in October 2021. Mississippi River flooding, Exxon-Valdez oil spill, and Hurricane Katrina in Louisiana are other examples of disasters significantly affecting oil prices.

Geopolitics

As mentioned earlier, geopolitics also affects the prices of oil. Because the supply of oil is in the hands of big countries, the tension in any of those nations will ultimately affect oil prices. For example, during the Gulf wars, oil prices rose as oil production fell.

Market forces

The single best influence of oil prices is the OPEC, consisting of 13 countries. It controls 40% of the world’s oil supply. Therefore, OPEC can restrict production at any time and force prices to rise. Although OPEC’s power has reduced drastically due to non-members, such as the USA having its output, it still has a role in the prices.

Oil correlation with forex

For three reasons, crude oil is strongly associated with most currency pairs.

For starters, because the contract is priced in U.S. dollars, any changes in pricing have an immediate effect on linked crosses.

Second, significant reliance on crude oil exports exposes national economies to energy market ups and downs.

Third, falling crude oil prices will cause industrial commodity prices to fall in lockstep, boosting the risk of global deflation and driving currency pairs to revalue their linkages.

For example, Canada is a big oil exporter; thus, the price of oil and the amount it can export impact its economy.

Because Japan is a large oil importer, the price of oil and the volume it needs to import impact the Japanese economy.

The value of the U.S. dollar heavily influences the price of oil. A stronger dollar exerts downward pressure on oil prices, while a weaker currency helps to promote higher prices.

Crude oil similarly follows the stock market but in the other direction. Higher oil prices tend to be supported by an expanding economy and stock market, but excessively high prices might smother the economy.

Best time to trade oil

The optimum time to trade crude oil is 9:00 a.m. to 2:30 p.m. EST during the New York session.

According to the cure oil seasonality pattern, the optimum time to buy crude oil is in March and June, when the WTI price tends to bottom. Similarly, the optimum time to sell crude oil is in mid-October, when the WTI price is expected to peak.

Strategies for trading crude oil

Crude oil gets significant trading volume throughout the trading day. So if you want to trade the black gold, you have to come prepared as a trader. Here are some of the strategies you can apply:

Buy and hold

The most well-known and widely used trading technique is to buy and hold. Traders consider fundamentals such as supply and demand and the geopolitical atmosphere before buying or selling crude oil futures contracts to expect a price increase or a price decrease.

Before the futures contract expires, the price must move significantly enough to provide the trader with a profit. The deal will lose if the trader’s prediction of market direction or price action is incorrect.

Applying technical analysis

Crude oil traders make investment decisions by analyzing crude oil price charts that cover various periods using technical indicators.

Traders can use candlesticks, bar charts, and volume indicators to forecast crude oil’s next price move.

Traders determine whether to buy or sell a crude oil future by applying the same technical indications on a two-minute chart, five-minute chart, one-hour chart, and day chart. To give the trade time to develop, technical traders often keep their positions open for a week or more.

What trading style mostly suits crude oil?

Now that you know which strategies are suitable for crude oil, let’s find out which trading style suits the pair:

Swing trading

Swing trading entails buying crude oil for a brief time, usually between a few minutes to four days.

Crude oil swing traders use short-term variations in supply and demand and technical analysis to identify the market’s trend.

Swing traders buy crude oil when the market is rising and sell when the market is falling. Swing traders in crude oil futures profit from the volatility of the commodity and will close off a deal when it earns a little profit. However, swing trading is extremely dangerous, and traders can quickly lose money if the market turns against them suddenly.

Day trading

Rather than estimating the true worth of crude, day trading crude oil involves betting on short-term price swings. As a result, day traders can profit whether the price of crude is rising or decreasing by utilizing a combination of long and short positions.

By definition, day traders close out all of their trades each day. As a result, the profit or loss money on each trade depends on the difference between the price at which they bought or sold the position and the rate at which they sold or bought it later to close the trade.

Spread trading

Buying one crude oil futures contract in one month and selling another futures contract in a later month is known as spread trading.

The idea is to profit from the predicted difference in both contracts’ purchase and selling prices.

A trader could, for example, sell the March crude oil position at $80.50 and buy the June position at $85.80, a difference of $5.30. The trader makes money if the trade widens more than $5.30.

The trader would acquire a March position and sell a June position to close out the trade. However, if the spread tightens, the trader will lose money.

Final thoughts

So, now you know everything about crude oil.

If you want to trade it, remember that oil is highly volatile, and you must come up with the proper trading plan.

You can apply the trading strategies and styles we mentioned above for trading oil.

Most common questions asked by the forex traders about Crude Oil :

Oil production is mostly done in Canada, So if USOIL price increase, the Canadian Dollar gets strong which leads to USDCAD price fall.

Yes, there is some inverse relationship between gold and Oil. If crude oil price goes down, Gold goes up. During Covid-19 pandemic times, the Crude oil crash made the gold price XAU/USD breaks the all-time high and went to 2070$ per barrel.

There is positive correlation between Crude Oil and USDCAD due to the Canadian Economy. Canada is the biggest oil production country in the world. If Canadian dollar gets strong, oil price will price.

Crude oil is trending now and consolidating in the minor support resistance levels. Get live forecast here.

Oil price is crashing often due to economic impacts in the world markets and demand supply, stocks availability of the oil.

In trading view, doing your own analysis is good instead of following other traders crude oil forecast who uses different strategies like Elliott wave analysis, price action. Watching the Oil historical data charts from tradingview.com is helpful for looking the market in a long term view.

Crude Oil Trading Signals

Check Full Forex Market Signals with Technical Analysis Chart

Please note : It is better to do nothing instead of taking wrong trades, we focus on providing you the forex signals only at good trade setup.

Each trade signal given to you with fundamental and technical analysis chart which helps you to understand why our analyst team has given the Buy signals and Sell Signals. Now, you can trade with confident using our service. Sounds good? Let’s look out all our signal charts below.

If you want to test our forex signals, Try free plan (or) if you need more forex signals, Join here for Premium or Supreme plan

Check all our signal results and some of the subscriber’s Myfxbook results here. Try our free service now, let the results speak the rest.

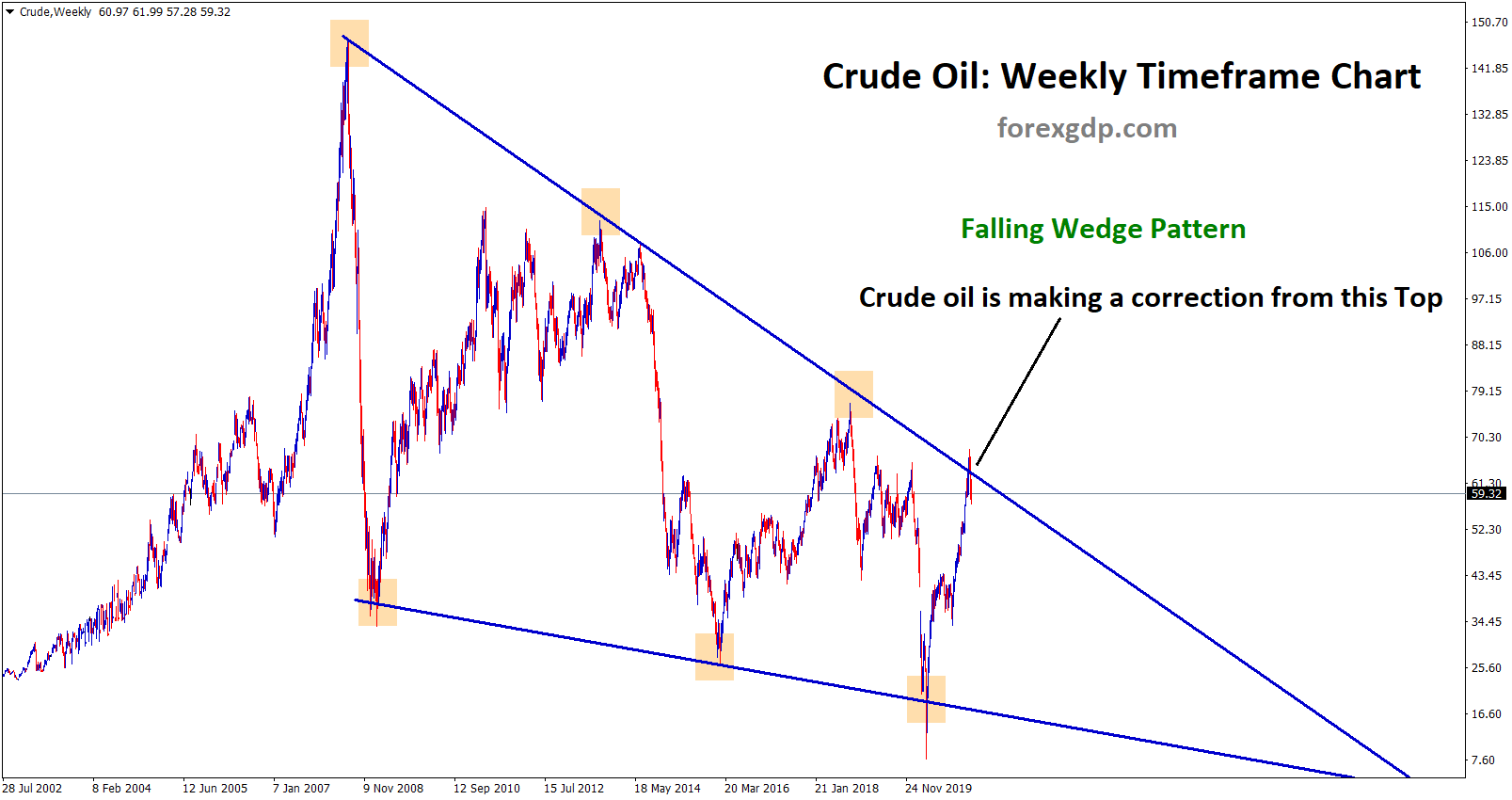

Crude Oil is making a correction now

Crude Oil Price Analysis Crude oil has formed a Falling Wedge pattern in the Weekly Timeframe Chart. Due to the

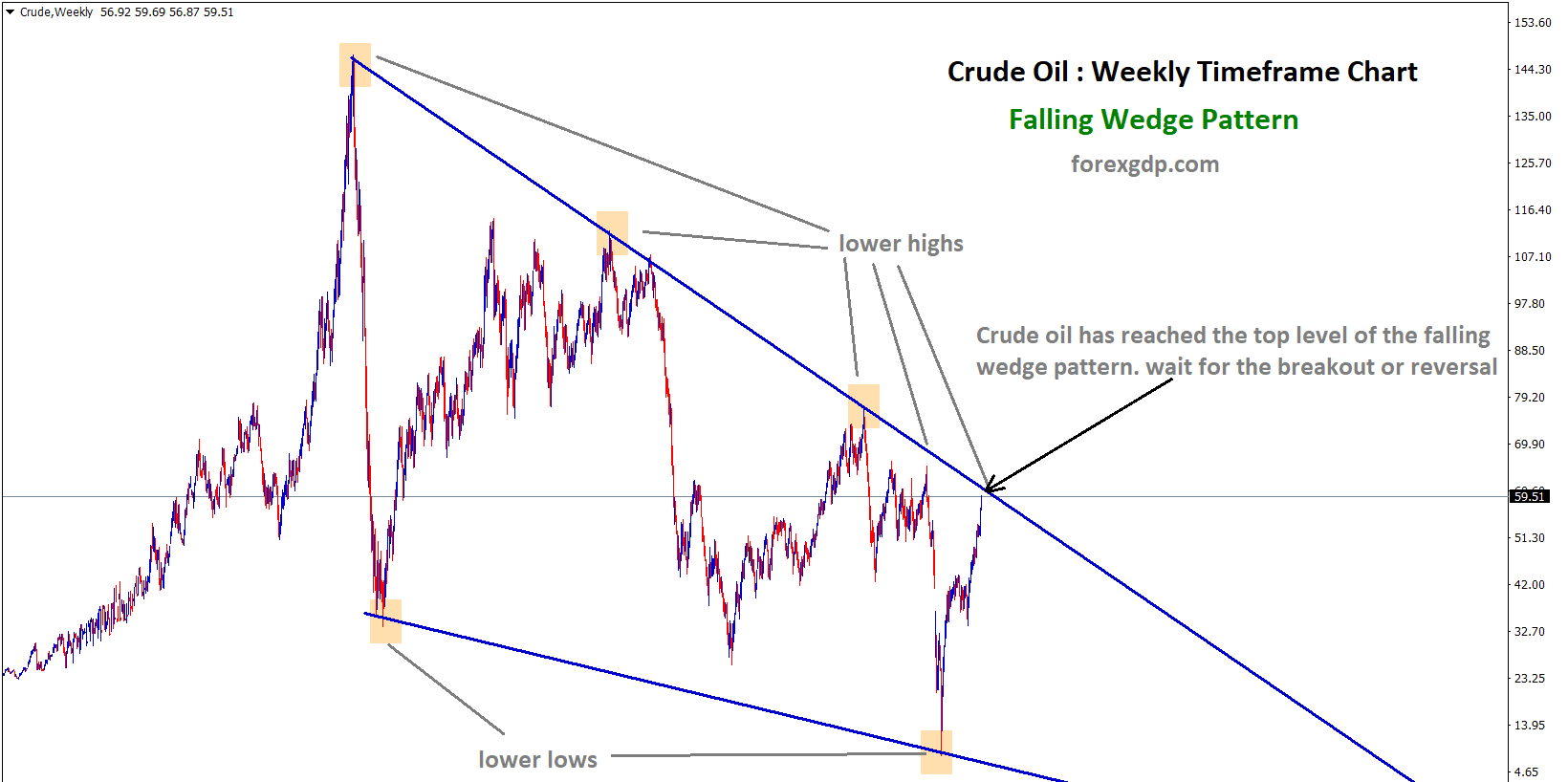

Crude oil price reached the top level of the falling wedge

Crude Oil Analysis Crude oil has reached the top level of the falling wedge pattern. Wait for the confirmation of