Gold: US and Russia talks soon on Ukraine war concerns

US Dollar surges higher in corresponding to the gold prices, so anyone has to move bottom then only another one gets benefitted.

XAUUSD Gold price is moving in the Descending channel and the market has reached the lower high area of the Descending channel.

US and Russia talk on Ukraine issues have come back this week to solve the war concerns.

And Russia has reported that 100k soldiers trooped in Ukraine mountain borders have been involved in this issue to solve the problem by Talks.

Gold prices are moving higher ahead of tensions between Russia and Ukraine; anything warlike escalated, gold metal prices will be higher.

US Dollar: Iraq Oil pipeline to Turkey port has exploded

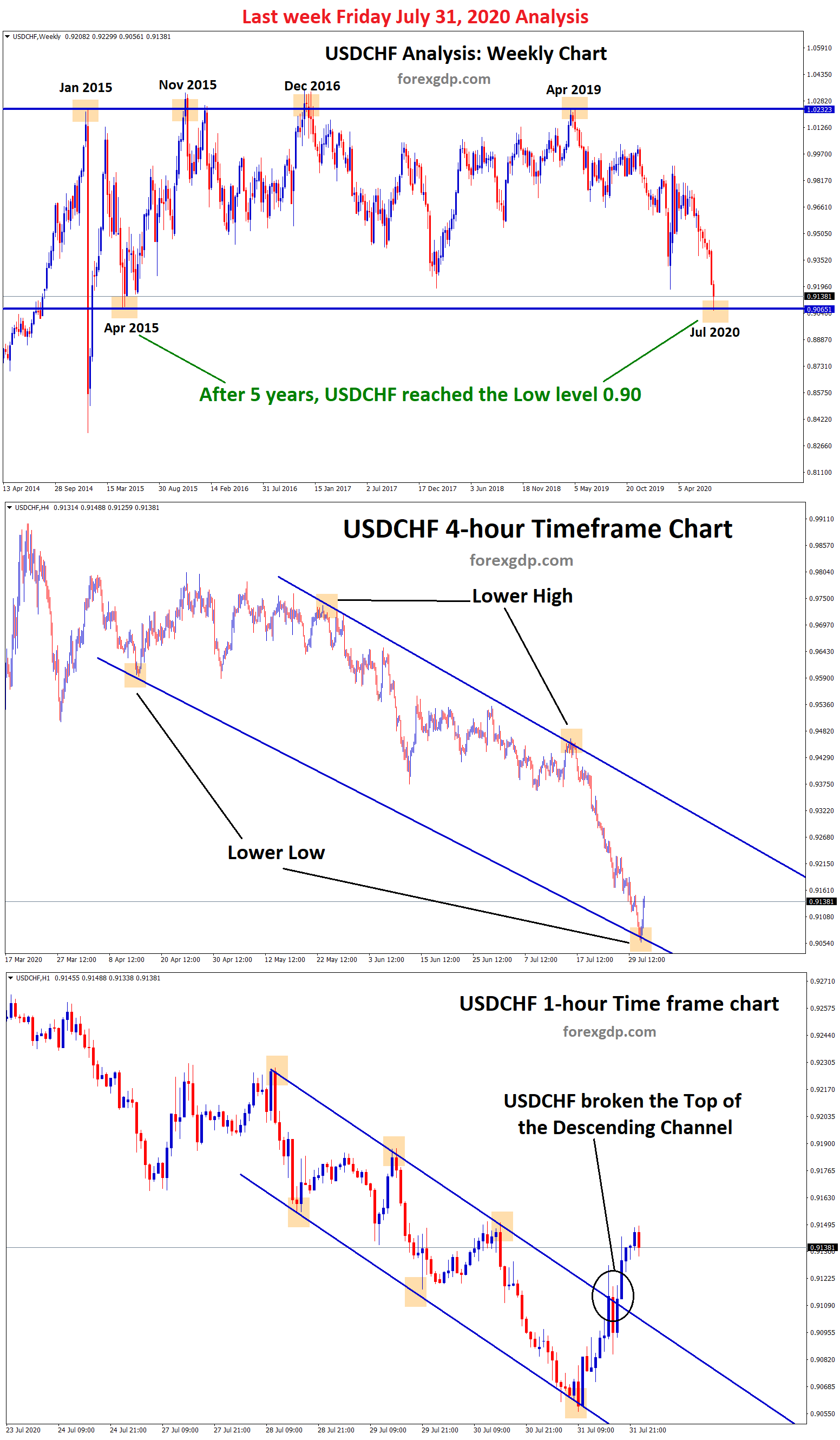

USDCHF is moving in a Symmetrical triangle pattern and the market consolidated at the higher low area of the triangle pattern.

US Dollar Surges to higher and 10-year yield surge to 1.89% and two years traded at 1.076% since the pandemic began.

This week US Initial Jobless claims are set to release, and Positive numbers strengthen US Dollar.

FED Members are supportive of FED Powell commitment to rate hikes this year.

And Iraq to Turkish port pipeline has exploited, affecting 450k barrels per day, and they are the second-largest Oil producer of OPEC+ nations.

Yesterday Yemen’s Houthi group attacked UAE made another Supply disruption on Oil supply.

EURO: ECB Member Villeroy Speech

EURUSD is moving in an ascending channel and the market has rebounded from the higher low area of the Ascending channel..

ECB European central bank policymaker Francois Villeroy De Gallahue said Central Bank would make proper adjustments to keep inflation below the 2% target.

And French regions within proper cases and Economy growth outlook are suitable and not affected by the Omicron variant.

But so much inflation across the Eurozone makes worry for ECB.

And German 10-year Bunds yields increased to Zero area for the first time since 2019, and Euro gets weaker as Yields rise.

Divergence in policy measures between US and EU, slower rates hikes, and more accommodative stance in Monetary policy in ECB makes Euro lose more than US Dollar.

UK Pound: UK inflation data printed at higher numbers versus expected

GBPUSD is moving in the Descending channel and the market has broken the lower high area of the Descending channel.

UK Inflation data printed at 5.4% versus 5.2% forecasted. Core inflation rate YoY printed at 4.2% versus 3.9%.

Both readings beat market expectations, and UK Foods prices increased with Furniture and clothing materials.

The UK faced a 12-year inflation rate high now, and the Bank of England planned for five more rate hikes in 2022.

And has less severe Omicron variant cases and announced Plan-B restrictions for further relief for People gatherings.

Canadian Dollar: Credit Suisse predicted Bank of Canada would hike 25bps this month

USDCAD is moving in an ascending triangle pattern and the market has reached the higher low area of the triangle pattern.

Analysts at Credit Suisse predicted the Bank of Canada monetary policy would do 25bps rate hikes next week.

And Oil prices created more inflation numbers in US and Canada, So Policy rates are a divergence from FED and BoC at this time.

In March, the FED 50 bps rate hike will be adjusted to BoC rate hike by 25bps this month.

So USDCAD will stay on the price level of 1.2500 area, and rate hikes from the Bank of Canada will undershoot the USDCAD to 1.2300, which formed the next support area.

And also the oil pipeline has exploded in between Iraq and Turkey Port makes Supply fears of 450kBarrels per day to a shortage; that’s why Oil prices are surging day by day.

Canadian Dollar prices are higher as Oil revenues rose compared to last month; the Bank of Canada may be rate hikes to calm down the Canadian Dollar prices to support exports revenues.

Japanese yen: Rising raw material pass-through to Household consumers

USDJPY is moving in the Descending channel and the market has rebounded from the lower low area of the channel.

Bank of Japan shows a quarterly outlook for import prices in Japan shows an apparent rise.

And Pass-through of rising raw material costs to the consumer, not for all materials.

The rising costs of raw materials to households appear too small.

But there is uncertainty prevailing in the market how many rising costs of raw material will pass to end consumers.

And Overshoot in Japan’s inflation rates may soon cause rising raw materials to pass to households.

The weak yen’s effect in boosting Export volume is less in recent years.

And Weaker Yen improves Japan’s income balance has been increased recently.

Australian Dollar: Australia’s Westpac numbers came lower than expected

AUDUSD is moving in an Ascending channel and the market has rebounded from the higher low area of the Ascending channel.

Australia’s Westpac consumer confidence for January crossed the wires at 102.2, down from December’s 104.3 printed.

And Omicron variant spread makes less enthusiasm on Australian Economy and more lockdowns make worry for Economy comeback in Australia.

In China Bond prices Tumble makes policymakers lower the five basis points in the short-term lending rate.

And to stabilize the housing market, China has taken the necessary steps to calm down the fears of liquidity crunch in Real estate.

New Zealand Dollar: NZ house prices hit skyrocketing highs

NZDUSD is moving in an Ascending channel and the market has rebounded from the higher low area of the Ascending channel.

New Zealand Dollar not supported by Domestic data events this month; Already New Zealand Dollar raised to pre-pandemic levels before lockdown announced in Auckland in 4Q 2021.

And the elevated inflation mark is 4.9% in the 3Q reading, and Housing prices surged to skyrocket high and calm down by rate hikes actions done by the Reserve Bank of New Zealand.

RBNZ has reported five more rate hikes in 2022, and expected rate hikes will lower the inflation rates.

This month, US Domestic data are critical drivers for Kiwi; next month, only the RBNZ meeting will happen.

New Zealand minister Chris Hipkins speech

Amid Booster shots, vaccinations are started for New Zealand Citizens this week.

New Zealand, Covid-19 health minister Chris Hipkins said Whether to open the cross borders restrictions in February, based on Omicron controlled in regions.

And the Only motto is self-isolation from outside travel entry people to control the Omicron community to zero level.

We want to give boosters to New Zealand citizens to control the omicron variant.

And We plan to make self-isolation from new arrivals from outlanders to New Zealand.

And we are still discussing progress whether to end February to the last end for Covid-19 lockdown.

Swiss Franc: Swiss Chocolate maker expected fewer sales growth in 2022

CHFJPY is moving in an ascending triangle pattern and the market has rebounded from the higher low area of the triangle pattern.

Swiss Chocolate maker Lindt and Spruengli expected sales growth to be less in 2022 compared to 2021.

And the main reason behind this is labour and Supply of raw material issues as Email statements by Lindt company.

During pandemic time 2020, growth slowed, and it was picked up in the 2021 second half.

But this year, more labour and supply chain bottlenecks Chocolate production will be less when compared to last year.

As Lindt said, the margin is expected to reach 15% next year and rise by 20-40 basis points per year from 2023.

And Full-year sales rose to 4.59 billion Swiss Francs, $5.01 billion ahead of the 4.55 billion Franc estimate in a Refinitiv poll.

Don’t trade at your free time, instead trade the markets only when there are confirmed trade setups.

Get confirmed trade setups here: https://www.forexgdp.net/buy/