Gold: Global Director Anthony Fauci commented on the Omicron variant

Gold prices are rebounded to higher from the Support area after corrections seen in the US Dollar index And Global infections and disease controller Health specialist Anthony Fauci said. Hospitalizations are lower than Delta variant for the Omicron variant.

XAUUSD Gold price is moving in an Ascending channel and the market has fallen from the higher high area of the channel.

Maybe in the upcoming days spread will be more than Hospital capacity.

China troubled real estate player Evergrande crisis on one side, Russia and Ukraine tussles on the other side.

So, Gold prices are remains consolidated due to negative cues.

US Dollar: Omicron variant shows Optimism and subside the investors’ fears

USDCHF is moving in the symmetrical triangle pattern and the market has reached the support area of the triangle pattern.

Optimism over Omicron Variant subsided the fears in Investor’s mind and poured full money on Risk markets rather than safe havens.

FED may act as Appropriate action against Inflation rate increases, soon maybe do rate hikes this year.

US Dollar was primarily driven by the Fears of Investors and FED rate hikes.

Optimism over the Risk currencies are appeared higher, and So haven currencies like JPY and USD get the weaker tone in the coming months.

This week ADP, Non-Farm Payrolls data scheduled and positive numbers will add a boost to the US Dollar.

Omicron cases were higher in the US; Hospitalizations were higher, holidays were over; now, lockdown imposition is expected from the US Government to curb the spread again.

EURO: ECB monetary policy forecast by Natixis

EURUSD is moving in the Box Pattern and the market has fallen from the resistance area of the Box Pattern.

ECB will maintain the expansionary monetary policy until 2022 because inflation won’t go above the 2% target.

It is a forecasting one by Natixis analyst firm, ECB is now focusing on Debts to solve by Businesses and Publics.

Public and Private investments to boost up by giving more stimulus to the economy.

And the inflation rate will be 2% or 2.5% until 2022 or mid-2023 is a forecast of ECB; after Mid-2023, ECB will do tapering and rate hikes like FED.

Wage earnings and Purchasing power will fall in 2021, and it will boost in 2022.

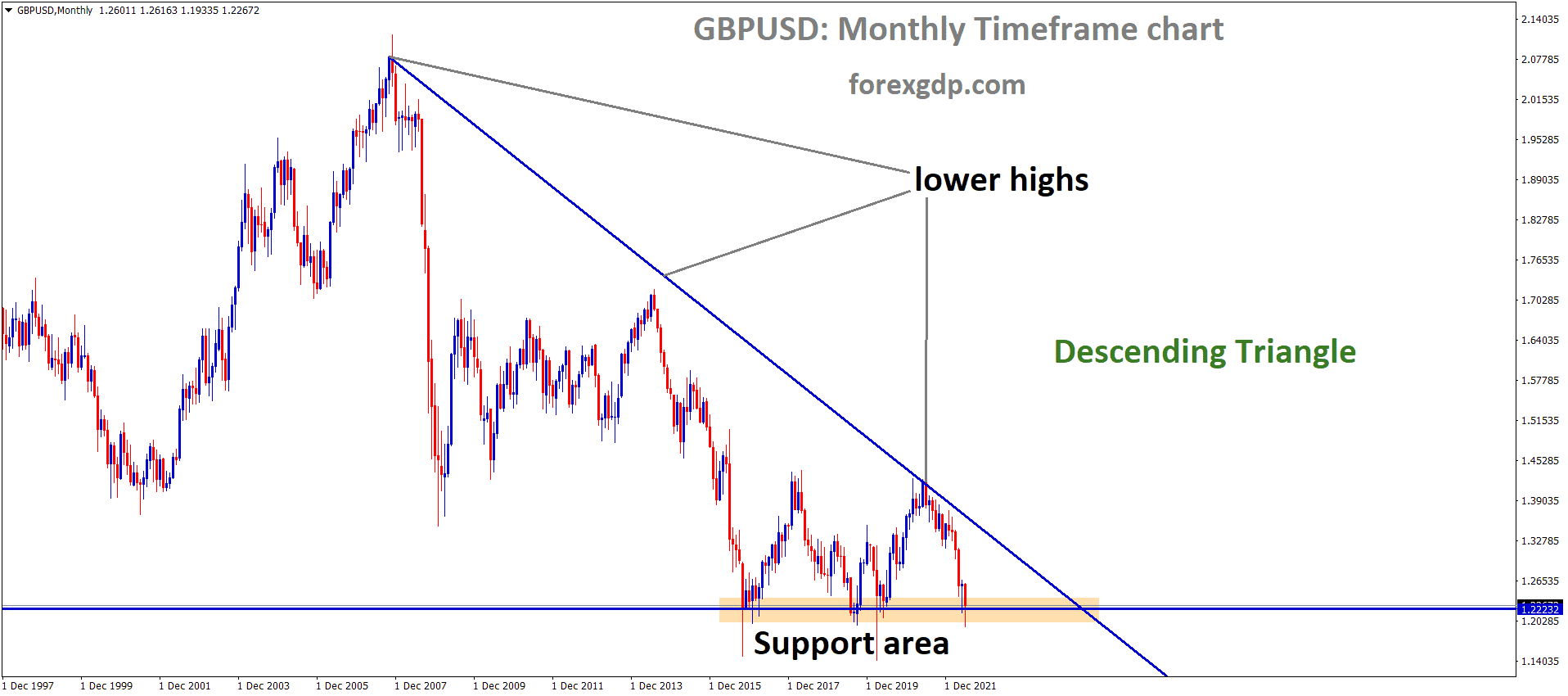

UK Pound: UK Manufacturing PMI forecast

GBPUSD is moving in the Descending channel and the market has reached the lower high area of the channel

UK Pound have Manufacturing PMI this week, and more robust numbers will appreciate UK Pound.

US Domestic data primarily drive in positive numbers, and US Dollar benefits from healthier Domestic data.

The UK have more Covid-19 cases and planning for lockdown after the Holidays are over.

UK and EU have tussles on Northern Ireland protocol, and any solutions will trigger GBP to higher levels.

Canadian Dollar: Canada faces more cases, and Vaccinations rates are higher

EURCAD is moving in an Ascending channel and the market has rebounded from the higher low area of the channel.

Canadian Dollar higher more as US Oil triggered higher after Demand for Oil soars in Global level.

And Four thousand flights were cancelled due to the Omicron variant spread, and Half of them are US flights.

A million cases per day detected from Dec 24-Dec 30 last week shows Curbing measures have to take by proper Government from all nations.

Canada has faced 4k cases daily since the pandemic, but vaccinations are higher in Canada.

USDCAD Dropped to 3% from highs, and export revenues from Oil mainly drove the Canadian Dollar.

Japanese Yen: Japanese Government injected more stimulus to strengthen the economy in 2022

GBPJPY is moving in an Ascending channel and the market has reached the weekly resistance area of the channel.

Japanese Yen is getting weaker in markets due to More stimulus injected by the Japanese Government to support small and big scale businesses, Vaccinations, and infrastructures developments.

And this week, US ADP and Non-Farm Payrolls data will drive USDJPY directions.

US 10-year US Yield stood above 1.50% threshold range since 2013.

The Japanese economy will achieve a 2% inflation target soon in the 2022-2023 year as BoJ forecasted.

More stimulus with negative interest rates will support the pandemic affected economy to rise in 2022.

Australian Dollar: Australia did not impose any lockdown due to the Omicron variant spread

AUDCAD is moving in the Descending channel and the market has fallen from the Lower high area of the channel.

Australian Dollar keeps higher in correction from Support area due to Omicron variant subsided investors’ fears.

Australia is facing more new cases daily, and the Government eases quarantine time to 1 week if having close contact with Covid-19 person.

They have not imposed any lockdown in Major populated cities until now; if cases are higher, further processes will be taken.

US Dollar steadied higher from the bottom due to Healthier domestic data performed in the US.

China easing monetary policy conditions will support Australian Exports more, and Revenues will be picked up for the Australian Government.

Investment Bank Morgan Stanley forecasted China’s 2022 growth

Investment Bank Morgan Stanley projected China Growth would be 5.5% in 2022.

China has well planned for a zero covid Approach for all regions of China.

Easing more fiscal and monetary policies makes China Defaulter Evergrande relieve from Defaults to the public.

And China has handled perfect money policies, and zeroes covid-19 target helps Industrial productions increase production.

Overall, as Morgan Stanley forecasted, China Growth will be bright in 2022.

New Zealand Dollar: 10 yr US Bond rate hits high since 2013.

AUDNZD is moving in an Ascending channel and the market has rebounded from the higher low area of the channel.

New Zealand has no scheduled news on the Calendar this week, and it is mostly driven by US Domestic news in the market.

10-year Benchmark US Bonds hit the 1.50% threshold range by the year-end of 2021.

And US Dollar makes higher after FED have planned for 2 to 3 rate hikes in the 2022 year.

The Employment change and unemployment rate are well in numbers.

And FED Powell stated that we wouldn’t wait for a 100% target to achieve in Employment rate; we have around 75% reached our target of FED, so rate hikes are necessary after Tapering completed in March 2022.

Swiss Francs: SNB will intervene in Q4 to control Swiss Franc values

CHFJPY is moving in an Ascending channel and the market has reached the higher low area of the channel.

5.44 billion Swiss Francs were spent by SNB during April and June, then less than 10.94 billion francs were spent during the third quarter of 2021.

But Swiss Franc appreciated more during July to September and 1.6% up over Euro.

The reason is inflation is lower than Euro, SNB enjoys currency appreciation by lowering FX intervention.

And Appreciations of the Swiss Franc make it uncomfortable for Exporters and Happy comfort for importers.

So SNB must intervene in the Forex market to reduce the Overvalue of the Swiss Franc.

The low level of FX interventions in Q3 makes CHF appreciated to 5% against Euro.

And in Q4, SNB maybe intervenes in Forex markets to control the Appreciation of the Swiss Franc.

Don’t trade at your free time, instead trade the markets only when there are confirmed trade setups.

Get confirmed trade setups here: https://www.forexgdp.net/buy/