Gold: US Real yields are lower than the Inflation rate

Gold prices are moved in the Consolidation range, and the 10-year US Treasury yield rose to 55 basis points over the year. and fear over the Omicron is eases around the Globe.

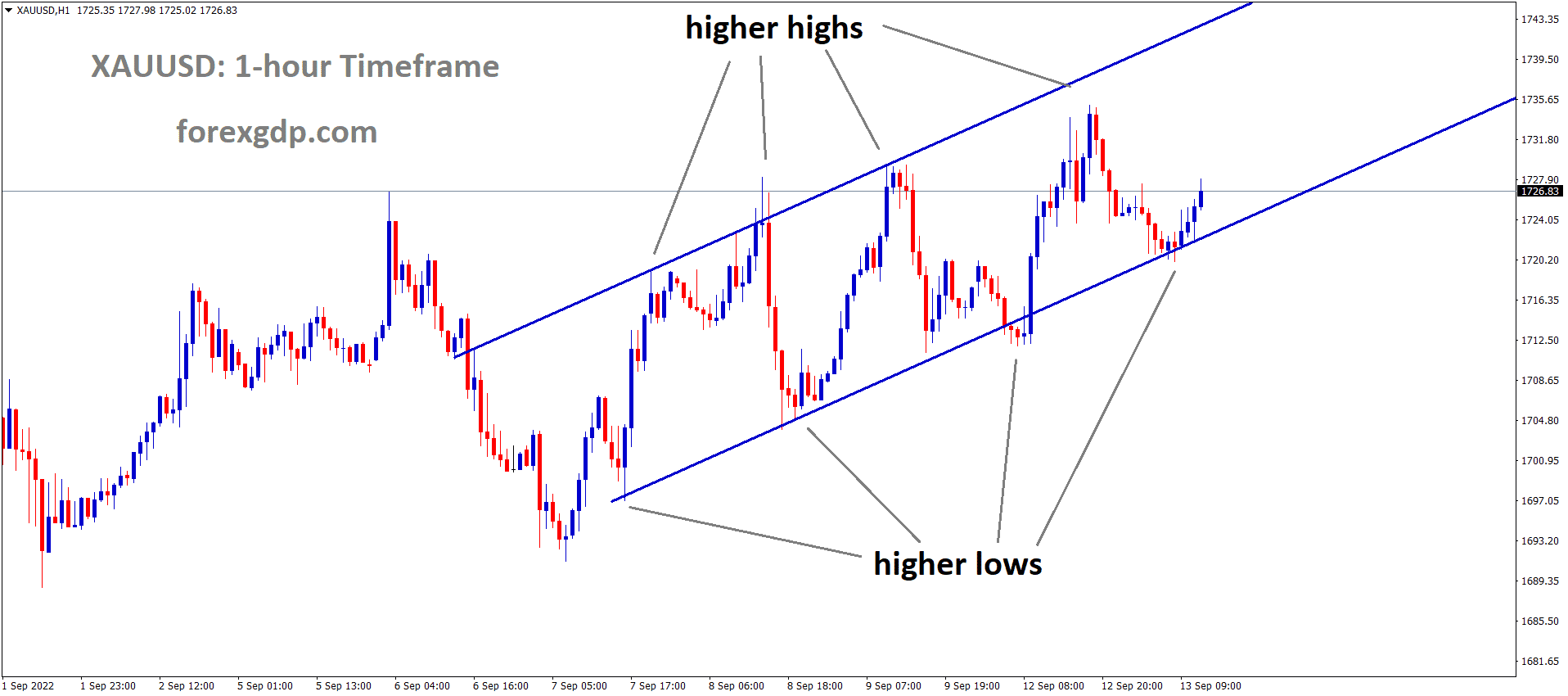

XAUUSD is moving in the Descending channel and the market has fallen from the lower high area of the channel.

And Nominal yields rise over 60 basis points, and the current yield is 1.55%.

So Real yields are lower than the inflation numbers of the 2% target.

Due to this, inflation numbers support gold prices as real yields are lower than the inflation rate.

And Joe Biden plan of BBB will be processed with the help of Vice President Vote is still Hopes for investors.

US Dollar: US Pending home sales came lower than expected

USDJPY is moving in an Ascending channel and the market rebounded from the higher low area of the channel.

US Treasury yields are higher in three weeks, but seven-year bonds rate slightly higher to 1.48%, and it is two basis points higher after Auctioned.

This shows disappointments over the Bond yields due to the Holiday season.

And Omicron variant fears are easing around the Globe, and the US has fewer fears due to deaths arising in very mere numbers.

The Escalating fears over the Omicron variant are slowed, making US Dollar Demand slower across the Globe.

For November, the US Pending Home Sales report dropped to -2.2% MoM from +0.50%.

US Goods Trade Balance hit a record deficit of $-97.8B versus $-83.2B Previous, and the US inflation gauge is flying to 2.53% till now.

US Initial Jobless claims expected to 205K today; better numbers will lift US Dollar.

Euro: ECB Member Visco speech

EURUSD is moving in an Ascending channel and the market has rebounded from the Horizontal support area of the channel.

ECB Governing council member Ignazio Visco said that ECB will not end the tapering of asset purchases before 2023.

And ECB shows more financing conditions for support Eurozone.

The inflation target for 2022 is 3%, and it will be slowed to 2% in 2023-2024.

Italy GDP growth only forecasted for Two percentage points in two years due to efficient implementations of recovery plan.

Public Budgets are sustaining in Europe and each member of the Eurozone.

There is no reason to change the vision of inflation target 2% now.

Finally, the Omicron variant is an unknown spread, and its impact will be high compared to other countries.

UK POUND: UK faced 182K new Covid-19 cases

GBPCAD is moving in the Descending channel and the market has reached the Horizontal resistance area of the channel.

The US Auctioned $56 Billion worth of Seven-year notes, but weak demand created in the market due to the Holiday season.

The US 10-year bond rate jumped to 1.56% for the first time since November 29.

And FED’s Hawkish outlook makes the Two-year yield highest since March 2020.

The UK faced 182k cases on Thursday, and UK PM Johnson was planning for tight restrictions during New year Festivities.

UK Pound supported by US Dollar weakness as inflation rate shooting higher.

Japanese Yen: Omicron Variant eases fears around the Globe

CHFJPY is moving in the Box Pattern and the market has reached the Previous Horizontal resistance area..

The Omicron variant created fewer deaths and was less severe than the Delta variant.

So fears around the market are now going down and selling for Japanese Yen and moving to riskier currencies like AUD, EUR, NZD, CAD.

US Initial Jobless claims report will be published today and will help USDJPY move beyond the 115.00 area.

Japan faced new cases of Omicron variant in little numbers and worried about spreading more than another variant.

Vaccination for a third booster dose is the only solution for curing the Omicron variant.

Canadian Dollar: 9lakh Covid-19 cases around the Globe daily

USDCAD is moving in an Ascending channel and the market has reached the higher low area of the Ascending channel.

Saudi Arabia’s King Salman Bin Abdulaziz said Iran’s Lack of Cooperation with the international community on its nuclear program and Ballistic Missile Development had worried Global Oil producers.

This news made Bullish Bias for Oil prices to move for 76$.

And 900000 cases daily around the Global countries affected by Omicron variant especially the US, Europe and China, UK.

But Oil Demand is rushing big due to tussles between US and Russia continuing on Ukraine matters.

This week US initial Jobless claims are scheduled in the table.

Saudi king Salman speech

Saudi King Salman said Iran did not cooperate with nuclear talks and Ballistic missile testing. It will be a great worry for relationships.

Saudi Arabia will be stabilizing the World need for Oil prices stably.

And soon we expected Iran will change its decision and we see nuclear all missiles are more expected.

The oil market keeps stabilizing is more important for Saudi energy policy and OPEC+ Agreement to support stabilizing.

Australian Dollar: Australian PM Scott Morisson speech

AUDJPY is moving in an Ascending channel and the market has reached the higher high area of the channel.

During today’s National meeting cabinet, Australian Leaders agreed to tighten the close contact exposure to Covid-19, but cutting the isolation time is a significant change in dealing with the pandemic.

Australian PM Scott Morrisson said Close contact cases are only for Fully vaccinated from Household contact if cases conformed only.

Close contact cases confirmed only after four hours of contact with Covid-19 person by Fully Vaccinated Person.

Increased spread of Omicron is slight fear for the Australian economy, but the third booster dose will vacate Omicron away from the Australian Residents.

And We have to reset the Australian economy from the pandemic, and we plan to manage ourselves and social meetings like Governments.

New Zealand Dollar: Omicron Variant hit in Auckland

NZDUSD is moving in the Box Pattern and the market has reached the horizontal resistance area of the Box Pattern.

Omicron Virus cases first time hit in the New Zealand area of Auckland this week.

Chris Hipkins, NZ Health minister, will deliver the speech on media about Omicron cases in New Zealand.

The new year has not been affected by tightening restrictions and waiting in patience for lockdown measures.

Today US initial jobless claims are set to release, and more numbers will support for US Dollar.

And China Evergrande missed giving payments to investors bonds, and 30 days Grace period were extended.

Swiss Franc: Japan Government easing funds makes support for Swiss Franc

USDCHF is moving in the Descending triangle pattern and the market has rebounded from the Horizontal support area of the pattern.

Swiss Franc made higher against Japanese yen due to Japan’s Government more funds easing to recover the economy from the pandemic.

US Dollar shows less strong against Swiss Franc, and inflation is picked up higher in US Economy it will be plunging the US Dollar prices more.

Deposits over the Swiss Franc are rising more due to the Swiss economy’s stability.

The US seven-year bonds worth $56 billion are a disappointment for FED because the price was rose to two basis points from the Auction price.

Due to the festive season Bonds, buyers are lower than normal season.

Don’t trade at your free time, instead trade the markets only when there are confirmed trade setups.

Get confirmed trade setups here: https://www.forexgdp.net/buy/