Gold: US CDC reduced the quarantine period from 10 to 5 days in the US

US 2-year Treasury yields Jumped to highest since March 2020 and now easing to 0.75%, 10-year bond shows 1.48% from 1.7 basis points Decline on Monday and US dollar is performing well.

XAUUSD Gold price is moving in the ascending triangle pattern and the market has reached the resistance area of the pattern.

US center of Disease and control prevention reduced the isolation and quarantine period from 10 to 5 days.

US Hopes of Joe Biden plan of BBB will remain active next month if Senator Joe Manchin approves.

And US Retail sales Jumps to 8.5%, which makes the best performance for US Economy.

Gold prices are consolidated around 1815$ to 1765$ in the market due to US Domestic data light this week.

US Dollar: Q1 2022 forecast

USDJPY is moving in an Ascending channel and the market has reached the higher high area of the channel.

US Dollar will do better in Upcoming Q1 2022 year, Process of tapering is faster by $30 billion per month, and it will end at $120 billion at March 2022.

And Rate hikes will be done three times in 2022, and US Inflation is above 5% is more worried for US Economy, rate hikes will make down the inflation readings.

And tapering of asset purchases will benefit US Economy from inflation reading.

ECB, BoJ and RBA central banks are Dovish stance until 2024.

But Bank of England already done rate hikes in year-end 2021, and RBNZ did two rate hikes this year.

Now FED is the next central bank going to hike the rate of interest in April month meeting is more expected from analysts.

China Finance minister speech

China Finance minister said the Chinese government will soon reveal fiscal, monetary policy for 2022 economic growth.

And the Fiscal expenditures will boost the growth of the Chinese economy.

The Central government will transfer sufficient funds to Local governments to spend to develop the proper regions.

And China will maintain social stability ahead of the 20th congress meeting of the Ruling communist party next year

Euro: Russia and Ukraine tussles make worry for Global markets

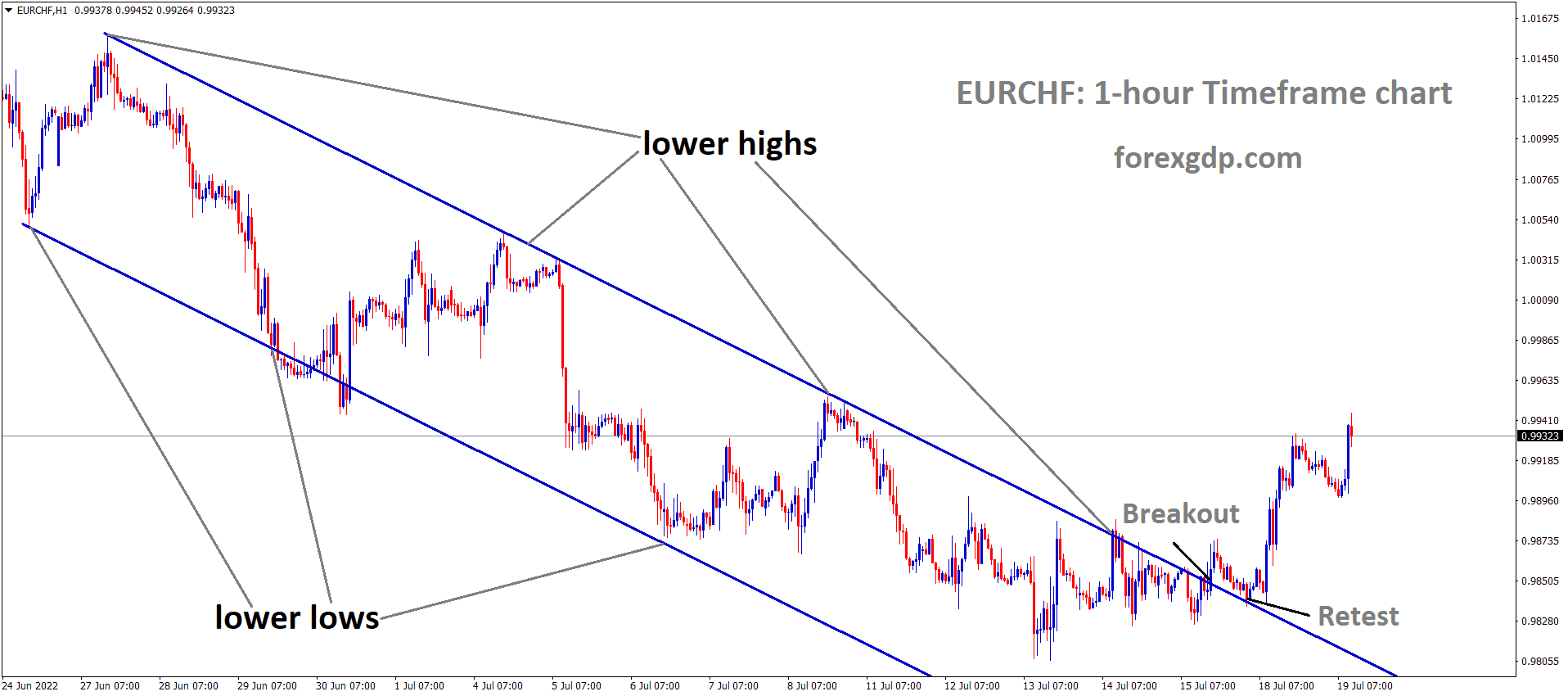

EURCHF is moving in the Box Pattern and the market has reached the support area of the Box Pattern.

Fears of the Russia- Ukraine made higher, US and Russia face to face direct talks to smooth tensions between Ukraine and Russia.

China announced more easing monetary policy to support the public from the pandemic.

And now US 2-year treasury yields easing to 0.75% and 10-year yields to 1.48% makes favourable for US Dollar.

ECB makes no steps for tapering and rate hikes in Eurozone, So Euro is weaker against GBP, USD and CHF pairs.

And Thin Domestic data due to Holidays makes the Consolidation range for EURUSD around 1.1370-1.1170.

Yesterday US VP Harris added her vote is a tie break vote that let them pass the Joe Biden BBB plan and rescue the public from pandemic burdens.

UK POUND: UK Health minister Speech

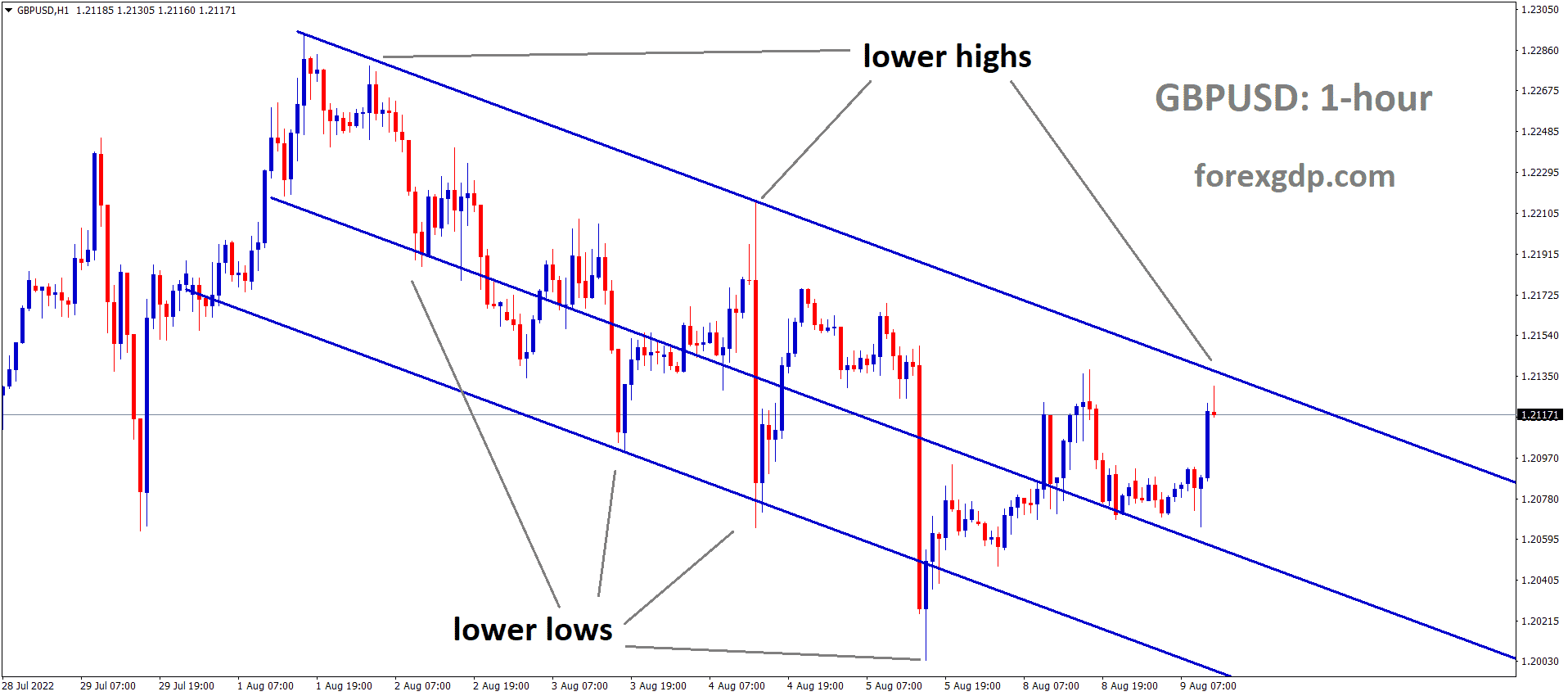

GBPUSD is moving in the Descending channel and the market has reached the horizontal resistance area of the channel.

UK announced 75 million Pound would be added to improve UK Fishing ports and add more jobs in Seaports.

And 70% of British Crew and 70% of fish must be landed in UK Ports as per new Fishing rules.

UK has now come down to 98K cases from 100000 cases daily, which are relieving for the UK.

As UK Health minister Sajid Javid said on Tuesday, there are no Covid-19 lockdown restrictions until the end of the year.

Canadian Dollar: Oil prices are increased and made support for CAD

AUDCAD is moving in the Descending channel and the market has reached the lower high area of the channel.

Canadian Dollar posted gains from lower support areas in recent one week after US Dollar fell due to US PCE index rising to 5.7%.

Oil prices rose from 62$ to 76$ in December, supporting the Canadian Dollar rise against the US Dollar.

And Canadian economy is mainly affected by Oil revenues in CAD.

And corresponding to Oil prices in the international market, CAD prices will fluctuation according to them.

US Joe Biden plan of Build back better now pending still not closed, it has been postponed to next month 2022.

And US Dollar keeps rallying after Hopes of Joe Biden stimulus package will hit anytime soon.

Japanese Yen: Japanese Finance minister speech

EURJPY has broken the Descending channel and Horizontal resistance area.

Japanese Finance minister Shunichi Suzuki said we do not think current inflation will negatively impact the economy.

We have to promote wages growth respectively to inflation numbers meet higher.

And We have added healthy stimulus to protect the economy from pandemic times.

And also, We have supported a lot of microfinancing and proper financial support to small scale companies to improve from the pandemic.

Japanese Yen weaker tone after more stimulus injected in economy.

Australian Dollar: New south Wales reported 6.5k Cases

AUDNZD is moving in an Ascending channel and the market reached the higher high area of the channel.

The Australian government has cancelled the restrictions between interstate travelling and makes Favours for New Year’s holidays season.

And New South Wales has reported 6500 cases per day; it will be less severe than the Delta variant.

Australian Dollar makes more positive as Australian government doing well and Favours for Public by limiting restrictions.

And China has suffered from the Omicron variant at is higher pace, and part of the regions announced lockdown where the Wuhan regions were affected in 2020.

US Dollar is going higher as US Domestic data performed well, and next week non-farm payrolls data will decide the direction of the US Dollar.

New Zealand Dollar: Kiwi waiting for RBNZ meeting rate hike

GBPNZD is moving in the Descending channel and the market has reached the lower high area of the channel.

New Zealand Dollar keeps consolidating and waiting for the RBNZ meeting in February for rate hikes.

As of now, US Domestic data plays directions for NZDUSD this month.

And Omicron Variant is not severe is more favourable for Risk currencies investors and add more funds to Emerging economies than Core countries.

And Economy is performed well, Retail sales and inflation are higher, and interest rate hikes are compensated for the inflation rate in New Zealand.

Omicron cases were very low in New Zealand, and spreads were controlled due to tight restrictions for international travellers.

Swiss Franc: SNB soon to intervention in Forex markets

USDCHF is moving in the Descending triangle pattern and the market has reached the Horizontal support area of the triangle pattern.

Swiss Franc makes higher after Risk appetite for omicron virus shows less severe than higher.

And SNB is trying to intervene in the Forex markets to undervalue Swiss France from Overvalue stance, as already mentioned in the previous meeting.

And the time has to come to intervene in FX markets, and Sight deposits are higher in SNB due to pandemic concerns.

USDCHF made a range-bound market around 0.9150-0.9300 area for last one month.

Don’t trade at your free time, instead trade the markets only when there are confirmed trade setups.

Get confirmed trade setups here: https://www.forexgdp.net/buy/