Gold: US PCE index came at higher and US FED is scoping

Gold prices remain higher after US Data came in all positive numbers and US FED is getting ready as inflation is rising

XAUUSD Gold price has reached the Horizontal resistance area of the Box Pattern.

Core PCE index shows 4.7% from 4.5% expected and 4.2% previous reading.

PCE index shows 5.7% from 5.1% YoY data.

US Dollar dropped slightly after Higher inflation data number printed.

And Tapering is progressing at a faster pace to conclude the process in March 2022, until inflation will be expected to be higher only in the public view.

US FED is watching out for these inflation numbers and will take action in the Next meeting for wrapping up the Bond purchases.

Omicron Variant is not serious trouble like the Delta variant, hospitalizations are lower, and Severity is down for the new variant.

US Dollar: US Home sales lowered and US FED is getting ready

USDJPY is moving in an Ascending channel and the market has reached a near to the higher low area of the channel.

US Dollar index performed lower after US Homes sales came lower than expected, printed at 744K versus 770K and Previous 662K.

US Initial Jobless Claims came at 205K versus 205K expected.

And US Core Durable Goods came at 0.80% versus 0.60% expected and 0.30% previous reading.

An overall mixed bag of Domestic data dragged down the US Dollar index from higher levels.

And US FDA consecutively Approved Pfizer Pill and then Merck Covid-19 Pill last day.

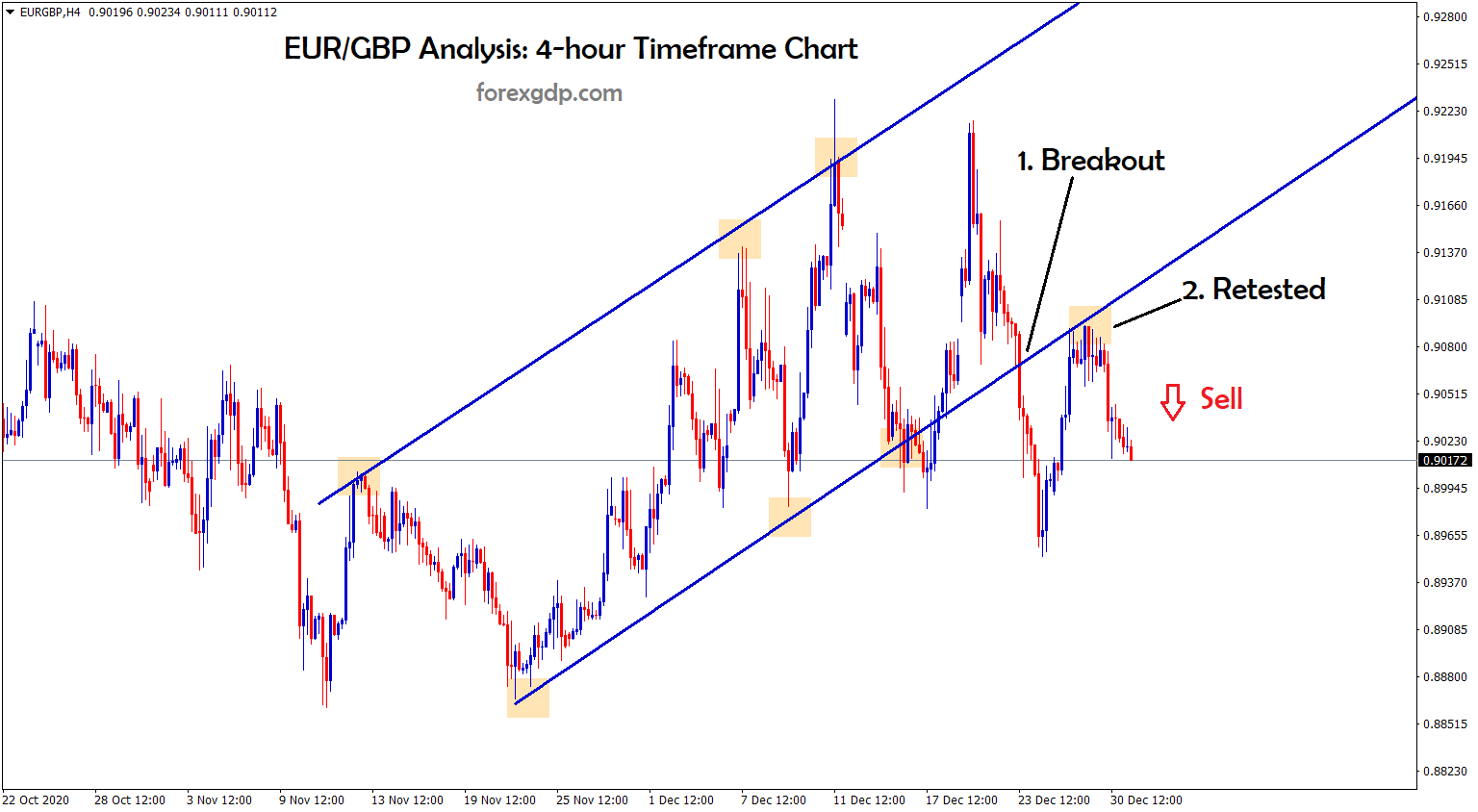

EURO: US FDA Approved for Merck Covid-19 pill.

EURNZD is moving in the Descending channel and the market has fallen from the lower high area of the channel

France has rejected the Merck Covid-19 Pill last day due to the lower use of curing 30% of the Omicron variant.

And US FDA is going to approve Merck Covid-19 Pill today after the first approval of Pfizer Pill last day.

US Joe Biden plan of (BBB) now in hanging on Senate and China made tussles with US action of passage bill against China on Uyghur minority Muslims human offence.

Due to these scenarios, EURUSD is rebounded from the Support zone and consolidated around the 1.1180-1.1380 range this week.

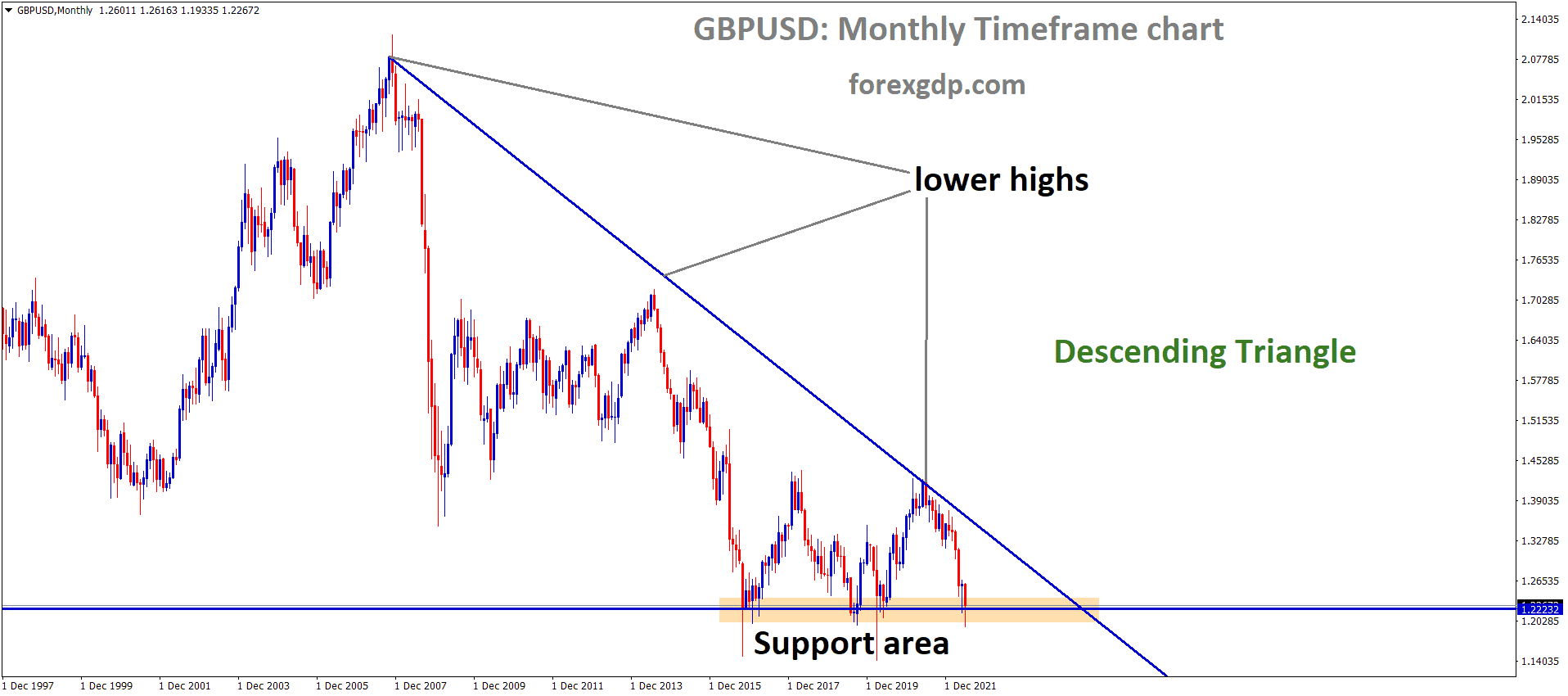

UK POUND: France proposed Litigation against UK overfishing issues

GBPJPY has broken the Descending channel and the market has reached the horizontal resistance area of the channel.

France is going to propose Litigation against Britain due to cancelling the Fishing licenses in British waters.

And this news was a major impact on Brexit Deal to the Vulnerable position.

According to the British business chamber of commerce said 45% of trade goods with the EU faced difficulty, up from 30% since the Trade and Cooperation agreement reached on January 2021.

France disapproved of Merck Pill, which shows less effectiveness for the New Omicron variant.

The US Approves both Pills from Pfizer and Merck to solve the Omicron variant soon.

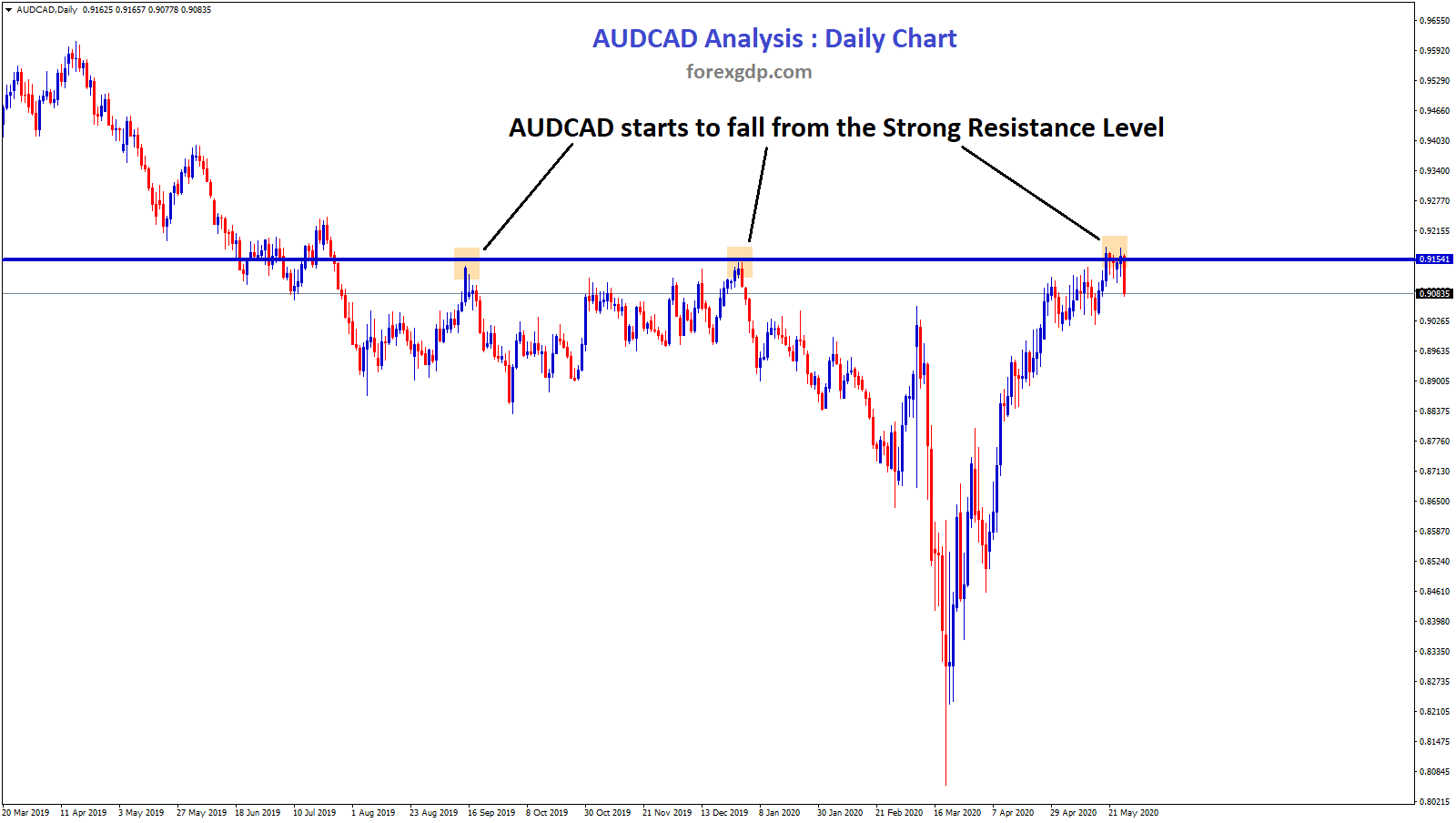

Canadian Dollar: Canadian GDP came in higher numbers

CADJPY is moving in the Descending channel and the market has reached the lower high area of the channel.

Canadian GDP numbers came at 0.80% versus in line with expectations of 0.80%, up from 0.20%.

Canadian Dollar slightly up from the Support zone as Domestic data performed well.

Due to this, USDCAD performed lower from highs and declined to 2% this week.

And US Dollar index performed lower as the US PCE index showed positive numbers yesterday.

Omicron Variant have a less severe impact than the Delta variant.

Canada faces 4k Cases daily, and Pfizer got approval from US FDA last day for Covid-19 Pill.

Japanese Yen: Japan inflation rate came at a higher

EURJPY is moving in the Descending channel and the market has reached the Horizontal resistance area of the channel.

Japan inflation came at 0.60% versus 0.10% expected, which is a higher value than expected.

And Japanese Yen like to benefit after inflation reading made higher.

The pace of inflation to increase higher in Japan makes spending more in Japan Economy by injection of more stimulus.

JPY Counter pairs are increasing higher against JPY, and weakness showed in Japanese Yen due to the $985 billion stimulus approved for the Japanese Economy.

US Dollar shows weakness after Core PCE index came at higher numbers.

Australian Dollar: Omicron variant calm down and support for investors

AUDJPY is moving in an Ascending channel and the market has reached the higher high area of the channel.

Australian Dollar shows strength against US Dollar last day after US Core PCE index, and initial jobless claims came in positive numbers.

Among that US PCE index is vulnerable to US FED monetary policy and Economy burden to cost more for buying Goods.

Investors are afraid now of calm for the Omicron variant since it is less severe than the Delta variant.

And Australian Dollar shows a healthy Bull move after investors afraid got calm.

Australian PM Scott Morrison said that lockdown measures would not be taken, but the public must be aware of common senses and gather in public meetings.

Booster Dose will start from Jan

Australian Health Minister Greg Hunt said that the gap between Two doses and the Booster dose was usually five months.

But now, After the Approval from the Australian Technical Advisory Group on Immunization said Bring the Booster Dose to Four months from 4th January 2022.

Currently, 3.2 million candidates were eligible but now 7.5 million people to suitable for Booster doses.

It will be expanded again from 31st January to three months, and it will take it out 16 million Australians to be taken Booster dose.

And 192k Booster Doses are administered last day.

New Zealand Dollar: NZ Government soon approval for Covid-19 Pill

GBPNZD is moving in an Ascending channel and the market has reached the horizontal resistance area and consolidated around the resistance area.

New Zealand Dollar made corrections from lower levels after the US PCE index came higher.

And the Government extended the Border restrictions till February due to the Omicron variant.

And Economy developed from a pandemic, and RBNZ did two rate hikes from lows.

Following the previous rate hikes, we can expect another in February month and a 2.0% target of a rate hike at the end of 2022.

And New Zealand will also soon approve the Covid-19 pills to avoid more spread from the new strain.

Swiss Franc: SNB having higher sight deposits in recent weeks

USDCHF is moving in the Symmetrical triangle pattern and the market has reached the horizontal support area of the pattern.

SNB has a slight deposit increase in Banks, which makes a positive for the Swiss Franc.

And the inflation zone difference between Euro and the Swiss Zone makes erode the purchasing power of the Euro faster than the Swiss Franc.

Covid-19 Omicron Variant is less severe than Delta variant makes comfortable for Euro against Swiss Franc.

European Government makes fewer lockdowns on regions due to less impact of Omicron Variant.

Don’t trade at your free time, instead trade the markets only when there are confirmed trade setups.

Get confirmed trade setups here: https://www.forexgdp.net/buy/