Gold: FED patience for rate hikes supporting for Gold

XAUUSD Gold price has broken the Descending triangle pattern after a long time.

XAGUSD Silver price is moving in the Descending channel and the market has broken the Recent resistance area.

Gold prices have broken the major resistance area the previous day and rallied to 1865$ due to US CPI data coming at higher as 6.2%.

And Higher inflation corresponds to gold prices increases and is inverse to US Economy.

The FED keeps patience in rate hike makes support for Gold.

And Gold is a Hedge currency for currency inflation, so the inflation rate makes higher prices for Gold in the coming months if not controlled.

Bank of England, Bank of Canada, ECB, and FED did not make rate hikes in a recent meeting, and this will support gold prices to rise.

US Dollar: Inflation reading worries for US Economy

USDJPY has reached the lower higher area of the Descending channel.

USDCHF has broken the Descending channel and recent consolidation resistance area.

US Dollar index last day breakout upside range of 94.5 area after two months ranging market.

As US CPI data printed at 6.2% versus 5.8% forecasted.

And more heating pressure of inflation gives confidence to investors for FED will soon rate hikes.

Now FED is waiting for rate hikes due to US Economy is better performing, but inflation prices increase continuously.

US President Joe Biden’s $1 trillion packages for infrastructure plan will be passed in House of members this week.

And it will affect the US Debt ceiling limit, as Jerome Powell commented.

EURO: Euro Domestic data failed to impress numbers

EURUSD is moving in the Descending channel and the market fell from the Lower high area of the channel, Market has broken one month box pattern in the downside support area.

EURNZD is moving in the Descending channel and rebounded from the lower low area and now the market has broken the Box Pattern at the resistance area after one month.

Eurozone shows fewer numbers on industrial productions, retail sales and factory order, which was reflected in the German ZEW economic sentiment reading.

Eurozone shows fewer numbers on industrial productions, retail sales and factory order, which was reflected in the German ZEW economic sentiment reading.

German inflation crossed the expectations last day, and ECB members urged Rate hikes and tapering assets for inflation worries.

And Last day, US CPI data came at higher numbers than expected, EURUSD fall to 0.50% from highs.

UK Pound: UK GDP shows softer data

GBPUSD is moving in the Descending channel and the market reached the previous support area fell from the lower high of the channel.

GBPNZD is moving in the Descending channel and the Market Has broken the Channel in the upside.

UK GDP came at 1.3% as 3-month average data versus 1.5% forecasted, and GDP YoY data came at 5.3% versus 5.4% forecasted.

UK GDP came at 1.3% as 3-month average data versus 1.5% forecasted, and GDP YoY data came at 5.3% versus 5.4% forecasted.

UK Pound keeps patience, and no moves after the news are released.

And UK trying to trigger article 16 against the EU on Northern Ireland protocol; this issue makes worry for Bullish GBP in the market.

UK Economy performed well, and Employment rate in lower numbers only, So we can expect Rate hikes from Bank of England next month.

And Yesterday, the US CPI report did well; the positive numbers gave a boost to US Dollar, and due to this, GBP dropped.

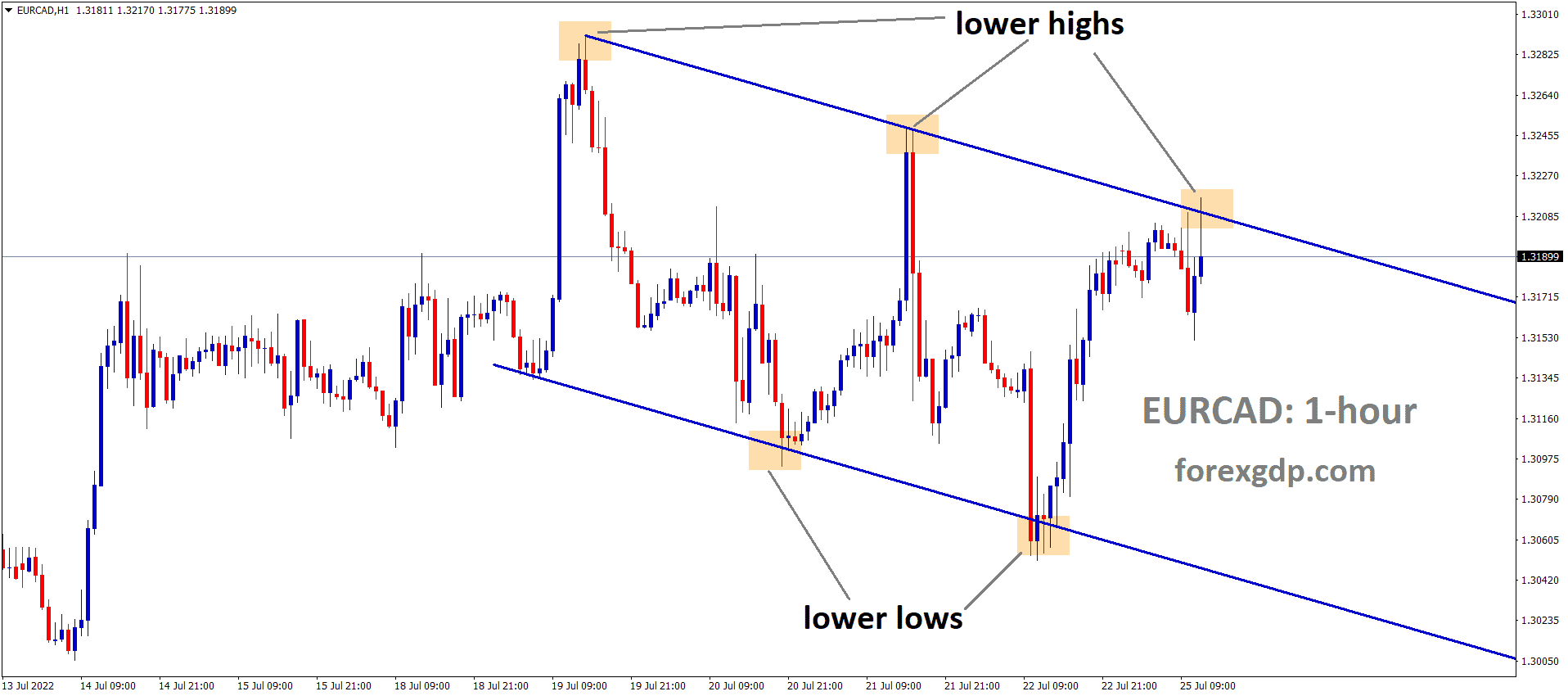

Canadian Dollar: OPEC+ nations maintain the Oil supply

USDCAD is moving in an Ascending channel and the market breaks higher high area of the channel.

Canadian Dollar makes down after US CPI data rising numbers came Yesterday.

And Bank of Canada is waiting for rate hikes in 2022 earlier as Domestic data performed well.

Oil prices are doing solid increasing after OPEC+ nations maintain the same point of productions.

US Dollar keeps stronger against Canadian Dollar compared to Domestic data strengthens versus Canadian Data.

And US Joe Biden plan of $1 Trillion is expected to pass in House of members in Next week is expected.

Japanese Yen: US CPI came higher than expected

EURJPY is moving in the Descending channel and reached the Support area of the lower low of the channel.

US CPI reported higher reading for 30 years high touched last day at 6.2% versus 5.8% expected and core at 4.6%.

Due to this Japanese Yen dropped against USD at least 1% down.

And San Francisco Federal reserve Daly said inflation readings are Eye-popping show only not permanent, soon rate hike is expected from FED in earlier 2022.

As Daly added, PPI numbers above CPI show more worry for markets and take time to slow down at the end of 2022.

Australian Dollar: Employment data came at worse than expected

AUDUSD is moving in the Descending channel and the market fell from the Lower high area of the Descending channel and higher high area of the Minor ascending channel.

The Australian Unemployment rate increased to 5.2% from 4.6% the previous month, and Jobs added -46.5K versus +50K expected.

The Very weaker Jobs added makes Aussies too vulnerable against US Dollar.

And Yesterday, US CPI data was a blow for AUDUSD, Now Domestic data of Australia makes an impact for Aussie.

A trade deal between UK and Australia also happened today; the China Evergrande crisis makes more impact on Australian Export revenues.

Australian Consumer inflation expectations rose to 4.6% from 3.6%.

New Zealand Dollar: ANZ Economist analysis on NZ Economy

NZDUSD is moving in the Descending channel and the market now re-entering into the descending channel.

Economists at ANZ analyzed the New Zealand Dollar well-performed, and it’s not depend on RBNZ to increase the rate hike.

FED will do rate hikes in 2022 correspondingly, RBNZ will do rate hikes in 2022 at least 50BPS rate hikes.

China Evergrande issue and energy demand make fewer imports from New Zealand nation.

Once recovery starts in China, then New Zealand Export revenues will get stabilized.

New Zealand Government announced an easing lockdown for travellers and many regions to travel.

And Quarantine regulations were eased and smoothen to pass easy journey to people.

UK and NZ agreed with the FTA agreement

New Zealand and UK Free trade agreements were passed today; this deal resulted in 40% exports from New Zealand to the UK and 7% of exports from the UK to New Zealand.

And UK PM Johnson said we did Favours for New Zealand exports and New Zealand Job market will be opened for UK Professionals.

UK trade deal with New Zealand makes 0.2% of UK GDP, so needle may not look as positive for UK Economy.

But this FTA agreement benefits the UK to access Asia pacific markets well to business and support for Perimeter countries.

Swiss Franc: US Domestic data performed well than Swiss zone

CHFJPY is moving in the Descending channel and the market fell from the lower high area of the channel and touched the Bullish trendline.

Swiss Franc dropped against USD last night at a 1% rise in USDCHF after US CPI data published higher reading.

The Swiss economy is performing well, and SNB is waiting for intervention in FX markets to stabilize CHF currency.

Investors pour money at negative rates for safer money parking against uncertainties.

US Dollar keeps rising against the Swiss Franc and major currencies as Risk factor keeps higher in the economy.

Don’t trade at your free time, instead trade the markets only when there are confirmed trade setups.

Get confirmed trade setups here: https://www.forexgdp.net/buy/