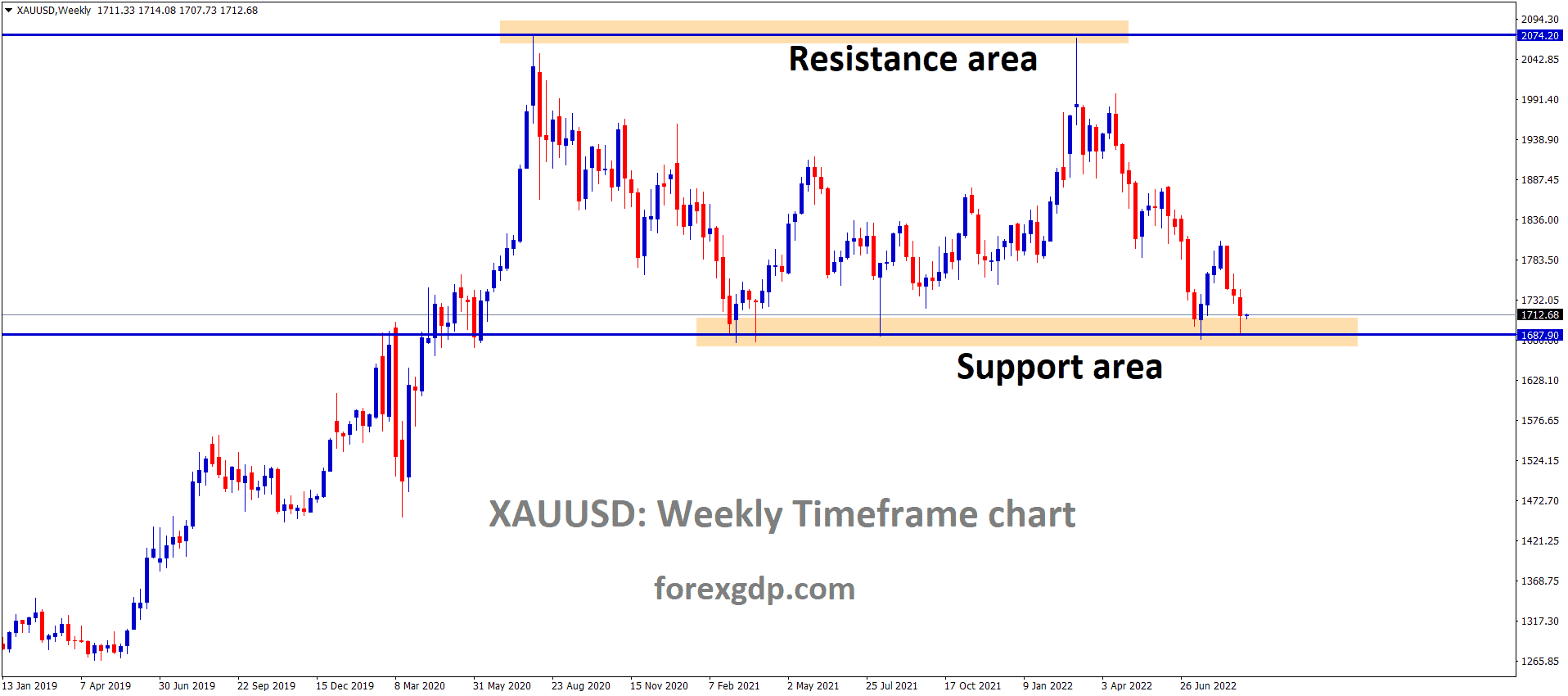

Gold: 10Y Treasury yields lower supported Gold prices

XAUUSD Gold price moving in an Ascending channel and price standing at higher high area.

XAGUSD Silver price standing at the higherlow price of Ascending channel.

Gold prices headed higher as US 10-year treasury yields lower- and 2-Year Treasury yields make lower last day.

And due to lower yields from interest assets, and investors moved partial funds to non-interest yielding assets.

US FED Powell commented rate hikes cannot be seen until 2022, and planning for tapering soon happen in 2022 earlier.

So Gold prices are ticked higher as US Dollar corrects the market.

Chinese Company Evergrande last day settled 83.5 million Dollars in US Bonds to creditors before date, but still $300 billion worth of loan to be settled.

US Dollar: US inflation predictions are higher in 2022

USDCHF price after hits the retracement level of 61.8% and entering into channel..

US inflation expectations are much higher, and the 10-year Breakeven inflation rate ticked higher, as per St. Louis Federal reserve Data.

And 10-year treasury ticked higher to 1.70% in the past 3 months as US Dollar rallied from 89 to 94 mark in the market.

So, the US Inflation reading will be much higher until 2022; FED Powell also commented we see higher prices of inflation points in 2022, and it will come down in 2023 to 2024.

So in next month FOMC meeting, we can expect the tapering of assets at least low as possible.

EURO: ECB meeting forecast

EURCHF market price standing at the weekly support area.

ECB monetary policy meeting will happen this week, and tapering or rate hikes are not on the table.

In the Eurozone, Inflation prices are ticked lower, which support ECB to stabilize in this pandemic level.

And the Important Domestic data like Services, Industrial, manufacturing data are lower in Eurozone.

This week US GDP data and New Homes sales data are scheduled, which will give the direction of EURUSD.

And in the ECB meeting, expect a forecast of tapering announcement for 2022.

And US FED is planning for tapering at the end of 2021; if FED does, then ECB will think to do it in mid of 2022.

German IFO data

German IFO readings show the Fourth Consecutive fall due to Supply problems and primary products issues; these problems impacted the Exports industry.

Due to this German export expectations fell to 13 points in October from 20.5 Points in September.

And EURUSD created more downside pressure as the German economy got more weakens in the Exports area.

UK POUND: Rate hikes expected in November meeting

GBPAUD moving in a descending channel and price bouncing from lower low area.

UK Pound is moving in the ranging market and waiting for the Bank of England monetary policy meeting and FOMC monetary policy meeting next week.

UK Chief economist Pill said that 5% of inflation jumped by next year mid of 2022, so the Bank of England sees 65% of rate hikes of 25bps or 15bps expected in the November meeting.

And in the December meeting, there are 50-50 chances for rate hikes if not raised in November.

UK budget and spending review took place this week; Chancellor Rishi Chunak may increase the wage of minimum level, it will benefit individuals.

And Tax hikes may affect business people and high salary income professionals.

So minimum wage hikes result in rising inflation measures.

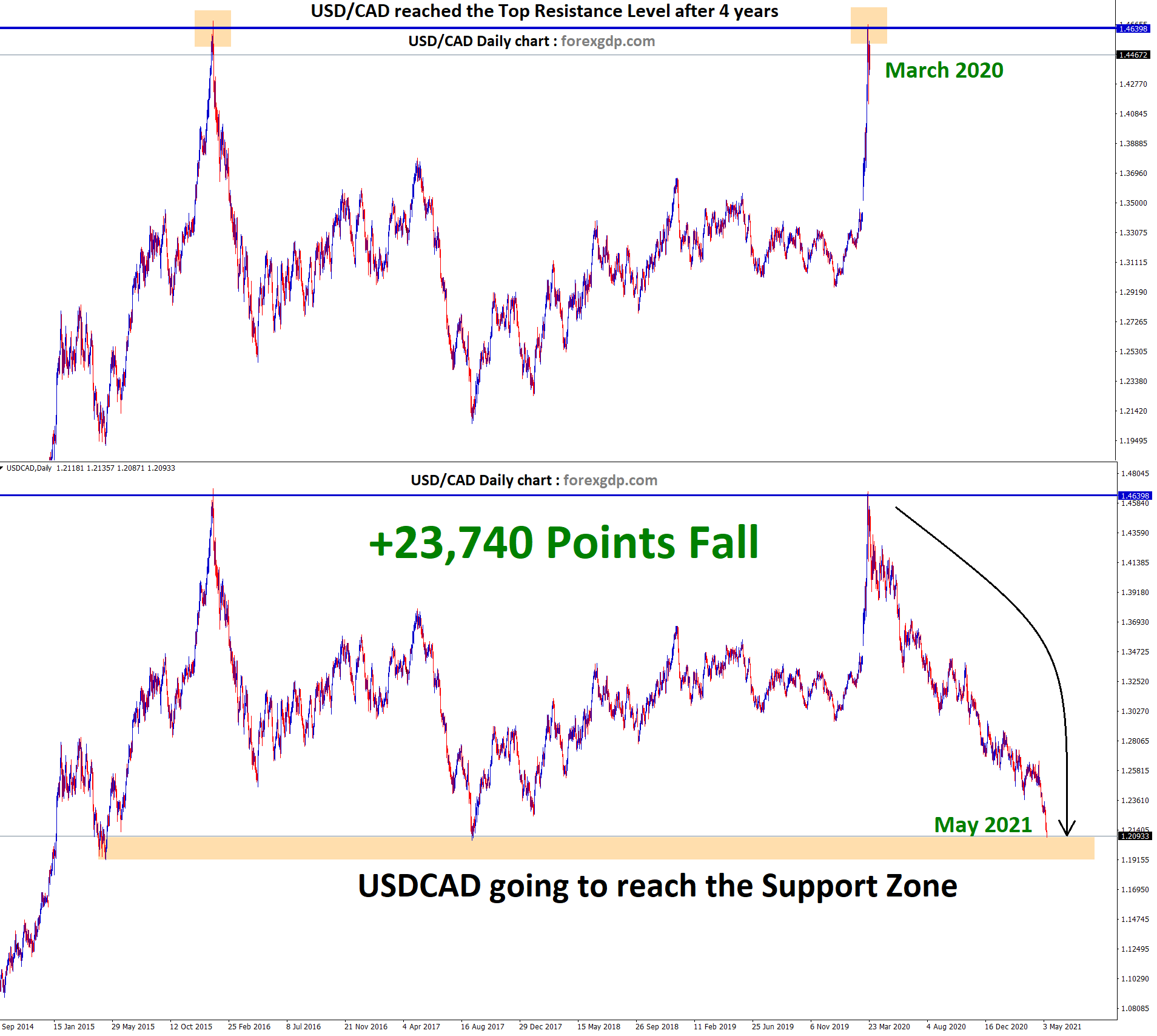

Canadian Dollar: Bank of Canada monetary policy meeting this week

CADJPY rebounding from 23.6% retracement level and higherlow area of Ascending channel..

Canadian Dollar edged towards the higher high level of Previous resistance region, this week Bank of Canada monetary policy meeting happening, and more tapering is expected due to Higher employment rate and higher inflation in Canada.

And Oil prices soaring as OPEC+ nation cautiously increasing supply without any problems to itself for Gulf nations, so proper increasing supply work going on according to demands from Global countries.

The Oversupply of oil will lead to Prices being lower, So the medium phase of supply is conducted in Saudi Arabia.

And USDCAD waiting for US Q3 GDP data published this week.

Japanese Yen: Japanese PM Kishida speech

USDJPY moving in an ascending channel and markets standing at the higher low area of the channel.

Japanese PM Kishida urges the Economic panel to create Urgent proposals by early November and Sign to implement them soon after the election.

The proposal includes Advanced technologies of Digitalization, Decarbonization and Economic security issues like Semiconductor supplies and Vaccination improvement.

And also, he stated that We need a Step-by-step recovery in Economy growth, and Japan has to rebound to a normal from the Pandemic level.

Australian Dollar: US and China speech over phone call today

AUDUSD moving in an ascending channel and market rebounds from 50% retracement level,higherlow area of Bullish trendline.

In G10 currencies, the Australian Dollar performed well, and Another China company that makes defaults payment on Dollar bonds is a modern land company.

So the Chinese economy was affected by the Real estate sector, the Covid-19 crisis and Coal shortages.

And Coal remains more efficient exports from Australia to China because of more scarcity of Coal in China.

Today second call like to happen between US Treasury secretary Janet Yellen and Chinese Vice Premier Luihe, and more smooth relations will be expected from the outcome of the speech.

As US Treasury Janet Yellen commented, inflation is higher in the US, and it will drop down in the late middle of 2022.

New Zealand Dollar: RBNZ Governor ORR speech

NZDJPY price rebounding from 23.6% retracement level.

The Reserve Bank of New Zealand Governor Adrian Orr said that inflation is reaching higher in New Zealand. And we see prices hike in Food, transport and services sector.

We want to control this inflation by monetary policy tools, and it is not easy as think; Climate changes make changes in All essential requirements, Prices increases as Supply and demand mismatch at the Global level.

Due to raw material shortage, production numbers were slowed, demand higher in the end, creates prices hikes in Industrial sectors.

Considering the above scenarios, RBNZ might do another rate hike at the end of 2021 as all are expected to control inflation reading.

Swiss Franc: Another Chinese company made default on payments

CHFJPY Moving in a Descending channel and market stands at lower high area of Descending channel.

Swiss Franc prices are ticked higher against the Japanese Yen, and China seeks another real estate company to default.

So, more interest payments to creditors make support for Swiss Franc and US Dollar.

And the US Bonds payments made by China defaulters makes the demand for US Dollar higher and another safe currency Swiss Franc.

The Swiss zone has lower inflation, and the country makes negative interest rates from 2015. With more deposits from China and other global nations due to pandemics and real estate crises, the Swiss Franc makes dominant currency for Investors.

Don’t trade all the time, trade forex only at the confirmed trade setups.

Get more confirmed setups at premium or supreme plan here: https://www.forexgdp.net/buy/