Gold: US CPI data came higher

Gold price has broken the top of the consolidation zone and starts to move higher breaking the recent resistance levels.

Gold prices remain higher after US CPI data printed at higher 5.4% versus 5.3% expected.

And Yesterday, FOMC minutes happened, and tapering will be confirmed based on the November meeting will see the outcome.

US Dollar declined as US CPI inflation numbers came at higher and 10year US Yields declined.

Gold prices surged high to 1796$ from 1750$.

So, US Dollar declines are positive for Gold as of yesterday move.

And in the coming months, FED Tapering is the main issue for other counter pairs to surges. Whether tapering is done in November or not, the Hopes of investors are eroding, and once the tapering news comes, then US Dollar keeps higher.

US Dollar: Tapering of FED is more concern for Investors

USDJPY has reached the ascending triangle pattern breakout target – wait for some correction on USDJPY.

NZDUSD is poping up between the channel levels.

US Dollar makes sell-off from a higher level as 0.70% lower as US CPI data came at a higher level when compared to last 2 months.

And FED Tapering tool may be used or waiting for use based on the November meeting will decide.

But Running inflation numbers higher makes investors have fewer hopes on US Dollar as printing money is higher in FED.

This week US Retail sales and Michigan consumer sentiment data are still scheduled on the table.

EURO: US and EU meeting on Tariffs discussion

EURNZD is moving in a downtrend creating further lower lows.

In Yesterday’s meeting between the US and EU on discussion with Aluminum and Steel tariffs were smoothened on Tax disputes.

And in Now coming months may relieve some tax burdens on Steel and Aluminum on Eurozone, as hopes come from the meeting.

This is positive for the Eurozone after the Trump administration on Tariffs War.

US CPI data came at higher as 5.4% versus 5.3% expected, and the Core inflation rate stood at 4%, in line with expectations.

EURUSD rising over 1% from lower after US CPI data kept higher and keeps hot for FED to keeps raise interest rates or tapering soon as early as the end of the year.

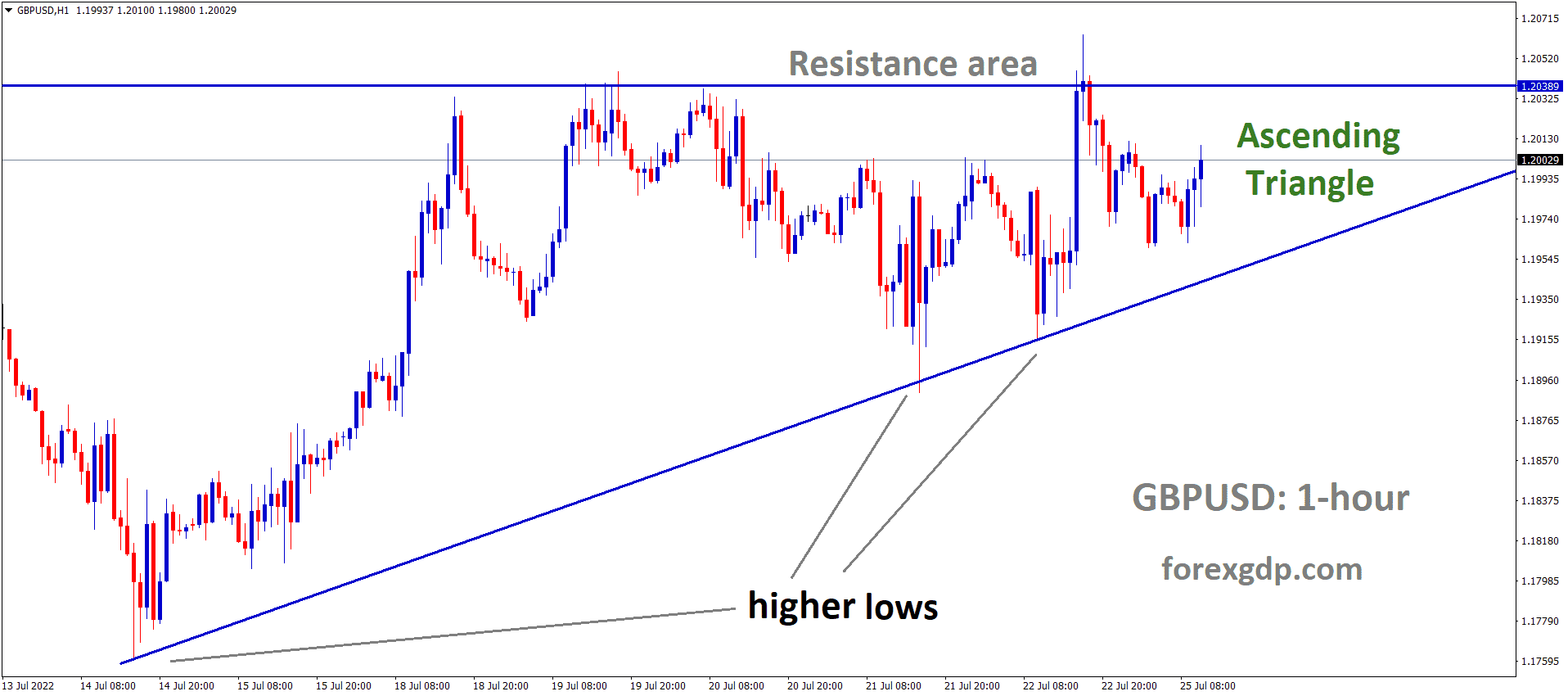

UK POUND: Wages growth remain a concern for UK Companies

GBPUSD is moving in a downtrend line – going to reach the top (lower high) of the downtrend.

UK Pound makes higher as GDP rate in the UK was higher number printed at 6.9%, and CPI data came at 3.2% in last month September.

The unemployment rate is at 4.7%, and the Bank of England may be ready to hikes rates of interest by the end of 2021 at least 15 basis points.

And GBP 895 billion Bonds purchases program is likely to end in March 2022, and tapering assets leads to Support for UK Pound.

The Brexit issue on Northern Ireland Protocol weighs on the UK and the Still no-compromise solution from the UK side.

In the UK, 90% of 1st dose vaccination completed in the UK and 80% of second Dose vaccination progressing, So Covid-19 remains less pressure on UK and Energy crisis makes worry for the UK as More European workers left after Brexit deal.

Now British companies want more workers in place of EU workers, but wages are higher to UK Employees when compared to EU Employees.

UK Government Furlough Schemes were Ended and So many Job Vacancies created for UK People.

Canadian Dollar: Surging Oil Prices supports for CAD

USDCAD is moving with strong sellers pressure due to increase in crude oil prices – USDCAD is breaking all the recent supports without much retracements.

Canadian Dollar soaring to higher as breaking the previous level of Resistance at June month.

As Oil Demand makes higher in EU and China supports for Oil Prices to higher.

And in the upcoming meeting, the Bank of Canada will do tapering or rate hike is possible after last week positive employment data booked.

US CPI data came at higher numbers and put pressure on US Dollar more, and USDCAD broke the support level of 1.24500.

OPEC agreed to extend production

UAE Energy Minister Suhail AL Mazrui said that the balance of Oil for All nations keeps in mind and ready to ramp up productions as OPEC and Allies decide and more productions are going to started what they planned.

And this positive information came from UAE after Russia made a compromise with OPEC+ for extending Oil Production.

Japanese Yen: Bank of Japan Board member speech

AUDJPY is moving up stronger after breaking the channel line.

Bank of Japan Board member Asahi Noguchi said the pandemic lending program wouldn’t be stopped until Japan attains a Full pace of recovery.

If the Pandemic stimulus stopped then 2% of the inflation goal will not soon achieve.

And rising raw material costs hurt the consumer side and raise corporate profits.

But the long run of Rising Raw material costs will affect corporate profits as Retail sales declines.

So balance the pace of Cost of raw material purchases and consumer spending cost of products, then only Business runs smoothly.

And Japan will never goes into Stagflation, and Government is hardly spending stimulus to recover the Economy.

Australian Dollar: Weaker Unemployment data

AUDNZD is making a correction from the lower high and the old support which act as new resistance.

Australian Jobs data shows loss of 138000 jobs versus -110K expected, and Unemployment rose to 4.6% from 4.5%.

And Sydney announced easing lockdown restrictions after 80% of people were vaccinated, NewSouth Wales completed 80% of Above 16 Vaccinated.

Energy prices soaring makes the Australian Dollar pushed for Higher highs.

And US CPI data came at higher than expected and becomes a backlog for US Dollar.

Whether US FED Do tapering or not in November inflation gauge came at higher numbers.

When Consuming costs becomes higher, Spending will decline if the price of borrowing products is more elevated.

New Zealand Dollar: RBNZ Deputy Governor speech

GBPNZD is moving between the channel ranges.

Reserve Bank of New Zealand Deputy Governor Bascand said that Housing prices and Covid-19 make more risks for New Zealand Economy.

We must ensure the regulatory of financial institutions and remain cautious as Covid-19 poses a higher risk.

New Zealand Housing market remains at a higher cautious level, and Institutions should avoid to overexposed to Housing and Business sector.

NZDUSD Ticked higher after US CPI data came at higher than expected.

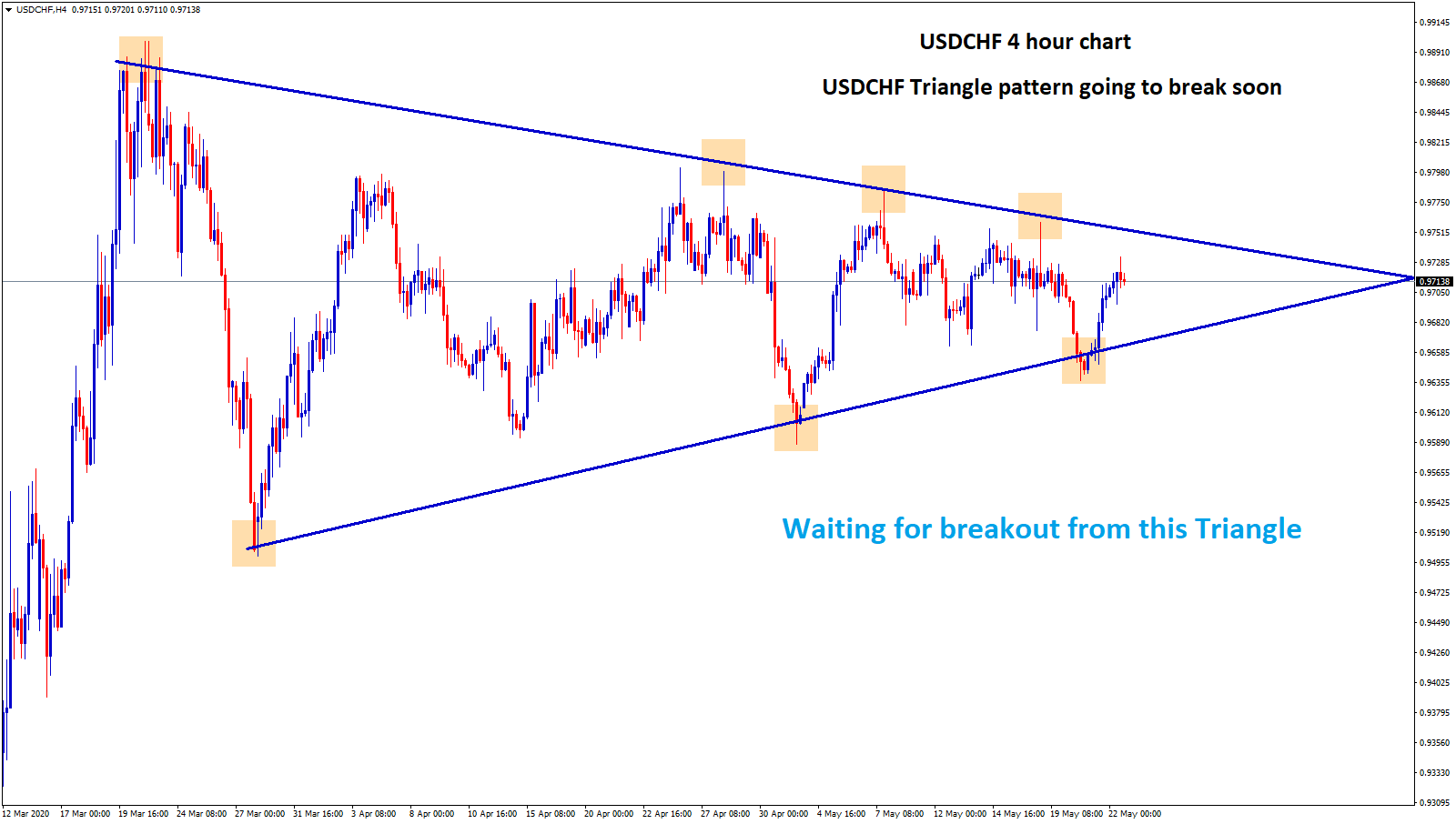

Swiss Franc: Demand higher after Global Energy crisis increases

USDCHF has broken the uptrend line and now falling between the channel range.

Swiss France broke out the June Month resistance level of 123 as Demand picked up higher.

And China Evergrande crisis makes Investors panic about safety and pours money into the Swiss National Bank for safety.

And JPY becomes weaker as Lower economy recovery in Japan and US Dollar makes little bit higher after Vaccination adequately done.

But US CPI Data showed a higher number yesterday makes worry for US FED to tapering soon.

Due to ti, this USDCHF declines 1.5% from highs after the Weaker CPI data listed yesterday.

If continuing higher CPI inflation and no tapering from FED leads to weaker US Dollar.

Don’t trade all the time, trade forex only at the confirmed trade setups.

Get more confirmed setups at premium or supreme plan here: https://www.forexgdp.net/buy/