Gold: US FOMC minutes

Gold is trying to make a correction after retesting the previous support level twice – today and yesterday retested the support which might have chances to turn into support.

Gold prices headed towards higher as US Domestic report of Retail sales came at -1.1% versus -0.3% forecasted.

And Today’s FOMC minutes are not more important in investors view, as Next week Jackson’s holes symposium meeting is important to speak about US economic performance; tapering and rate hikes decision is forecasted.

Today we expected any hint of speech seen before the Jackson Hole symposium outlook.

US economy performed in a mixed bag of domestic data this month. Retail sales and consumer sentiment got fell, and US Jobs numbers and unemployment rate got past in data.

By con FED waiting for more confusion in Domestic data and getting clearance until all pandemic problems are solved.

Gold prices will be expected to break the resistance of 1800$ as last 2 weeks got big fall from level, now retested to the previous level of 1800$.

US Dollar: Retail sales data

GBPUSD is at the restest area of the descending channel line.

US Dollar bounces back to lows as Retail sales data lower and Michigan consumer confidence made lower last week.

And now all eyes waiting for FOMC minutes held today, and any tapering and rate hikes speech by Powell will reflect in Dollar prices higher or no speech shows declines in Dollar prices.

US Joe Biden plan of infrastructure package of $2 trillion is passed in the Senate.

And through this plan, a greater number of jobs created for US Citizens and from that Employment rate will be increased step by step in 2021.

FED Powell answers to Students and Educators

FED Powell responded to Educators and students as the Economy is doing well; millions of people in service sector jobs are still out of work, and recovery is more important to compensate for their lost jobs.

FED is now focusing on tools regarding emergencies, and Digital money is more important now in this pandemic situation.

FED Powell’s speech to Students was hope given to US Economy will be recovered soon as we expected.

EURO: CPI data

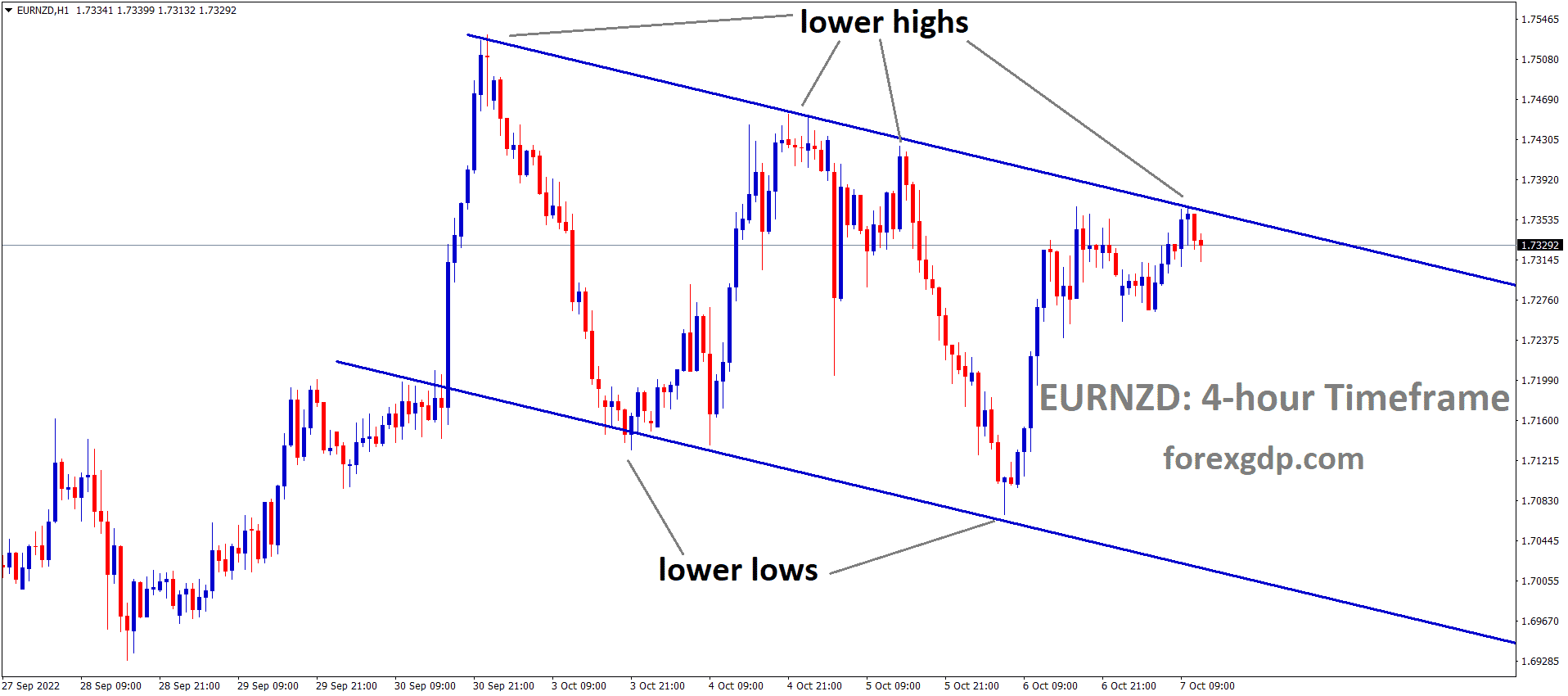

EURNZD is at standing at the resistance area now, wait for breakout or reversal.

EURCHF is moving in a range area.

Euro CPI meets estimated reading of 2.2% in July month.

And EURUSD got weaker more and unfazed by better data flashed. This is because of more pandemic fears in the EU region.

And Vaccination is in partial progress; due to this, Delta variants will affect more people, and it will get hampered by ECB monetary policy decisions.

The inflation is above the 2% goal, but employment numbers are not sufficient to reach.

Now more easing monetary stimulus is possible from ECB if cases in the EU region gets worsens.

UK POUND: UK Inflation data

Similar to EURNZD, GBPNZD also standing at the resistance area, if it breaks up, it will move to the next resistance..

GBPCHF rebound from the support and retesting the previous broken ascending channel line, wait for the confirmation of break through or reversal from this broken channel line.

UK Inflation rate came at 2% versus 2.3% expected and came lower than 2.5% in June.

UK PPI index numbers came at higher shows raw material prices and factory gate prices are higher at month on month and Year on Year reading.

Inflation will reach 4% at peak and drop back as Bank of England forecasted this year, Rate hikes are expected in March month in 2022 as 25 basis points and 25Bps increase in September month as investors expected.

UK Pound slight bounce back from lows in markets reflects after the data came.

Canadian Dollar: CPI Data

GBPCAD has formed a symmetrical triangle pattern, market going to break this triangle soon as it getting narrower.

AUDCAD is moving in descending channel and trying to break the horizontal support..

Canadian CPI is ahead this week, and the expected reading is 2.8% in July Versus 2.7% in the previous month.

USDCAD got rejected in the previous resistance level of 1.26500 last day after free fall progress in the Canadian Dollar.

Oil prices contribute more to price fluctuation in the Canadian dollar, and US Dollar performance will reflect in Loonie pairs.

US retail sales data released last day got disappointing numbers; due to this US Dollar weakens and the Canadian Dollar slight jump in the market.

Japanese Yen: Investors Parking funds to Safe-haven currencies

EURJPY bounces back from the minor descending channel, however it has broken the recent lows..

Japanese Yen got gains from the Delta variant spread across Asia and Europe regions.

And this gain in the Japanese yen is no real gain from the Domestic data performance of Japan, but fears from investors mind parking the funds from Riskier currencies to haven currencies like JPY and CHF.

The US got weaker retail sales data last day, and due to this US Dollar was slightly weaker from last week.

And Today, FOMC minutes will regain US Dollar to the previous level of resistance.

USDJPY now get back to the previous resistance of 110 level is possible by this week or revert to previous support of 109 is possible based on Speech of Jerome Powell today.

Australian Dollar: Delta variant spread

AUDNZD bounced back little up from the support area of the descending triangle.

Australian Dollar has fallen from highs in the last 2 days as the ranging market broke out moved in the last 2 months.

New cases of Delta variant spread in New South Wales pushed most of the cities to lockdown by the Australian Government.

And Now, Fears started in the US as Spread will transfer from the Asian continent to US Continent. Well-vaccinated US People also feared attacking the Delta variant spread, So proper Vaccination to cure the Delta variant is possible in this situation.

Domestic data of Australia got weaker as Lockdown increases. RBA clearly said No rate hikes are possible before 2024.

New Zealand Dollar: RBNZ monetary policy meeting kept rates unchanged

NZDJPY is moving in a descending channel and now it reached the support area, wait for the breakout or reversal.

Reserve Bank of New Zealand made interest rate unchanged today at 25BPS rate as 0.25% kept stable.

Because Yesterday New Zealand PM Jacinda Ardern announced a 3-day lockdown after one case of Delta variant confirmed in the Auckland area.

Now RBNZ left all instances of Employment numbers and inflation data, Strong GDP numbers, Lower PPI numbers and only focused on the measures to control the spread Delta variant.

These Delta variant case makes RBNZ full stop to rate hike stances today because Small cases of Delta variant will close the Domestic data reading to sluggish mode.

Due to this, RBNZ feared the Delta variant spread, and they have to stop it earlier.

RBNZ Governor Adrian ORR speech

Reserve Bank of New Zealand Governor Adrian Orr talks about the biggest concern in the economy is now is inflation.

We will soon tighten the monetary policy than other countries. Our Domestic data performed well.

And now Delta variant cases made little worry for economic growth. If any slowdown occurs in the economy, RBNZ will give a stimulus to support the economy.

We will do rate hikes if situations come under a normal stance.

Trade forex market only at the confirmed trade setups.

Get Each trading signal with Chart Analysis and Reason for buying or selling the trade which helps you to Trade with confidence on your trading account.

Want to increase your profits in trading? Get the best trading signals at an accurate time. Try premium or supreme signals now: forexgdp.com/buy