Gold: ADP data forecast

Gold has reached the horizontal resistance again from the support and higher low level of uptrend line.

Gold Prices moved in the sideways market ahead of non-Farm payrolls data scheduled this week.

Gold Prices purely depend on Speech of FED comments on monetary policy tools, FED member Clarida reassures with Powell moves on monetary policy meeting as Dovish stance.

Fed Member Waller said that tapering is rejected by other FED members last day.

FED is waited for the pure economy to come back from Pandemic as Healthier as seen in 2019.

This month Jackson Hole symposium may determine further actions on US Dollar to a stronger or weaker tone.

ADP Private employment data scheduled today defining the Outlook of NFP data scheduled on Friday. More numbers in ADP will give NFP as Positive numbers based on Previous reports published, but it is not sure for the same will be reflected in NFP. Sometimes reverse numbers will come in NFP.

Gold is now waiting for NFP data this week.

US Dollar: ADP Data forecast

USDCHF continues to fall breaking the support and lower low of descending channel.

US Dollar index tilted downwards to 92 levels as FED commented. Dovish stance and No tapering is seen before 2021.

The inflation goal of FED is achieved, and now full aim focuses on Job creations and the Unemployment rate to down to 3-3.5%.

This week’s ADP Private jobs report is expected to come at 695K in July and 692K in June.

More numbers printing is positive for US Dollar and reverses if negative numbers are printed.

EURO: Domestic data

EURCAD continues to rise up in an uptrend channel range.

EURNZD is ranging between the resistance and support areas.

Eurozone Services PMI is announced as Lower numbers, and Retail sales came at 1.5% MoM in June versus 1.7% expected.

Due to more spread of Delta variant in Eurozone makes Downward reading of Eurozone.

US Dollar seems downward pressure, and This week, ADP report and NFP report are scheduled, and Positive numbers will help strengthen US Dollar, and Negative numbers will be strong Euro.

ECB Council member speech

ECB Governing Council member Martins Kazaks said before ending the PEPP Purchases program, ECB will give perfect reason to alter the asset purchases.

So, no need to worry about when the will ECB gets tapering assets.

ECB says before scaling back assets and rate hikes based on Domestic data performance.

Now Delta Variant is more concerned and Euro likely to announce in Next month about tapering or hike rates.

UK Pound: Bank of England meeting Forecast

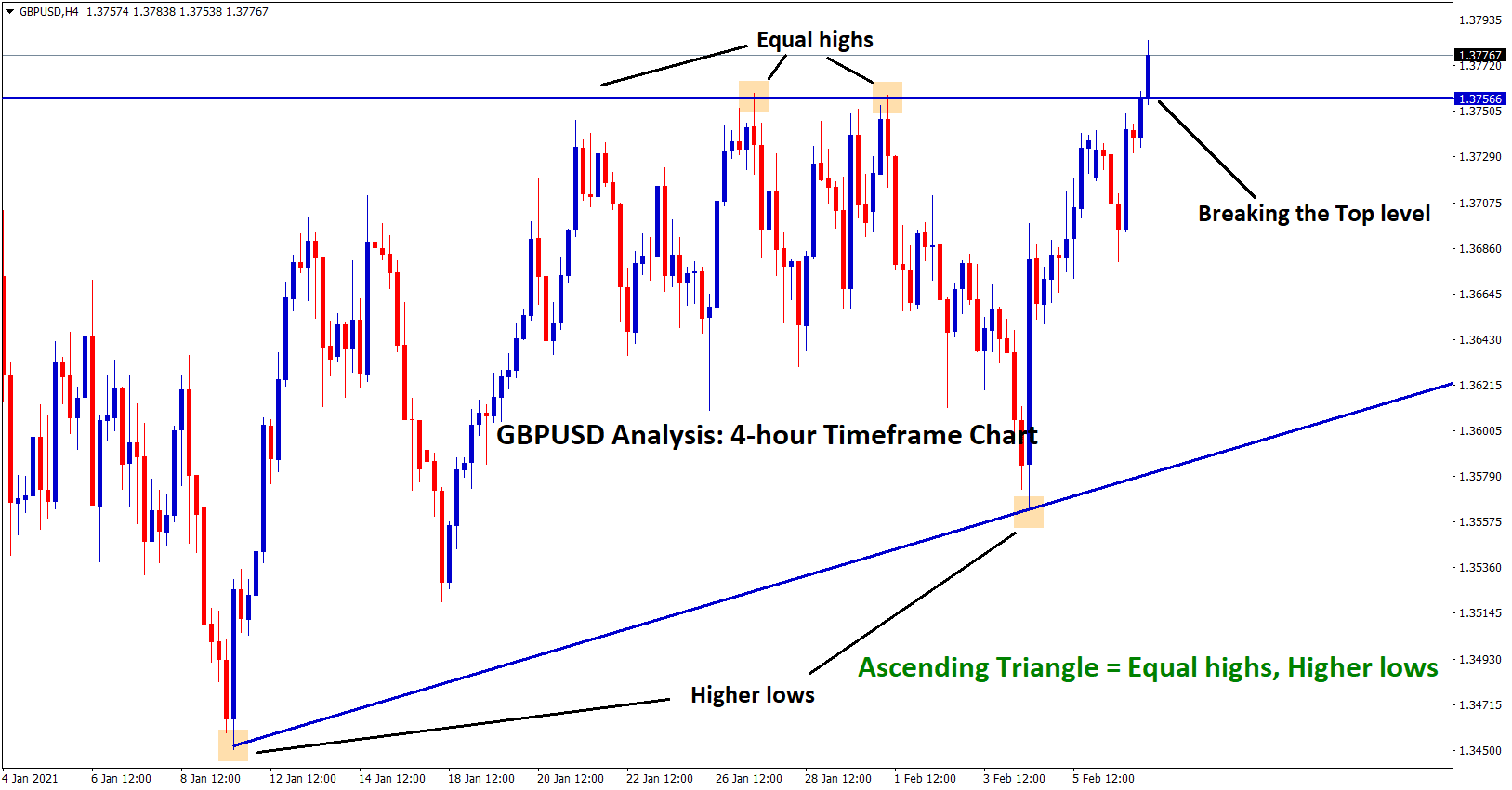

GBPUSD is rising up again to the recent high.

GBPCHF has retraced until 78% from the recent high in an descending channel range.

Bank of England monetary policy meeting will happen Tomorrow, tapering assets is possible, and Chances for rate hikes speech is expected from Meeting.

GBPUSD is waiting for a breakout the resistance level of 1.40 as the past week reached.

But Delta variant spread is the main concern for Freedom from lockdown country Faces more pressure.

And now England people are free to move inside the nation, once higher cases are reached, the nation will worry for the lockdown button to push.

Post-Brexit Deal is a concern with Northern Ireland Protocol; the UK is not accepted to sign, Euro gets calm after the UK decision, But Northern Ireland will not leave as a European nation.

Delta Variant is spread reduced

Bank of England monetary policy meeting is set for Thursday this week. Voting members vote for 6-2 for Staying with asset purchases and No tapering assets, and No rate hikes in the near term.

Inflation goal of 2% and increasing inflation numbers seen as a near term and long term will be stable.

Delta Variant is spread reduced to 20K from 40k is excellent handling by UK Government.

Bank of England will deliver tapering assets purchases as little as expected Because RBNZ and RBA already cut their assets purchases.

Canadian Dollar: OIL supply concerns

GBPCAD is now at the top level of the Ascending Triangle pattern – wait for breakout from this pattern.

CADJPY has retested the recently broken support.

Canadian Dollar faces a 0.90% fall yesterday from 87.500-86.600 after China announced the lockdown spread of Covid-19 in major cities.

China is the second-largest country performing GDP levels, So Oil Supply may reduce if lockdown is announced.

US Dollar on other side facing selling pressure but Oil Supply concerns makes worry for Canadian Dollar to Upside move.

Japanese Yen: Lockdown in Tokyo

USDJPY continues to fall in a descending channel clearly by creating further lows.

Japanese Yen suffered more against Counter pairs as Tokyo facing more lockdowns headwinds of Delta Variant.

Fiscal conditions are more worsening, and Vaccinations is the only treatment for recovering from a pandemic, as the Japanese Finance minister said earlier.

US Dollar faces selling pressure as FED Powell plays Dovish stance as year-end 2021, and no tapering is expected until employment data to fulfilled.

Australian Dollar: China Domestic data

AUDUSD is bouncing back from the lower low level of the downtrend channel.

China Caixin PMI services for July month printed at 54.9 against 50.3 expected.

And Caixin Composite PMI came at 53.1 from 50.6 for June Month. A normal reading above 50 is considered Bullish for PMI data.

But China facing slower economic growth, and Q2 GDP will arrive. Lower numbers are fears of Investors.

China announced more lockdowns to control delta Variant and is now ready to inject more funds into the economy and give lower lending rates for Private banks to tackle the economic situation.

Australian Dollar is benefitted from the RBA policy meeting of tapering assets from A$5 billion to A$4 billion.

New Zealand Dollar: Unemployment rate

NZDUSD is going to reach the resistance area after breaking the channel ranges.

New Zealand Unemployment rate fell to 4.0% from 4.6% from march to quarter to June 2021 second quarter.

This reading is the most dominant number to chance for rate hikes in the August 18 meeting of the Reserve Bank of New Zealand.

Rate hikes will be expected to be 0.50% from the 0.25% current level.

RBNZ is worrying about Mortgage lending standards and tightening the assets to control the hot housing market in New Zealand.

NZDUSD up from last day to today as 0.90% as 0.70700 range.

New Zealand Bank will be the first around G10 countries to rate hikes in 2021 is expected.