Gold: Delta Variant

Gold hits the lower high zone of the Descending Triangle.

Gold prices see some correction in lower highs last day, Moderna vaccine makes curing for Delta variant type Covid-19.

Due to this scenario, US Dollar makes a stronger view as Vaccines helped to destroy the Virus spread.

And Now June’s ISM manufacturing data is in focus and expected reading at 60.9 and looks stronger performance compared to 53-55 area, the fastest expansion since 2004.

Increasing raw materials cost and demand concerns and labour shortages make ISM manufacturing data looks higher reading.

US Dollar: ADP and NFP data Forecast

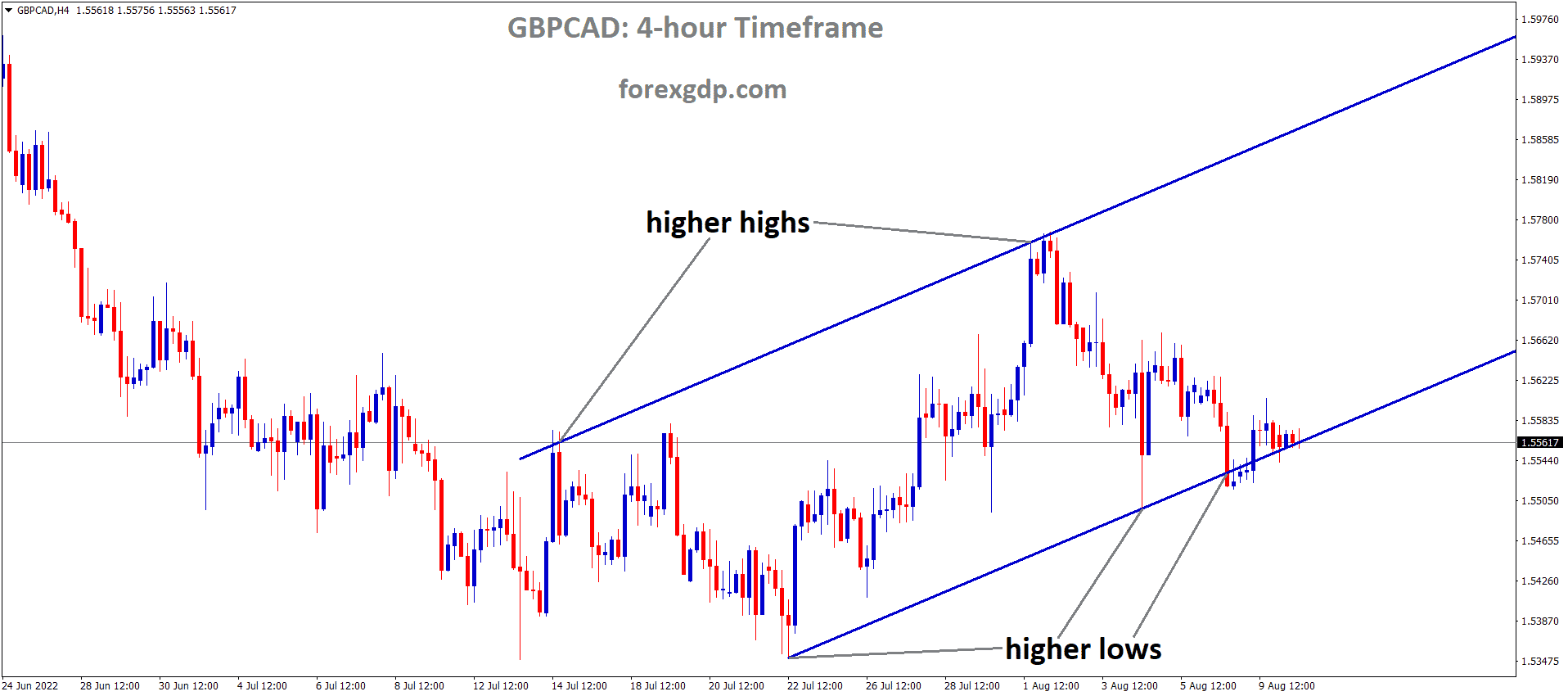

USDCHF is moving in an Ascending channel forming higher highs and higher lows.

AUDUSD is standing at the support zone and moving in a descending channel.

US Dollar closed to a higher rate of 111 level for the first time in the last 3 years as vaccinations doing well progress.

Last day ADP data shows stronger numbers than expected and the unemployment rates this month will declines more from the previous month if Employment numbers produced more.

US Dollar now looks for more demand as a new type of Delta variant sharps all over the globe.

And Moderna Vaccine only cured the delta virus sooner than other vaccines.

By considering this Global investor shift their funds to the US Dollar index for Safe purposes. Rate hikes and Tapering is possible in next year confidence for investors.

EURO: ADP DATA

EURUSD hits the support zone and now still moving in a descending channel, wait for a breakout from this channel.

EURGBP is breaking the top level of the falling wedge pattern.

EURUSD dropped to 0.50% yesterday after ADP data shows 692k jobs versus 600k jobs expected.

Last time it is not suitable for NFP data predetermined levels, this time NFP data is expected to 700k jobs report.

US Dollar remains stronger as 0.50% higher yesterday after ADP data released.

And Delta Variant of Covid-19 spread across Eurozone and rate hikes are not possible until 2023 on the ECB side.

FED forecasts for Job growth makes steady and will focus on tapering assets and Rate hikes sooner than later.

EURO: Strategy plan for exiting stimulus funds

ECB plans for a special strategy meeting in Frankfurt Next week to keep price stability in the market as comments from David Marsh, Chairman of Official Monetary Financial Institutions Forum.

The meeting is expected to start on Tuesday and until Thursday next week. The inflation target of 2% below only in the Eurozone but the ECB wants to achieve the goals of the inflation target.

ECB now plans for how to tighten monetary policy settings from crisis state to Stable state.

UK Pound: BoE Governor Bailey comments

GBPUSD moving in a descending channel and it hits the recent support zone.

Bank of England Governor Bailey said the new form of the Covid-19 Delta variant keeps jittery in the economy and the Nation will face another tough lockdown soon.

Manufacturing PMI shows 63.9 versus 64.2 expected.

And UK Pound shows declines of 2% from last week as the US Dollar on another side stronger upside move after ADP data came in higher number.

UK pound still struggling for Dovish comments from Bank of England Governor Bailey and this week NFP data will decide the directions of GBPUSD.

BoE no rate hikes forecasted

Bank of England Governor Bailey said on Thursday as Temporary inflation numbers will shoot up the cost of living.

Inflation numbers shoot up is short-lived only and Bank of England shows no more rate hikes and no more tapering assets as temporary inflation rate higher.

Demand and supply declines caused by Covid-19 is temporary.

This speech from Governor Bailey causes UK Pound to declines.

Canadian Dollar: Bank of Canada tapering forecast

CADJPY bounces back to lower high after 61.8% retracement.

Bank of Canada is possible to tapering assets purchases in July 14 meeting as balance sheet stopped contraction in May month.

Interest rate hikes expected in Q2 of 2022 than H2 in 2022. This will Favor for Canadian Dollars to move higher than US Dollar.

Oil prices show stronger robust growth as Vaccinations are perfectly pitching in all parts of the Globe.

And Oil prices are the main key drivers for Candian Dollar price rising and now holds for recent delta variant in Canada regions.

Japanese Yen: Tankan manufacturing index

USDJPY hits the higher high zone of the Ascending Channel.

Japan’s Tankan Large all industry CAPEX came at 9.6% versus an estimate of 7.2%.

Tankan Large manufacturing came at 14 below the expectations of 15.

And the economy is slower than the manufacturing index showing and Only 11.5% of the Population only Vaccinated.

Due to this economy facing loose monetary policy settings and low interest rates maintaining.

Inflation rates remain lower as nationwide lockdown just a few weeks before release.

Australian Dollar: Slow Vaccine rollouts

EURAUD broke the top of the Ascending Triangle, now it’s trying to break further resistance levels.

AUDCAD has formed a Descending Triangle pattern in the H4 chart.

Slow Vaccine Rollout and monetary policy settings of RBA remains pressure on the economy.

Covid-19 handling by the Australian Government much more lacking than developed countries.

Due to this now facing for new delta variant in Q3 and Facing more lockdowns in south Wales and Cities in Sydney.

Recent stability in Iron ore prices makes less potential to rise in further months.

Wage growth and inflation remain lower but RBA now looks for more cautious on monetary policy meeting in July month.

Compared to other currencies AUD may suffer more against USD.

New Zealand Dollar: Travel Bubble with Australia

China’s manufacturing index shows positive numbers in June Month but it was lower than the previous month.

Due to delta variants around the Globe manufacturing activity remains slower than better expected.

But the report shows having huge orders on the list will pump up manufacturing in the coming months.

New Zealand looks travel bubble with Australia as the Delta variant spreads across Australia.

Due to this temporary halt across travel from Australia to New Zealand. Now passengers look to check on arrival and Tourism revenues get affected.

New Zealand Building permits drop to -2.8% month over month basis. This is down from 5.1% in April month.