Gold

Gold at the higher high zone creating a bearish engulfing candle.

Gold Prices Delighted Higher Highs to near Des. Channel Point and Gold importing increasing higher by China lead gold prices to a higher pace.

And SPDR Gold Trust reported last week Inflow higher than Outflow in the last 1 months.

Investors’ fears are Covid-19 in Asian Countries, and liquidity flows to non-Yielding assets like Gold rather than Riskier currencies like AUD and NZD.

And US Dollar also supported gold prices higher as Domestic data underperformed in May Month.

Due to these scenarios, Gold Prices moved higher pace followed until the end of May Month as Chinese Imports will close their Importing Quotas for Gold.

USD

USDCHF breaking the higher low level of the uptrend line.

US Dollar faces selling pressure as FED has no idea of tapering bets and Hike rates until 2024.

And Commodity prices turned higher after US Dollar weakness continues, and Domestic data shows negative numbers than expectations.

This scenario keeps US Dollar declining more, and the US spends more fiscal stimulus on the Economy, and the Economy is recovering from Vaccination.

Once a pandemic occurs, exports fall, imports makes higher the US Dollar keeps higher on January 2021. Once Vaccination keeps full stop for a pandemic, then the US recovered from injury, resulted in exports makes higher and imports makes lower finally US Dollar gets Down.

This is the market Cycles of the process; Here, FED is acting accommodative play for US Economy, progressing well played from the Crisis level.

China’s Digital Currency:

China has two main reasons for launching the Digital Yuan as the world intermediary currency instead of the US Dollar.

ANT Group and Tencent are two big giants that ruled for 94% of the online payment system; once Digital currency applied, the A to B supply is destroyed. The government should easily monitor unique transactions.

Chinese Currency is also a threat to US Dollar usage once all countries agree to tie up with China for Using yuan as Digital payment for all business purposes.

Digital currency makes no transactions theft and payments made simple without holding hard-earned currency in pocket.

More secured and Government also monitored any illegal made transactions in Digital Yuan.

China made loans to other countries through Digital Yuan instead of US Dollar, and this makes Digital Yuan placing Hammer point in all over the countries who are taking loans from China.

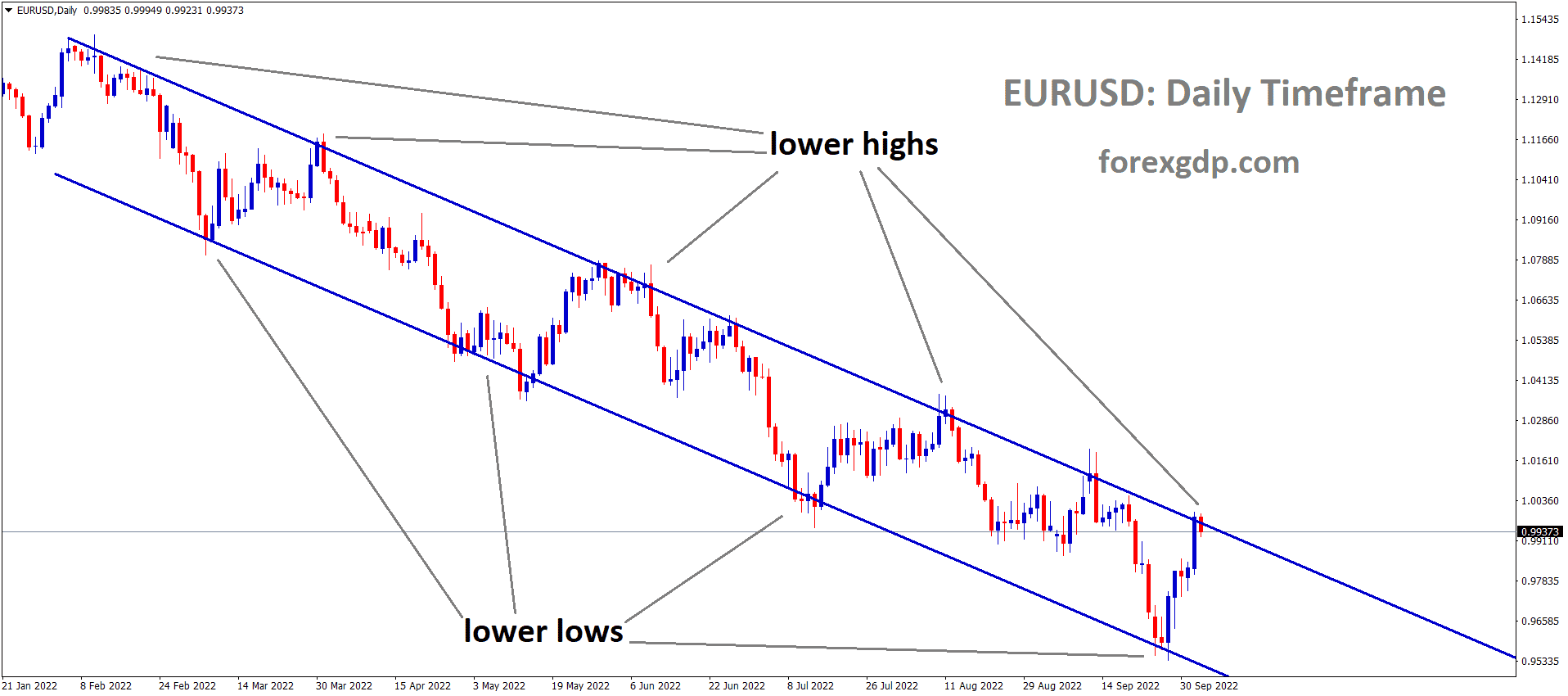

EUR

EURUSD is near to the top resistance level after 3 months.

EURGBP moving between the Support and resistance and in an uptrend range.

Eurozone Preliminary data shows a declining reading of 0.6% versus-0.6% expected.

Employment change also contracted to 0.3% on QoQ and 2.1% on YoY in the first quarter of 2021.

And Easing more lockdowns and reopening economies this month will reflect in the Next quarter of Eurozone GDP.

And the Vaccinations are in slower progress in the First quarter of 2021, but in the second quarter follows the faster pace of Vaccinations and will expect good numbers in Eurozone for Q2 GDP.

EURUSD raising further and climbed to 1.22 level Today as US Dollar fell to 0.20%.

GBP

GBPUSD reaches the higher high zone of an Ascending channel.

GBPJPY is moving in an Ascending channel in the H1 chart.

UK Employment data came in Positive numbers but still below Pre-crisis level as per data reported.

And the Employment Change came at 84k versus 50k Forecasted and Previous reading -73K.

The reopening of the UK economy shows clear strength on Labor statistics and soon reached a stable level once the Full population gets Vaccination.

And the UK reopened the economy with the 4th stage level, and People allowed to travel to foreign countries that get vaccinated.

US Dollar moved down as Domestic data failed to given Positive numbers, and FED allowed no rate hikes and No taper Bets formula until 2024.

This scenario helped Cables to drive higher against US Dollar, and GBPUSD Surpassed 1.42 level Today.

CAD

Canadian Dollar flourished higher highs as Oil Prices climbed higher day by day.

And the Tensions surrounding the Middle East as Israel and Palestine attacks, Oil Prices climbed higher more due to war fears.

Bank of Canada said there is no tapering of assets purchases only if the pandemic gets solved.

And the Domestic data shows positive numbers and supports the economy in Full-fledged and Boc also maintained the rate stable and No tapering until the fulfilment of Our goals of inflation and employment numbers.

USDCAD fell another 0.50% and reached a 1.20 level remains pressure on US Dollar over the Canadian Dollar in one 1months.

JPY

USDJPY at the higher low level of an ascending triangle.

Japanese GDP Data came at -5.1% versus -4.6% estimated in the Q1 report.

And the missed expectations showed the Third phase of Lockdown implement from April 25 last month.

And More lockdown Leads to More Businesses Struck up and Declines of Exports of Automobiles.

US Dollar, on the other side, facing declining in retail sales and Consumer confidence last week.

Due to this, both haven currencies are now vulnerable to conditions, but US Dollar is a stronger view than the Japanese Yen.

The main reason is Vaccination done for 70% of the population compared to 5% in Japan.

AUD

AUDUSD moving between Support and resistance ranges

Australian Dollar moved higher by 0.50% from last day as Chinese Data released in positive numbers.

A Fixed asset data shows positive numbers, and retail sales show less expected numbers.

And RBA Minutes scheduled this week, and no tapering bets and No rate hikes are expected from the meeting conclusion.

But Commodity Prices like Iron ore and Copper are the heavyweight revenues for Australian Dollar exports to China.

These Commodity prices are the only ones that pushed the Australian Dollar paced higher and soon will touch 0.83 level in 2021.

NZD

New Zealand Dollar rose higher after US Dollar steady fell as a Downtrend started.

And the Commodity prices like Copper and Iron ore prices higher support the revenue of New Zealand exports.

New Zealand Dollar may soon touch 0.76 level by the end of 2021.

And the Vaccinations are smoothly provided, and economic easing is perfectly done, and Covid-19 spread is very lower than other countries.

China remains the biggest importer of Dairy products from New Zealand.

And by seeing this scenario’s RBNZ may soon taper bets and hike rates by the end of 2021.

CHF

GBPCHF moving between the ranges in h4.

US Dollar index dropped 0.20% today as Downtrend started to fell and Swiss Franc continuous higher after 5 years resistance level broken.

And the Swiss Franc remains ultrasafe haven currency funds flow rush into Francs Third-wave hits most parts of Asian Countries.

US Dollar now goes for downfall ahead of FED meeting minutes and Housing data and Building permits scheduled this week.

USDCHF dropped to 0.20% as Domestic failed to inspire the investors and 10-year Treasury yields declined.