As human beings, it’s normal for us to dream big. We love to pursue our life to such a standard where the financial burden is not going to be an issue. Our dream is to think about the elite traders who will help us to change things dramatically. These CFD trading tips should help you finally be one step closer to your ultimate goal.

It might a tough task at the initial stage, but if you focus on the core concepts of the trading industry, you will learn to take trades professionally. Investors in Singapore are doing relatively well because they know the rules they need to follow to improve their skills. Though there are thousands of rules, we will discuss the top four rules that can change your life.

Trade the raw price data

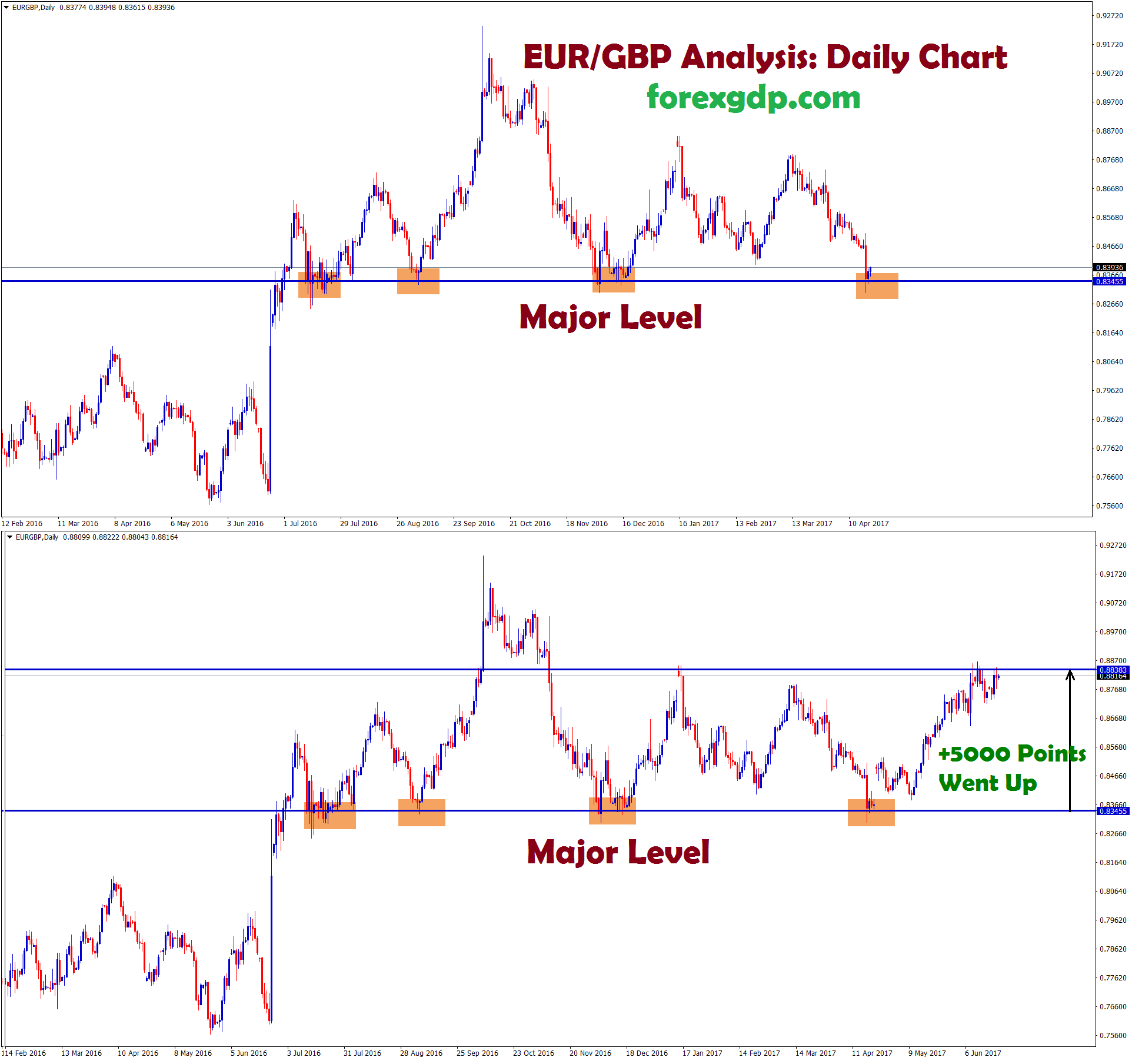

The CFD market is extremely volatile and it is hard to predict the price movement in the major stock market. Ask an expert trader how they invest money in the mutual funds. They will tell you a different story which will create the urge to become a full-time trader. You don’t have to depend on complex data to make a big profit from this market. At least the top traders don’t follow this method.

To them, raw price data is the most effective way to improve their skills in trading. Taking trades with the help of the raw price data is also known as using the price action trading method. Get used to the basic price action trading pattern, and soon you will learn the process of taking the trades with a high level of precision. You don’t have to push yourself to the limit to become a top trader. Learn the basic price action pattern, and your skills will improve.

Learn to find the retracement phase

Taking the trades in the retracement phase is the most elegant way of taking the trades. Open a demo account and see for yourself. Those who don’t have the demo account can try it out here.

By choosing a demo account with a reputable broker, you will get the unique ability to improve your mental skills. As you will not be exposed to real-life risk, you can take quality trades more confidently. This will help you to make better decisions in the market. If possible, learn to use the Fibonacci retracement tools so that you can make better decisions in the trades.

Memorize the chart pattern

You heard us right. We are asking you to memorize the major chart patterns to become a skilled trader. Without memorizing the major chart pattern, it is going to be tough to take trades in the extreme volatility of the market. Being an active trader, you have to learn more about this market.

Focusing on the chart pattern is one of the key steps you should follow. The retail traders always think they can do well without knowing about the major chart pattern. Chart pattern trading technique is the only one that will allow you to trade with big movement without exposing yourself to high risk.

Learn about the news factors

You must learn about the news factors to improve your trading skills. Those who are making regular profit know a lot about market news. They are not taking a high risk since they know the news data can allow them to take trades at an insane level of volatility.

Things might be hard, but if you can focus on the core elements of trading and blend the new data with your technical analysis, you can make the best decision at trading. Taking trades with news data is not all that tough. But you must learn to adapt to the price feed according to the condition of the market. Once you learn this technique, it will be easy to boost the profit potential. This will greatly improve your analytical skills.

Final Verdict for CFD Trading Tips

We understand that sometimes it may take you a lot of time to master these CFD trading tips in order to become a successful trader. This is why forex signals are a great way to be one step ahead of the game. You can now trade with the utmost care towards risk management to ensure that you only place the trades that have the best shot at becoming profitable.